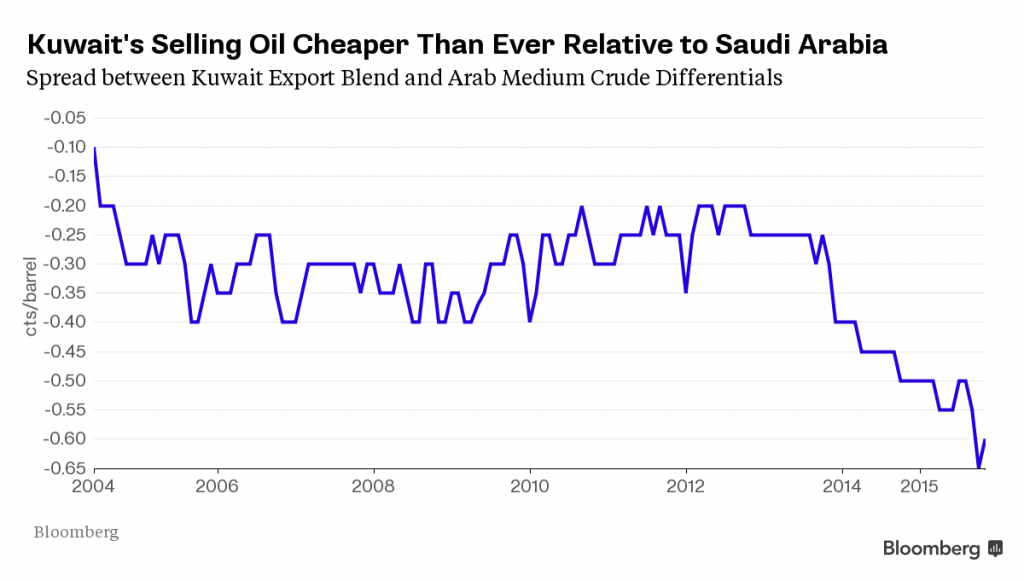

The spread on OPEC members’ crude widens as competition increases

Members of OPEC are beginning to cut their own prices relative to one another as the competition over share of global markets, particular Asia, continues to intensify. Traditionally, members of OPEC move prices together, but data today shows Kuwait is undercutting Saudi Arabia by the most on record and Iraq is selling at deeper discounts as well, reports Bloomberg.

Kuwait’s official price for its Export Blend crude to Asia was a record $0.65 cheaper than Saudi Arabia’s similar-quality Arab Medium crude in October and $0.60 for November. The difference has widened from $0.40 at the beginning of 2014.

Iraq’s selling its Basrah Heavy grade $3.70 a barrel below Saudi Arabia’s Arab Heavy variety, the biggest discount since April when Iraq started marketing the oil. Qatar Land crude is $1.20 a barrel cheaper than Abu Dhabi’s Murban, the most since official selling prices were set for June 2013, according to data compiled by Bloomberg. The spread was as narrow as $0.40 in May.

Asia-Pacific is expected to account for 34% of global oil demand in 2015, making it a prized market for oil producers. China alone will make up more than 25% of consumption growth next year as it looks to fill its strategic reserves with cheap crude, according to the International Energy Agency (IEA).

“It’s a full-on fight for market share within OPEC,” said Virendra Chauhan, a Singapore-based analyst at industry consultant Energy Aspects Ltd. “That’s even as the group tries to fend off a rise in non-OPEC production from countries such as Russia, Brazil and the U.S.”

Shifting markets; Russia and Saudi swap customers

As competition for Asian markets continues to increase, OPEC’s largest producer, Saudi Arabia, is being increasingly pushed to the sidelines. Russia in particular has been looking to increase its presence in Asia, reducing the need for Saudi oil.

Saudi Arabia, in turn, is now looking to increase its share in European markets, once dominated by Russia, but now looking to diversify as political tensions between Moscow and the West increase. Trading sources said majors such as Eni (ticker: E), ExxonMobil (ticker: XOM), Royal Dutch Shell (ticker: RDSA) and Total (ticker: TOT) have been buying more Saudi oil for their refineries in Western Europe and the Mediterranean in the past few months.

“I’m buying less and less Russian crude for my refineries in Europe simply because Saudi barrels are looking more attractive,” said a trading source with a one major, who asked not to be named because he is not allowed to speak to the media. “It is a no brainer for me as Saudi crude is just cheaper.”