Shareholders send billions in equity capital flowing into oil and gas

Since November 27, 2014, the American and Canadian oil and gas extraction industry has received more than $59.1 billion in new equity capital. That is approximately 681 days since OPEC decided market share was more important than cash flow.

A quick note for our OPEC friends: while in college we learned about Stars, Cash Cows, Dogs, and Question Marks. You keep the Stars and Cash Cows. If your crude oil represents more than 35% of your export dollars, you should have been taught that that is a Cash Cow. By definition, a Cash Cow faces less competitive pressure and is on a slower growth trajectory. On November 26, 2014, crude oil was trading for $73.69 per barrel. What pressures were OPEC feeling? Was it a pressure of the piles of Benjamins they were sitting on?

On June 1, 2013, Saudi oil minister Ali al-Naimi told Gulf Business “Let me tell you this, this is the best environment for the market. Supplies are plentiful, demand is great, balanced – inventories are balanced.” The article went on to say “the Kingdom – holder of most spare capacity in the Organization of the Petroleum Exporting Countries – shows no sign of opening the taps to bring down prices and curtail that output by making it uneconomic.”

The 2013 quote doesn’t quite jibe with the doom put forth by al-Naimi at a conference in Kuwait on April 17, 2011, saying “the global market is oversupplied with crude even as the world’s largest oil producer cut output last month by more than 800,000 barrels a day.”

What changed in the 777 days between quotes? The Saudis were enjoying great prosperity, generating more than US$720 million of revenue per day in 2013. In 2011, the U.S. imported 1.2 million barrels per day (MMB/D) from Saudi Arabia, the highest level imported from the OPEC nation since 2008. The U.S. imported the 2.2 MMB/D from Canada, making our neighbor to the north the largest supplier of crude oil. Imports from Mexico, Venezuela and Nigeria were an aggregate 2.8 MMB/D, down about 32% in 2011 compared to 2010. While not first, Saudi was not last when it came to exporting crude oil to America.

In December 2011, the U.S. imposed sanctions on Iran’s Central Bank. The country produced 3.6 MMB/D in November 2011. By spring time, Iranian crude oil production was less than 2 MMB/D. The pain was on.

“There is a sufficient supply of petroleum and petroleum products from countries other than Iran to permit a significant reduction in the volume of petroleum and petroleum products purchased from Iran by or through foreign financial institutions,” Obama said in a statement in March 2012.

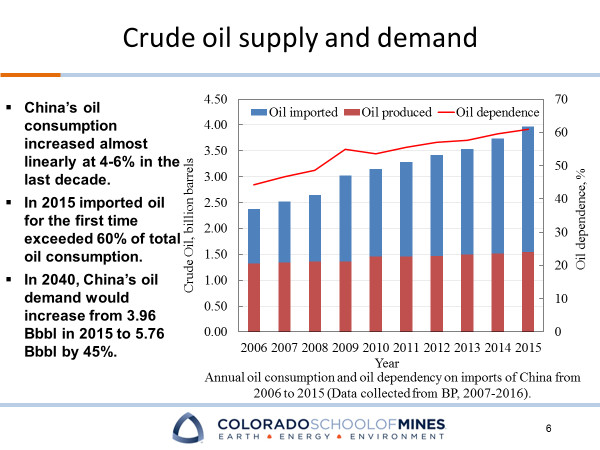

Call it what you want, but Saudi Arabia was the largest benefactor of the Iranian sanctions. The country’s biggest Mideast competitor was taken out, and unlike the U.S., could export at will to any country/region – China, India, Europe. Over the last decade, China’s unquenchable thirst for crude oil was real. In 2014, Saudi delivered 16% of China’s crude oil import supply. In fact, 58% of China’s crude oil was imported from OPEC nations. Zero percent was imported from the U.S. Why then was market share of such great importance to Saudi Arabia?

The U.S. and Russia

In January 2011, the U.S. imported 4.9 MMB/D from OPEC nations. That level dropped 16.6% in less than 12 months. In February 2013, the U.S. imported 3.1 MMB/D from OPEC, a decline of 36% from January 2011. The February import rate was the lowest level since the beginning of 1994. During the January 2011 to February 2013 period, the U.S. saw daily crude oil production rise to 7.1 MMB/D, an increase of 29.8%. The U.S. producer was disintermediating the importance of OPEC. In doing so, the U.S. producer also inflicted pain on the U.S. industry. Over-levered, over-producing and over-staffed led to bankruptcies, the cold-stacking of rigs and widespread industry layoffs in America.

We know that the Saudis were displeased in how Russia was a “bad player” in the global crude oil market in 2008 when the Saudis voluntarily cut daily volumes by 1MMB/D. Reported by The National in August 2008, “OPEC may cut oil production early next year to halt the slide in oil prices, but this could cause a sharp rebound in prices if the cuts are too deep, according to an energy think tank. ‘We expect OPEC to act to defend a price floor of somewhere around US$100 a barrel,’ the Centre for Global Energy Studies (CGES), a respected London-based analysis house, said yesterday in a report. ‘To do this, they would need to start cutting production at the start of 2009.’ While Saudi was seeking to support a price floor, Russia was increasing its production and selling crude oil to Saudi’s biggest crude oil customer.”

Continuing to turn the bit to the right

The strategic change for the Saudis was evident when they continued their drive to keep or grow market share regardless of the price of the commodity. As the most powerful OPEC player, the country kept turning the bit to the right as evidenced by its monthly production profile. In November 2014, Saudi’s daily production was 9.64 MMB/D. By July 2015, Saudi production was 10.29 MMB/D, which only expanded to a Saudi record of 10.7 MMB/D in July 2016.

November 2014 average WTI spot price was $76.99; the average was $54.34 in July 2015 and $44.13 in July 2016, confirming the Kingdom’s belief that they didn’t care if prices were US$30 or US$70, they were no longer ceding market share to balance global oil markets.

How should you treat a Cash Cow? You feed it. You don’t starve it. Even a graduate of the Wharton County Community College knows that. But back to the idea of shareholder dilution.

PXD

On November 5, 2014, Pioneer Natural Resources (ticker: PXD) issued 5.75 million shares at $175.00. OPEC made its “market share announcement” on November 27, 2014. On January 5, 2016, PXD issued 13.8 million shares at $117.00. On June 15, 2016, 6.04 million shares were issued at $157.50. On June 14, PXD’s stock closed at $163.04. Over 589 days the company issued 25.59 million shares raising $3.572 billion. On October 6, 2016, PXD’s stock closed at $186.20. While the shareholder that purchased the 11/5/2014 shares felt the pain with the OPEC decision 23 days later, 702 days later the return is 6.4% and OPEC is now working from a different playbook.

CXO

Concho Resources (ticker: CXO), another Permian Basin operator, issued three rounds of new shares between February 26, 2015 and August 15, 2016. A total of 26.1 million shares were issued, raising $2.921 billion. If a shareholder purchased the shares back in February 2015, and held them through the closing bell on October 6, 2016, they would have realized a price appreciation of 29.8%.

On a debt-adjusted growth per share for reserves for the three-year period ended December 31, 2015, PXD posted a negative 52% figure. Production grew 10%. For Concho, the company’s reserves grew on a three-year debt-adjusted basis of 22% and production grew 68%.

On a debt-adjusted growth per share for reserves for the three-year period ended December 31, 2015, PXD posted a negative 52% figure. Production grew 10%. For Concho, the company’s reserves grew on a three-year debt-adjusted basis of 22% and production grew 68%.

Reserve growth for the entire industry was hampered by falling crude oil prices; however, not everyone felt the sting of negative year-end revisions.

Three Marcellus players, Cabot, EQT and Range, posted the top three best growth per debt-adjusted reserve growth rates.

Both CXO and PXD have somewhat similar sized reserve base and debt-to-market capitalization ratios. PXD’s Q2’16 production was 60.3% more than CXO’s. Concho’s trailing twelve-month cash margin per BOE at June 30, 2016, was $12.47 compared to PXD’s cash margin of $9.40.

Shareholders of both companies are in the black (depending on when shares were bought and if held for a duration of time), and both have loyal analyst followers – 89.4% of analysts covering PXD rate the company a Buy, and 77.8% rate CXO a Buy. The upside, according to analysts covering PXD appears to be greater at 10.4% (PXD Equity ANR on your trusted Bloomberg terminal) while the analysts subscribe to a 5.9% upside for Concho.

It would be analytically wrong to just say these management teams were diluting shareholders. Rather, given the OPEC lemons, each company made fundamental changes to improve its operations, the management teams made strategic acquisitions, and both companies issued equity to stay in the game.

Looking for Money with J.P. Morgan

Meanwhile, Saudi Arabia is in America with J.P. Morgan looking for money. Back in May 2016 it was thought that the Kingdom would raise $15 billion. Now it’s $10 billion. On October 3, 2016, Doha Bank CEO Raghavan Seetharaman threw some “shade” on Saudi Arabia, telling Bloomberg Markets Middle East: “They have been pronouncing for borrowing for nine months, and they have still not executed, I’m surprised. They should have gone and borrowed when they knew they would have a budget deficit.” And, that is the dilution. Seetharaman said the austerity measures now undertaken by Saudi Arabia are historic: “The Saudi economy is straining, the banking sector is struggling with liquidity pressure and lending has slowed. As a result, the kingdom is undertaking austerity measures, including cuts to public-sector pay, that are not really required.” Further complicating the bond issuance is how the U.S. Congress roundly rejected President Obama’s veto of the 9/11 Legislation. It was the first override in the Obama administration and it was most definitely bipartisan.

The Kingdom is now fighting two wars – Yeman and ISIS – and make it three if you factor in the shown hostilities with its Iranian neighbor. Wars are not cheap. Since the 9/11 attacks, the U.S. has spent more than $5 trillion on them. The so-called post-cold war peace dividend is non-existent.

Dilution is in the eye of the shareholder. Changing a strategic focus to capture market share rather than generating the cash flow while fighting a financially superior competitor (the North American oil and gas industry) is similar to Super Bowl 50 – you might think your game plan is the right one, but you soon realize your competitor is bigger, faster and more determined to beat you than you are to beat him.

EnerCom talked about it at The Oil & Gas Conference® 2015, referring to how the Chicago School of Economists was the first to discredit the idea that predatory pricing was a long-term solution. About two decades ago, they conducted studies indicating that when companies tried to drive away competitors with predatory pricing, they generally lost a fortune by doing so and then surrendered any market-share gains as soon as they raised prices.

Thomas Sowell said: “Obviously, predatory pricing pays off only if the surviving predator can then raise prices enough to recover the previous losses, making enough extra profit thereafter to justify the risks. These risks are not small.”

Saudi Arabia may not survive long enough to raise prices high enough to recover its previous losses. The fact that the Kingdom is in America trying to raise cash on top of its announced austerity programs are proof enough that the Cash Cow needs tending to.

We recommend that Saudi send its ministers to Mississippi to learn the art of raising Cows.