Baker Hughes released an updated rig count today. This week’s count saw a shift in the oil and gas split, with oil rigs increasing by seven rigs while gas rigs fell by five. The rig additions were solely horizontal, with eight horizontal rigs added to the mix, directional rigs fell by four, and vertical rigs fell by three.

Looking at additions by basin, the majority of gains came in Texas between activity in the Permian and Eagle Ford, with one rig added in the Williston Basin. The Permian added five rigs, and the Eagle Ford saw an increase of four.

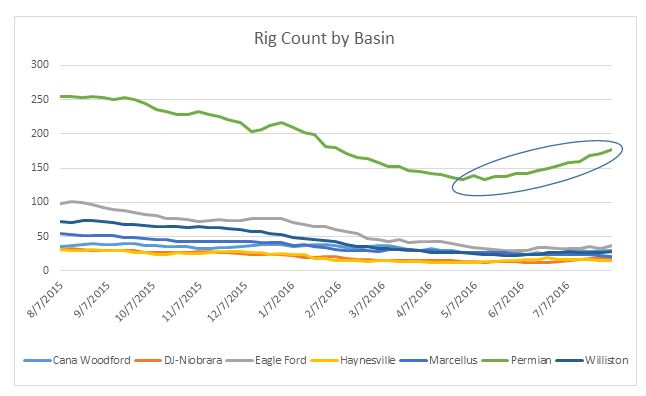

The Permian has been a major influence on the increase in rig count over the last 2 ½ months. Since May 13, 2016, there has been an increase of 63 oil rigs in the U.S. with 44 of them coming from activity in the Permian, or 70% of the rig count increase accountable to the Permian.

Focus on the Permian

Rig counts in the Permian continue to inch upward, extending the streak of weeks with a decline to 12 straight. Other basin have seen increases, in particular the DJ-Niobrara with a move upward from 12 to 18 over the same timeframe, but the addition of six rigs pales in comparison to the 44 additions in the Permian. What is it that makes the Permian so attractive? Well economics.

The Permian has two major sub-basins that include multiple horizons of wells, and a plethora of potential drilling locations. Those two sub-basins are two of the most sought after positions as of late with companies picking up acreage left and right in these basin. The two basins are the Delaware and the Midland Basin.

Well costs and recoverable hydrocarbons are two of the biggest factor in determining the IRR of a given play. And truth be told, this is relative to a specific well and the costs and returns associated with each well. However, on a basin to basin assessment, metrics averaged across several wells in the basin can provide insight in to the economics of the play.

Current wells costs in the Permian are averaging approximately $6-7 million across the basin with EURs in the 800 MBoe range. As a comparison, well costs in the Bakken are still in the range of $8 to $9 million with EUR rates approximately 650-700 MBoe. As noted, these numbers are relative to different parameters at each drilling location, but ultimately, in the Permian companies are drilling less expensive wells and realizing a greater return in sellable product.

As oil prices sit in the $40-$50 range, operators will be looking for the most effective use of capital to generate a return and consequent cash flow. Given the economics of the Permian, it is reasonable to expect that rig additions in the coming months will largely center around this basin with sporadic activity coming in other basins.