Russia produced roughly 10.9 MMBOPD in 2014

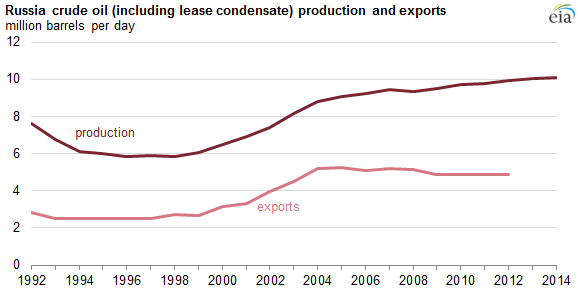

While the United States became the world’s largest producer of hydrocarbons in 2014, Russia remained the largest producer of crude oil and lease condensate, according to the U.S. Energy Information Administration (EIA). In 2014, the country produced an average of 10.9 MMBOPD of crude oil and condensate.

Russia exported more than 4.7 MMBOPD of crude oil and lease condensate in 2014, based on data from the Federal Customs Service of Russia. Countries in Asia and Europe received more than 98% of Russia’s crude oil exports. Asia accounted for 26% of Russia’s crude oil exports, and Europe – which depends on Russia for more than 30% of the region’s oil supply – accounted for 72% of Russian crude oil exports. Russia’s economy largely depends on energy exports: oil and natural gas revenues accounted for 68% of total export value in 2013.

Much of Russia’s crude oil production comes from the West Siberia and Urals-Volga regions in central and western Russia. Production from East Siberia and the country’s Far East regions has increased as well, but projects have been stymied by international sanctions.

Sanctions crippling Russia’s oil and gas industry

Russia’s economy is largely dependent on the oil and gas industry, with oil and natural gas revenues accounting for 50% of its federal budget revenues in 2013. Sanctions put in place against Russia following events in Ukraine in 2014 have damaged the country’s oil and gas sector.

Output from Gazprom (ticker: OGZPY) is on track for a post-Soviet all-time low in 2015. According to information published by the Russian Economy Ministry, Gazprom’s output has fallen 13% in the first half of 2015 from levels last year, and will likely reach 414 Bcm for full-year production. Combined with the drop in gas prices, the company’s revenue will likely be about $106 billion, about 27% lower than in 2014.

Sanctions have also put a stop to partnerships with international oil companies in developing the resources in the Arctic. Before sanctions were put in place, exploration of Russia’s Arctic resources attracted companies like ExxonMobil (ticker: XOM), Eni (ticker: E), China National Petroleum Company (CNPC), Shell (ticker: RDSA), Total (ticker: TOT), and Statoil (ticker: STO).

International oil companies still looking to increase involvement in Russia

Despite sanctions making business with Russia extremely difficult, many of the world’s largest oil and gas companies are still trying to expand cooperation with Russia. Shell announced earlier this week that it will swap a stake in one of its international energy assets for part of Gazprom PJSC’s Sakhalin-3 LNG project.

“Russia sits on 25% of the world’s gas reserves and is very, very close to markets that we are very familiar with,” Shell CEO Ben van Beurden during the company’s earnings presentation. Shell is also pushing “to see how we can work with Gazprom internationally.”

Statoil also announced that it plans to continue deepening ties with Rosneft (ticker: RNFTF), Russia’s main oil producer. Statoil has started a process to secure rig capacity to drill two wells next year in the Sea of Okhotsk in Russia’s Far East and will run test production at the North-Komsomolskoye heavy-oil field over the winter, reports Bloomberg.

“We wish to develop our relationship with Rosneft further,” said Lars Christian Bacher, executive vice president of Statoil’s international development and production. “We need to do so within the framework set by the sanctions.”