On July 15, 2015, Penn Virginia (ticker: PVA) announced the sale of its East Texas assets to an undisclosed buyer for gross proceeds of $75 million. The sale is expected to close by August 2015 and includes approximately 33,400 net acres in the Cotton Valley and Haynesville Shale with average Q2’15 production of 1,870 BOEPD (76% gas). The acreage includes 13.7 MMBOE of proved reserves (77% gas) and 85% are classified as proved developed.

PVA had deferred drilling operations in the region until natural gas prices strengthened, according to management. Penn Virginia is scheduled to discuss its Q2’15 earnings via conference call on July 30, 2015.

The Shift Continues

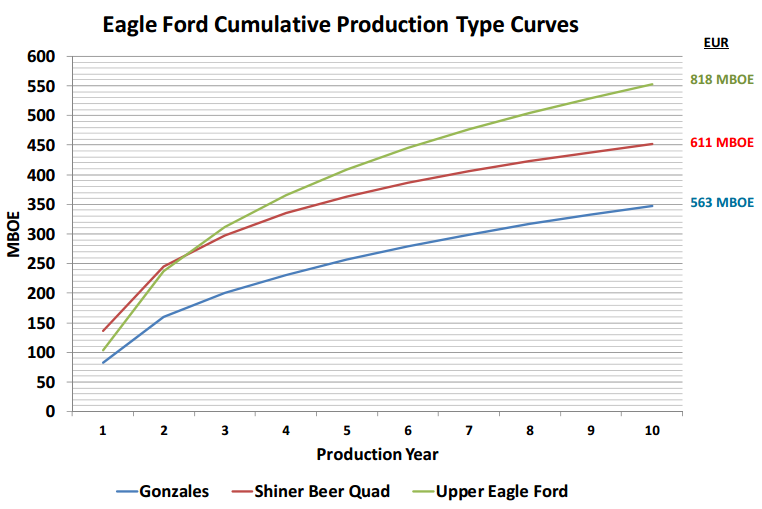

The portfolio of Penn Virginia (ticker: PVA) includes operations in Texas, Oklahoma and Pennsylvania, but the exploration and production company has made a definite shift to the Eagle Ford Shale in recent months. Approximately 96% of its 2015 capital budget is slated solely for development of the Upper Eagle Ford formation, where the company instilled type curves of 818 MBOE at 15% internal rate of return. In the last 12 months, the 23 wells drilled in the Upper Eagle Ford have returned average initial production and 30-day rates of 1,223 and 942 BOEPD, respectively.

Eagle Ford production accounted for 86% of PVA’s Q1’15 production and will now make up 94% of pro forma volumes. The remainder is sourced from its Midcontinent assets in the Granite Wash.

The company raised more than $320 million from asset sales last year, with transactions including an acreage-based deal of its Mississippi assets for $73 million. The company sold some midstream assets in the Eagle Ford, including an oil gathering system and a natural gas pipeline for gross proceeds of $150 and $100 million, respectively. Management recently mentioned the possibility of monetizing its Eagle Ford water system for additional cash.

Balance Sheet Improving

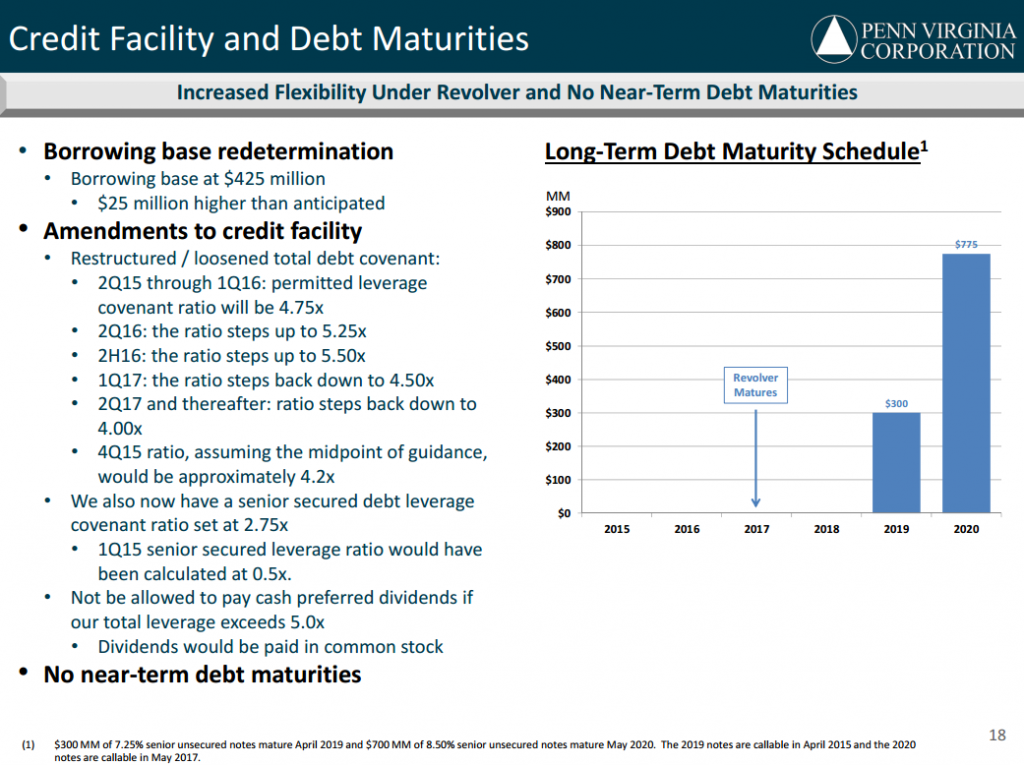

PVA reported liquidity of $265 million in its Q1’15 report, along with an increased revolver of $425 million. Capital One Securities expects PVA to exit 2015 with $245 million of liquidity, and KLR Group believes the extra cash solves any 2016 outspend that was initially projected by the firm (assuming a capital budget of $230 million).

KLR forecasts the divesture will dial down PVA’s 2015 net-debt-to-EBITDA to 4.5x from 4.7x, with the 2016 multiples declining to 3.8x from 3.9x.

Johnson Rice & Company called the transaction a “strong price” and believes it will offset any potential declines in its borrowing base redetermination. The firm added, “Of the high leverage small-caps, PVA remains one of our favorites due to its asset quality and its previously demonstrated ability to navigate tight situations.”