PDC Energy increases EURs 9% in core assets

A number of analyst notes were released following PDC Energy’s (ticker: PDCE) analyst day held in Denver this week discussing the companies impressive metrics. The company said that it has lowered completed well costs 2-4%, allowing the company to continue growing production while simultaneously lowering its projected 2016 capital budget.

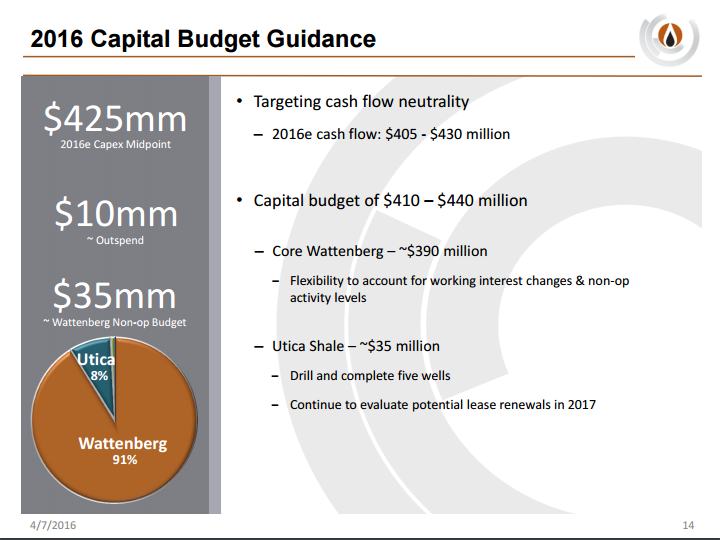

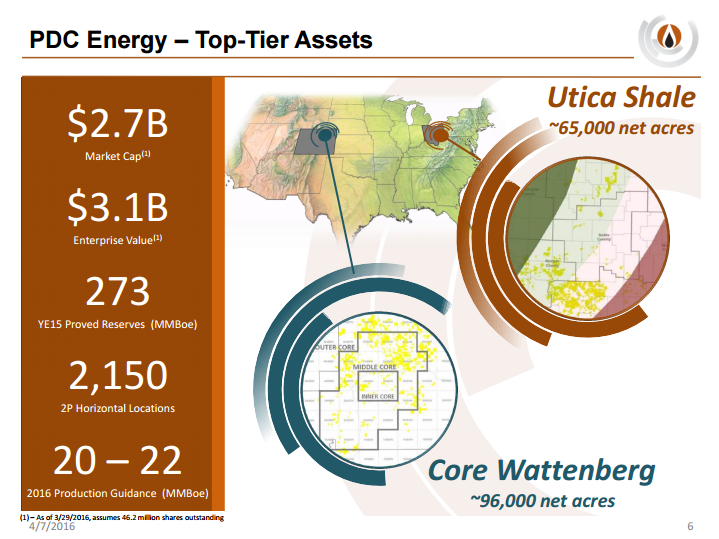

PDC Energy’s updated guidance calls for production of 20-22 MMBOE, a 35% year-over-year increase, with a capital budget of $410-$440 million, down $10 million at its midpoint from the company’s previous guidance. PDCE expects to be roughly cash flow neutral and maintain debt-to-EBITDA of 1.1x-1.2x for the year.

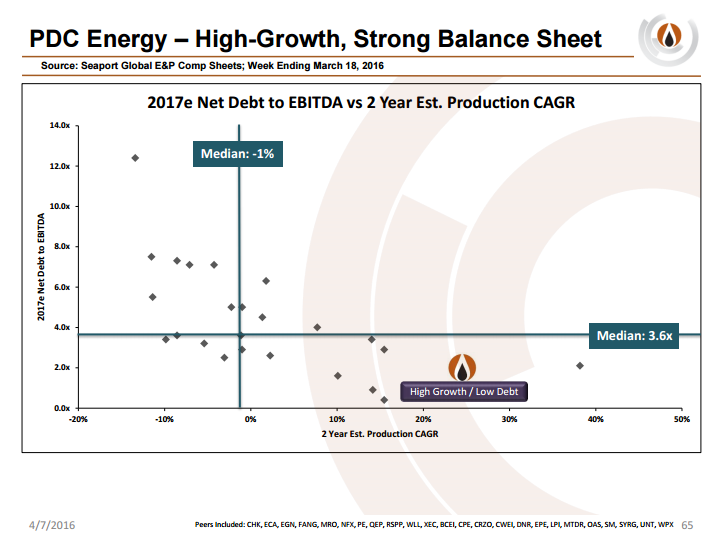

In EnerCom’s E&P Weekly, PDC Energy has a net debt-to-TTM EBITDA of 1.5x for the week ended April 1, 2015. The company’s debt metrics strong in comparison to the entire E&P group in EnerCom’s universe, which have a median debt-to-EBITDA of 3.2x.

“A top-tier balance sheet and robust hedge position should allow PDCE to provide peer leading growth in 2016 with minimal outspend,” said a note from Stephens.

“Incremental data points (lower well costs, higher EURs, favorable guidance) were positive, in our view,” said Stifel following the analyst day. Management indicated that recent [short reach laterals] Niobrara completed well costs averaged $2.5 million, 9% below our prior forecast of $2.75 million,” prompting the firm to raise its price target for PDC Energy shares.

“The important takeaways in our mind are 1) increasing production … and 2) capital discipline,” said a note from Johnson Rice. “We would note that FY:18 volumes are expected to tick down y/y under the lowest growth scenario, however we believe that the overall 3-year outlook update was positive.”