“The industry is set for a second straight year of painful austerity”

Overall, WTI has declined roughly 25% just from the end of June, when prices were hovering around $60. The uneasiness plaguing the oil and gas sector have been compounded with the release of Q2’15 earnings results, as more companies announced project curtailments, budget adjustments and more layoffs.

In a note on August 10, Raymond James & Associates believes there is no short-term fix to sub-$60 oil. “Oil market sentiment is currently as ugly as it’s been since January,” the note says, contributing the price dive to four factors:

- Saudi oil production at record highs,

- Greater visibility of Iran oil exports,

- Iraq’s “substantial and inexplicable” production surge in the last few months, and

- Chinese stock market concerns, leading to possible ceilings on oil demand.

Raymond James believes 2016 holds a bearish outlook for oil prices, even if the prospects of Iraq’s increasing production and China’s uncertain demand levels are excluded. “We no longer believe that oil prices should rebound to $65/bbl in 2016,” says the note, adding that its new WTI price deck assumes $50 and $55 per barrel in 2015 and 2016, respectively. Brent prices are projected at $56 and $62 in the same time frame. Long term prices for WTI and Brent are projected at $70 and $77 for 2017 and beyond, not including any potential disruptions from the Middle East.

The firm expects the bearish market to yield even lower capital spending levels in 2016 compared to 2015. That includes the deferral of several projects that the firm believes are generally uneconomic, specifically in the Gulf of Mexico, Brazil West Africa and Canadian oil sands. Scrapping some of those projects will eventually lead to some relief in the market due to less production, which Raymond James expects to be in the neighborhood of 0.3 MMBOPD by 2017 and expanding through 2019.

Are We Nearing a Saudi Shakeup?

Peter Cardillo, Chief Market Economist for Rockwell Global Capital, is on the same page as Raymond James & Associates. In an interview with Yahoo Finance, he said he expects to see a price range between $50 and $55.

However, rumors out of Saudi Arabia indicate the world’s top oil exporting country may be reconsidering its approach. “Even though Saudi Arabia started this, the OPEC nations are hurting, including Saudi Arabia,” said Cardillo. “From a political standpoint, that could be very dangerous.”

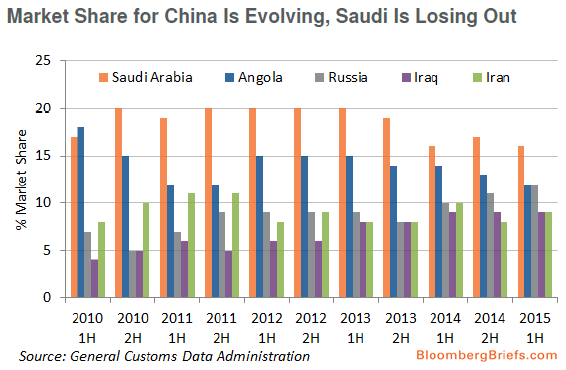

Bloomberg reported that the OPEC’s de facto leader has been losing roughly $10 billion per month since oil prices went south last fall. An August 6 report from Ben Sharples on Bloomberg’s Oil Buyer’s Guide indicates the Saudis have steadily been losing its China market share to Russia for the last year. Such bearish news for the Saudis were followed by a report from The Wall Street Journal in late July, citing sources that the country plans on scaling back production after the summer. The curtailments could come as soon as September and include 0.2 to 0.3 MMBOPD of production, accounting for about 2.3% of its record-high volumes in June.

OPEC itself cut its crude demand forecast in mid-July, revising its 2015 estimates downward by 0.1 MMBOPD to 29.3 MMBOPD overall. 2016 estimates place OPEC oil demand at 30.1 MMBOPD. The cartel produced 31.4 MMBOPD last month, according to its Oil Market Report.