Tesoro and Valero bright-spots on S&P500 Energy Index

The outlook for the refining sector continues to be a bright spot in an otherwise gloomy outlook for the energy industry. While E&Ps look for the best ways to cut costs amid the continued low oil prices, refineries are enjoying stronger margins on cheaper feedstock.

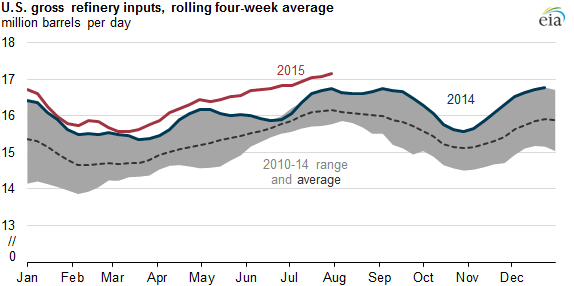

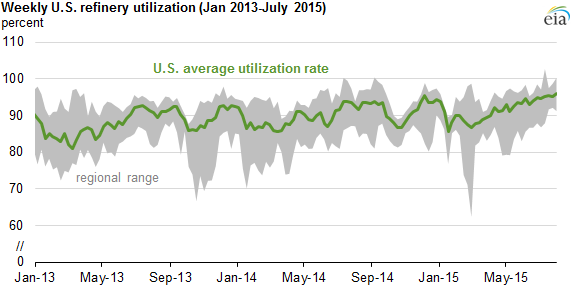

In August, gross inputs to U.S. refineries exceed 17 million barrels per day for four consecutive weeks, the highest level of refinery inputs recorded by the Energy Information Administration. Lower crude prices and strong demand for petroleum products, especially gasoline, led to more output from the U.S. refining sector.

U.S. mutual funds are taking notice of the stronger performance being posted by downstream over the general energy sector, with shares in Tesoro (ticker: TSO) and Valero (ticker: VLO) representing the number one and number two spots at the top of the S&P 500 Energy Sector Index. Compared to an index one-year return of minus 21%, Tesoro and Valero have posted gains of 62% and 40%, respectively.

The number of actively managed mutual funds investing in Tesoro and Valero increased by 20% and 32% respectively, this year, reports Reuters. Fund research firm Lipper Inc. said 319 funds currently hold Valero shares and 210 hold Tesoro. And the number of funds holding both companies has increased 31% to 151, according to Lipper.

One notable entrant is Fidelity Investments’ $103 billion Contrafund, which has largely avoided oil stocks during the sector’s meltdown. But this year, the fund, has accumulated stakes in Tesoro and Valero worth $93 million and $149 million, respectively, according to end-of-August fund disclosures.

The $4.4 billion MFS Research Fund also initiated a position in Valero, buying about 565,000 shares in June. Analysts at the fund praised management for increasing its dividend, reducing capital expenditure growth and boosting free cash flow, according to fund commentary for investors.

Portfolio managers say there is another important reason they are beginning to invest more heavily into refining, though. Management teams at the top of U.S. refiners have become disciplined about their capital spending and are returning more cash to shareholders.

“The group has found religion, especially with capital deployment,” said George Maris, manager of the $2 billion Janus Global Select Fund, which owned $39 million worth of Valero stock at the end of June.

U.S. hedge funds have already trimmed some of their holdings in Valero, cutting them to 46.3 million shares from 68.6 million during the first half of 2015, according to data compiled by industry research firm Symmetric.