Resolute Energy Corp. (ticker: REN) is engaged in the acquisition, development and production of onshore domestic hydrocarbons, principally crude oil. Its producing assets are the Aneth Field in the Paradox Basin of Utah, the Hilight Field in the Powder River Basin of Wyoming and in the Permian Basin of West Texas. Resolute completed the transition to a full scale horizontal operator at the end of fiscal 2013.

Production for Q1’14 totaled 12,598 BOEPD – an 8% increase from Q1’13. Adjusted EBITDA was $41.1 million – 35% higher for the same time period. Production on a quarter-over-quarter basis slightly decreased due to weather-related impacts. In a conference call following the release, management identified three themes of Resolute’s future: asset quality, visible growth potential and capital.

Asset Quality

REN has narrowed its 2014 focus to developing the Powder River and Permian Basins.

Powder River

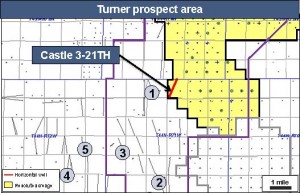

The Powder River consists mainly of the Turner and Hilight Field. The Castle 3-21TH well in the Turner has produced a total of 95 MBOE in its first 160 days on production (593 BOEPD). Ten permits are processing and could provide a full year of drilling once granted. EOG Resources (ticker: EOG) is operating nearby and forecasted its horizontal Turner wells to produce 860 MBOE in estimated ultimate recovery on a 8,200 foot lateral section. REN’s first Castle well was drilled on a 4,400 foot lateral.

“I look at EOG as being indicative of potential, and not necessarily determinative as to our acreage,” said Nick Sutton, Chairman and Chief Executive Officer of Resolute Energy, in a conference call with analysts and investors.

Resolute holds its Hilight assets (45,000 net acres) by production and will be able to commence drilling at its own pace, but current operations are targeting the Turner.

Permian

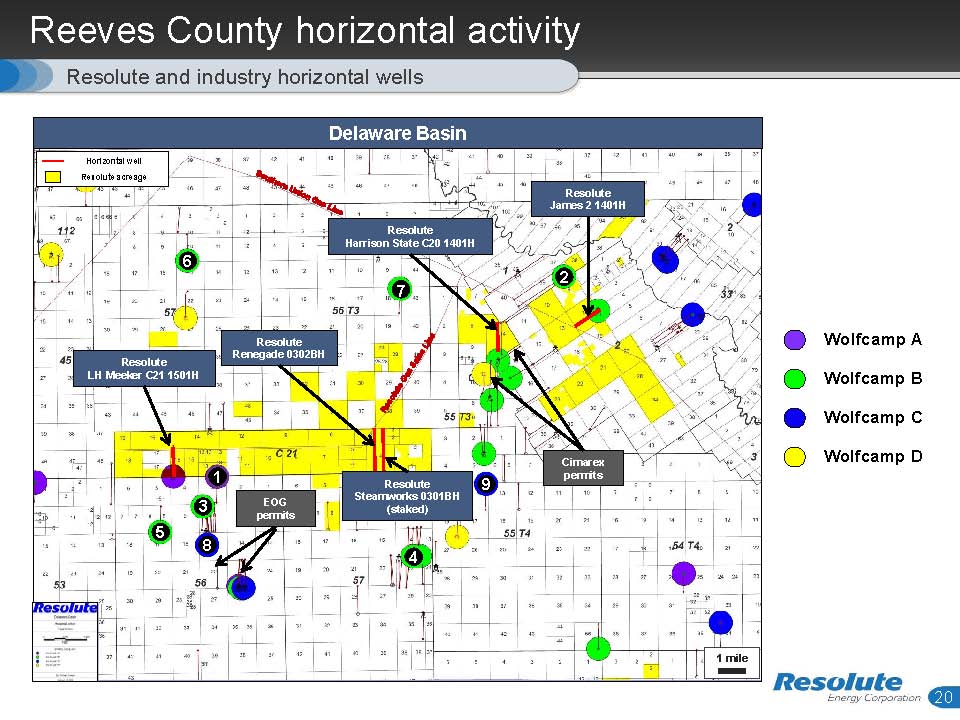

Management identified Permian Basin development as a main driver in 2014 and its focus is apparent in REN’s regional drilling breakdown. Permian production has increased by 48% on a year-over-year basis. The region accounted for 31% of Resolute’s hydrocarbon stream (413 MBOE) in Q1’14 as opposed to 27% in Q1’13.

The company’s first Delaware Basin well averaged 970 BOEPD for the first 100 days of production. The well targeted the Wolfcamp A formation and returned a peak 24-hour rate of 1,403 BOEPD. Three additional wells are currently completing and three to four more additional wells will be drilled in the region on REN’s current budget.

“We will maintain our focus on the Delaware Basin side of the Permian,” said Sutton. “A near-term catalyst for the program will be the first of four 7,500-foot laterals on our Mustang block.” All four laterals will target the Wolfcamp B formation.

The company expects to have two rigs drilling full time in the Permian Basin by the end of 2014 and anticipates standing up additional rigs in 2015. Benefits from activities are expected to become more apparent in 2H’14.

Visible Growth Potential

Sutton said: “Perhaps more important than any single quarter’s results, Resolute has captured an extensive inventory of horizontal drilling opportunities in the Permian and Powder River basins. We have approximately 250 potential gross locations which, with multiple prospective zones per location, meaning that we have more than 650 horizontal drilling targets. We anticipate that these numbers could grow significantly as Resolute works to expand its acreage position and as the industry continues to advance its knowledge as to the best ways to drill, complete and produce horizontal wells.”

Specifically, Resolute has estimated 210 horizontal drilling locations in the Permian with an additional 135 lower-risk recompletion opportunities. Another 48 potential horizontal locations have been identified in the Turner. The company plans on accelerating drilling activity once its balance sheet improves. Guidance for 2014 is expected to range from 4,525 MBOE to 4,890 MBOE, or 12.4 MBOEPD to 13.4 MBOEPD (77% oil).

“I want to emphasize is that not only are we more confident than ever in the quality of our oil assets,” said Sutton. “We have a lot of room in which to run.”

Capital

The last of the company’s Williston Basin properties were sold for $4.8 million in Q1’14. Quarterly results included a net loss of $3.5 million ($0.05 per share). At the time of its earnings release, the company had $320 million drawn on its credit facility and $400 million in senior notes.

REN plans to monetize up to half of its economic interest in the Aneth Field (its legacy oil asset in Utah) in order to accelerate drilling activity in the Permian and Powder River Basin operations. REN also plans to retain operating control of Aneth as it aims to create, as management described, “a yield-oriented tax advantage vehicle.” Aneth Field consists of 43,200 gross acres and 23 MMBOE of proved reserves.

In terms of the amount of capital that Aneth could fetch, Sutton said: “It’s going to take a market test. The market is going to tell us what it thinks the value of Aneth is, and that’s what we’ll deal with when we get there.” Management expects the transaction to provide enough capital to both reduce outstanding debt and accelerate its drilling programs. Since REN works primarily as an operator, the added revolver availability will allow the company to advance operations as it sees fit.

Sutton said: “Once we have strengthened our financial position we plan to significantly increase our activity level in the Permian and the Powder River basins. The pieces are in place – personnel, prospects, gas gathering, gas processing, SWD wells and drilling permits – to set up for an exciting, multiple-year growth path that will significantly change the Resolute story, resulting in a better public understanding of the value of our assets.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.