OPEC sees higher demand balancing markets

OPEC Secretary General Abdalla Salem El-Badri said the organization does not expect prices to fall any lower as demand picks up in 2016 and continues to grow through the end of the decade. “The balance of supply and demand must be brought into line by the market,” said a joint statement from El-Badri and Russian Energy Minister Aleksandr Novak after a meeting between the two, reports RT.

The global demand will increase by 7%-11% a year until 2020, said Novak, and will continue to grow from there as well.

“Despite continuing uncertainties, there are possible signs of achieving a more balanced situation in the oil market and to stabilize it by 2016, which is a mandatory requirement for the continuity of timely and sufficient investments,” said the joint statement.

The market is less optimistic

A monthly poll conducted by Reuters found that the majority of analysts believe prices will recover towards the end of this year to average $60.60 a barrel and $69 next year, when demand from emerging markets improves, but market volatility remains high. For oil derivative contracts expiring in December, volatility has reached its highest in nearly four months.

Holdings of ICE Brent crude put options, which give the owner the right, but not the obligation, to sell oil at a predetermined price by a certain date, outnumbered those in calls – which offer the option to buy – by an average of 2:1 over the coming 12 months, highlighting a bearish bias in the market.

“What’s happening is the market is coming to terms with the fact that these lower prices have not resulted in any significant change in supply/demand economics,” ICAP oil broker Scott Sheldon said. “Demand has picked up in gasoline and in distillates, but it just hasn’t been enough and we haven’t seen the supply response that the market is looking for.”

China and Iran

When asked about slowing demand growth from China, El-Badri said OPEC is not concerned. “China has a problem with oil reserves, there is some speculation there. But their economy is growing.”

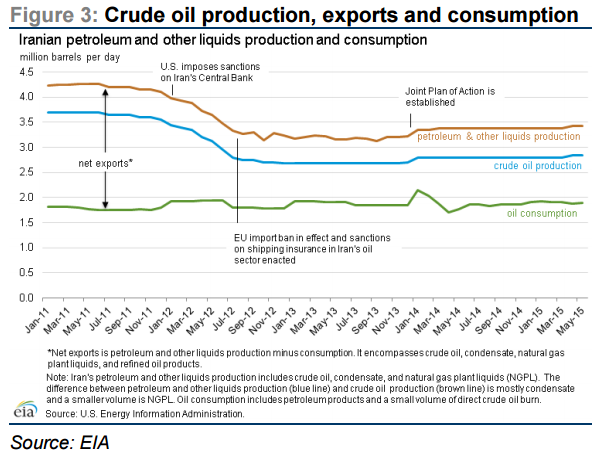

Addressing the concern over Iran’s return to crude markets, the OPEC Secretary General said the new crude oil will be absorbed. “We will certainly be able to accept the new amount,” said El-Badri. He went on to say that OPEC welcomes the lifting of sanctions against Iran.

The oil market could change by 2016 because of the Iranian comeback, said El-Badri. Iran also wants to develop new fields and develop new projects, but “it will begin to occur within 5-6 years.” Other experts expect new development to begin more quickly following the end of sanctions. To see Oil & Gas 360®’s exclusive in-depth look at Iran, click here.