Global Oil Industry Reacts to Commodity Crash by Downsizing

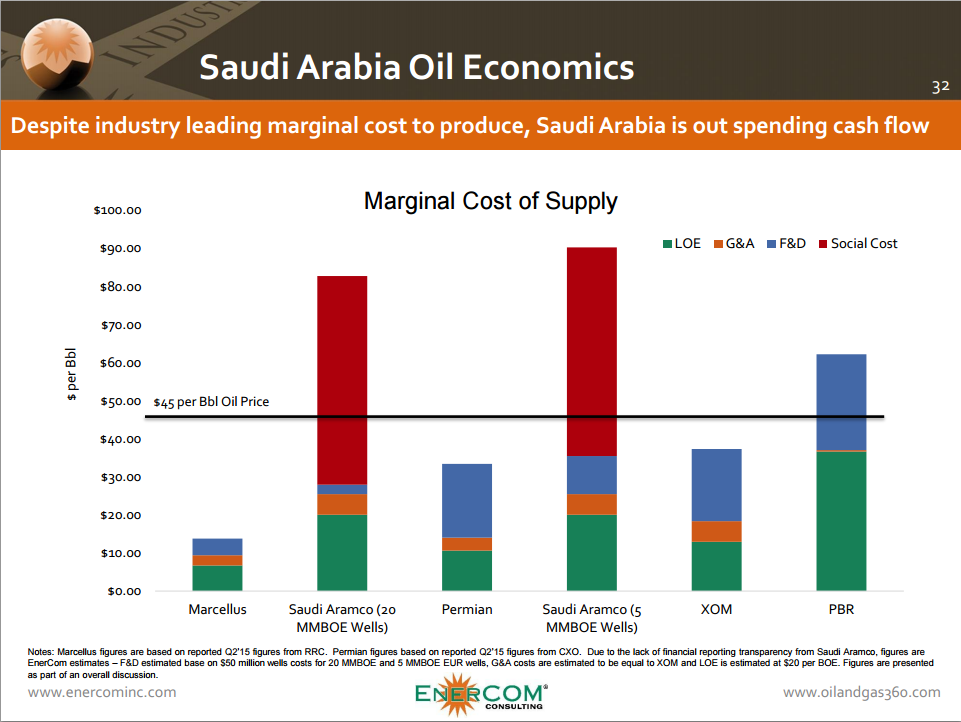

Saudi Arabia, a nation dependent on oil exports for 80% of budget revenues, 45% of gross domestic product and 90% of export earnings, is rumored to be creating a government division focused on monitoring government spending.

The report from Bloomberg was not an exact confirmation, as Saudi’s finance ministry declined to comment, but two sources “with knowledge of the matter” confirmed the development. The chief member of OPEC is likely to post a deficit of 19.5% of GDP for fiscal 2015, according to the International Monetary Fund (IMF), and its foreign reserves had fallen by nearly $73 billion as of September 2015. Bloomberg reported in August that Saudi was seeking advice on how to trim roughly $100 billion in government spending, with the information coming from “two people familiar with the matter.”

Saudi’s finance minister dismissed the notion of creating such an entity back in December 2014. Since then, the Saudis have pulled cash so rapidly that the IMF believes its spending support will dry up within five years.

The President of Saudi Aramco acknowledged that oil prices are too low, but believes the supply/demand imbalance will dictate prices, rather than production cuts. Saudi rig counts are currently trending among all-time highs.

Downsizing Elsewhere

Russia’s timeline is much shorter, as the low commodity environment may deplete that nation’s sovereign funds as early as 2017.

A handful of North American oil and gas firms are working had to preserve employment (Continental Resources, for example, has vowed to avoid layoffs), but the significant drilling slowdown has led to the inevitable. Forbes says more than 200,000 layoffs have occurred worldwide, with the oilservice giants of Baker Hughes (ticker: BHI), Halliburton (ticker: HAL), Schlumberger (ticker: SLB) and Weatherford (ticker: WFT) bearing the largest numbers of the group.

In Brazil, workers of Petrobras (ticker: PBR) are going on strike to protest government-guided initiatives to downsize the state-run company. Brazil’s oil labor union believes PBR should avoid all asset sales and remain the primary producer of the prolific sub-salt offshore operation.

Workforce reductions and stressed balance sheets are unlikely to offer any near-term relief to the oil markets, as OPEC Secretary General Abdalla Salem el-Badri said 2015 oil and gas investments will likely fall by $130 billion, or 22.4% on a year-over-year basis. The chief of the International Energy Agency agreed with the estimate. Paal Kibsgaard, Chairman and Chief Executive Officer of Schlumberger, said in SLB’s conference call that an oil price recovery would not immediately translate to project investments. “Any improvement in oil prices will likely initially to go towards strengthening the balance sheet and then the oil companies will likely assess how sustainable are these increases in oil prices before they start investing,” he said.

In a poll conducted by Oil & Gas 360® with industry executives, approximately 45% believe oil prices need to sustain at least $60/barrel in order to kick-start a new hiring trend. An additional 37% believed oil needed to be in the $70s range, while the same percentage of participants did not anticipate any new hirings in the upcoming year.