The price of West Texas Intermediate (WTI) maintained weeks of stabilization before falling below $44/barrel on March 16, 2015 – the lowest since a price of $42.33 on March 11, 2009.

WTI exceeded $50/barrel earlier in the month as the falling rig counts and flat production forecasts seemed to assist in pushing up the price, but sky-high inventories and recent comments by the International Energy Agency (IEA) and OPEC have led to a price drop of roughly 10% since Thursday of last week.

The United States Energy Department jumped on the declining prices on Friday by purchasing 5 million barrels of crude for the Strategic Petroleum Reserve. The purchase comes approximately one year after the Department sold off 5 million barrels in March 2014, when WTI prices averaged $91 to $97 in a bulletin from Plains Marketing. Delivery prices were approaching the $40/barrel mark in the latest update on March 13.

Carl Larry, Director for Frost & Sullivan in Houston, offered some optimism in an interview with Business News Network. Larry believes prices will climb to $70 by August or September followed by an even greater rise in 2016, driven by demand from the U.S., Asia and China. “You have refineries coming back out of maintenance, and production getting cut back,” he said last week. “Everything could come together where, all of a sudden, everyone thought there was plenty of supply and there’s not.”

When the supply shortage finally occurs, the North American market will be in position for the rebound, says Adam Waterous, Co-Head of Equity for Scotiabank. The North American market now accounts for 19% of global production, compared to 10% about a decade ago, and has squeezed out smaller markets in Europe and Africa. “There are two energy superpowers OPEC/Russia and North America – the rest of the world is the casualty,” Waterous said to BNN, mentioning the rest of the world’s share has declined to 29% from 35% during the time North America made its gains.

When the supply shortage finally occurs, the North American market will be in position for the rebound, says Adam Waterous, Co-Head of Equity for Scotiabank. The North American market now accounts for 19% of global production, compared to 10% about a decade ago, and has squeezed out smaller markets in Europe and Africa. “There are two energy superpowers OPEC/Russia and North America – the rest of the world is the casualty,” Waterous said to BNN, mentioning the rest of the world’s share has declined to 29% from 35% during the time North America made its gains.

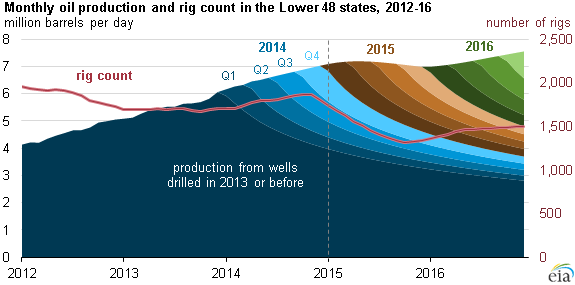

Larry mentioned how some smaller E&Ps have temporarily ceased their exploration programs and are only producing what is currently in their portfolio – an explanation of why rig counts have fallen by more than one-third since December 2014. Larger companies, meanwhile, can continue to produce at high rates on their legacy properties, even though the price per barrel has more than halved on a year-over-year basis.

The ongoing U.S. production is estimated to increase in 2015 to 12.56 MMBOEPD, according to the IEA. The gain is 0.15 MMBOEPD higher than its previous estimate and represents a total gain of 0.75 MMBOEPD compared to 2014. The lower prices are a tough predicament for all involved in the industry, but most producers have no choice but to endure the downturn. Some have opted to sell their product on the future strip price and lock in a few additional bucks, but cutting off production isn’t an option. “Nobody is going to be the white knight in this situation,” said Larry. Larry summed the situation up for small E&Ps, saying, “It’s either make money, or don’t make it at all,” predicting a number of small companies are l likely to fall by the wayside.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.