SM Energy announces sale of non-operated Eagle Ford assets for $800 million

Denver-based SM Energy (ticker: SM) announced Tuesday that the company has divested its non-operated Eagle Ford assets for $800 million.

SM has entered into a definitive agreement with a subsidiary of Venado Oil and Gas, LLC, an affiliate of KKR (ticker: KKR) for the sale of SM’s third party operated assets, including its ownership interest in related midstream assets, according to a company press release.

The assets expected to be sold include approximately 37,500 net acres in the Maverick Basin /Eagle Ford area of south Texas and a 12.5% interest in the Springfield Gathering System. As of year-end 2015, net proved reserves associated with these assets were 65 MMBOE (38% oil, 31% natural gas and 31% NGLs). In the third quarter of 2016, these assets produced approximately 27,260 net BOE per day (33% oil, 33% natural gas and 34% NGLs.) The transaction is expected to close in the first quarter of 2017, with an effective date of November 1, 2016.

Metrics for the deal work out to approximately $29,374.03 per flowing BOE, assuming no value for the gathering system. Based on today’s sale, Anadarko (ticker: APC), the operator on the assets sold to Venado, could generate around $2 billion in proceeds from the upstream portion if it were to sell its Eagle Ford position, excluding about $750 million of midstream value, Wells Fargo said in a research note following the announcement.

Continued focus on the Midland Basin

Today’s announcement continues a pattern of deals in which SM has focused its attention on its Midland Basin acreage and monetized other assets. In October and December, SM announced a number of deals in which the company sold Williston Basin acreage and purchased more land in the Midland.

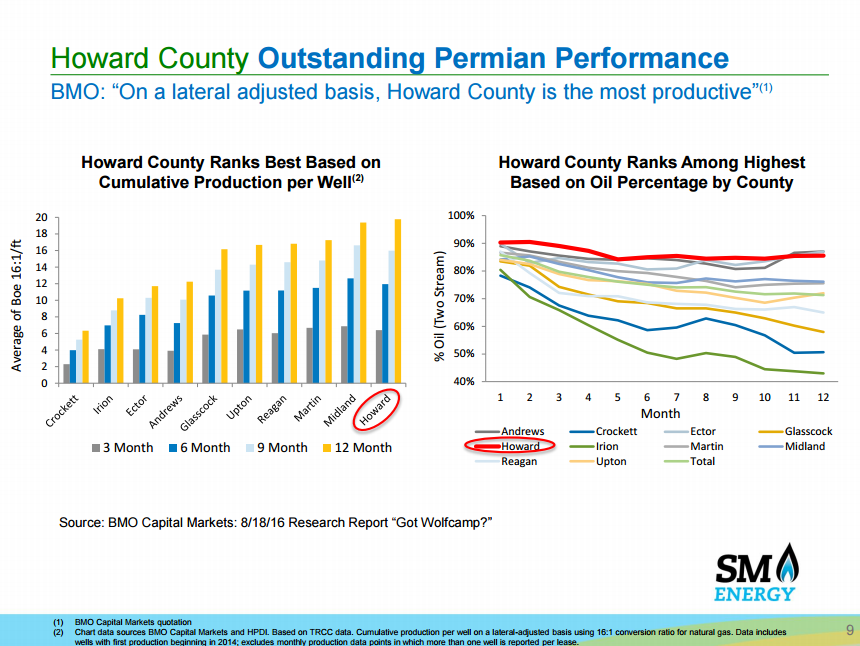

The October deal saw the company purchase 35,700 net acres in Howard and Martin Counties in West Texas from QStar LLC for $1.6 billion, and sell Williston assets for $0.8 billion. In the December deal, SM purchased an additional 4,100 Midland acres from QStar, bringing SM’s total Midland footprint to approximately 87,600 acres.

“Our 2017 capital program will focus on our top tier oil position in the Midland Basin , consisting of approximately 87,600 net acres, and our top tier operated natural gas and NGL position in the Eagle Ford, consisting of approximately 161,500 net acres,” said SM President and CEO Jay Ottoson. “The proceeds from this sale will provide us with additional flexibility to pursue aggressive growth from our Midland Basin assets, with related capital expenditures in excess of cash flow over the next few years, while at the same time improving our debt metrics and maintaining strong liquidity.”

Johnson Rice & Company now models full-year production and cash flow per share moving from 153 MBOEPD and $5.96 to 133 MBOEPD and $4.88, respectively. Enterprise value to EBITDA is expected to increase from 8.2x to 8.8x as well while net debt to EBITDA shrinks from 3.6x to 3.3x, and liquidity increases from $0.9 billion to $1.6 billion, giving the company a stronger balance sheet.