$40 Oil Prices Coming into View Once Again

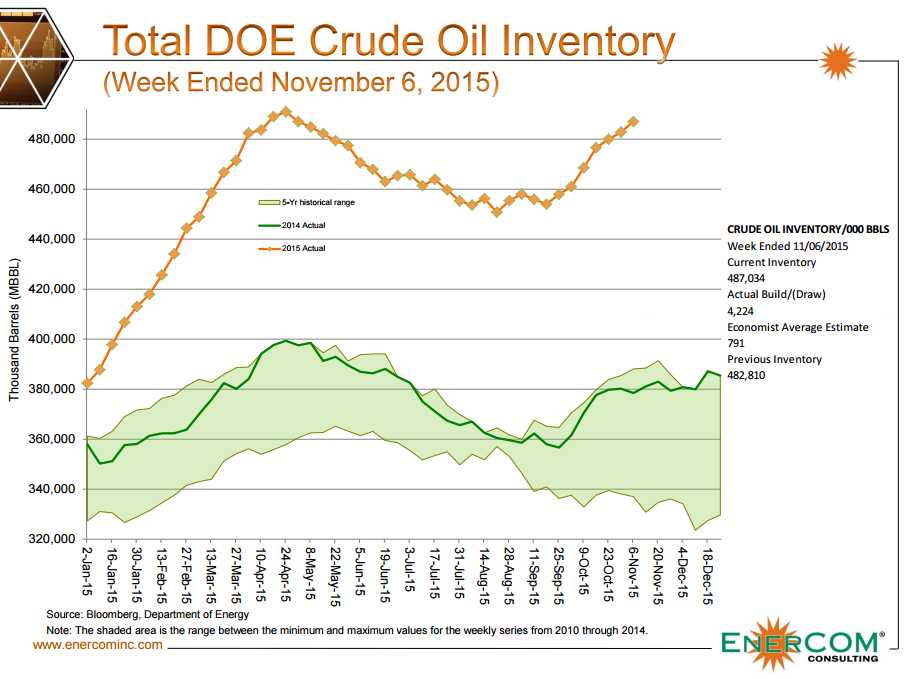

An inventory build of 4.2 million barrels (MMBO) pushed down the price of West Texas Intermediate (WTI) by nearly 3% in Thursday trading, increasing the United States’ crude stockpile to more than 487 MMBO overall.

Crude oil inventories have now increased on a weekly basis for the last seven reporting periods, adding more than 33 MMBO (about 7%) since September 18, 2015. The latest inventory report is the fourth highest in 2015, trailing stockpiles in late April – early May that saw the number eclipse the 490 MMBO mark.

The swelling tanks are not a bullish sign for oil traders, especially considering that the Organization of Petroleum Exporting Countries (OPEC) declared the inventory glut is the highest in “at least a decade.” Prices of WTI closed below $42.00 on November 12, 2015, marking its lowest price since August 26, 2015. Prices have dropped by 13% since November 3 and a total of 16% since early October, when prices were nearing the $50/barrel benchmark.

The swelling tanks are not a bullish sign for oil traders, especially considering that the Organization of Petroleum Exporting Countries (OPEC) declared the inventory glut is the highest in “at least a decade.” Prices of WTI closed below $42.00 on November 12, 2015, marking its lowest price since August 26, 2015. Prices have dropped by 13% since November 3 and a total of 16% since early October, when prices were nearing the $50/barrel benchmark.

More Saudi Criticism

Speculation is abound on both sides of the new commodity environment, with experts and analysts declaring “winners” of the price war even though the global oil and gas market is enduring revenues cuts in the ballpark of 50%. Although opinions on the winners and losers may vary, one thing is difficult to argue: the resiliency of the United States shale industry was underestimated.

“The massive stockpile overhang is one more indicator, along with the ongoing slump in prices, that Saudi Arabia’s oil strategy isn’t working so far,” said Seth Kleinman, head of energy strategy at Citigroup Inc. in an interview with Bloomberg. “The physical oil market is falling apart just as we are hitting the winter, when it’s all supposed to be getting better.”

To the credit of U.S. shale producers, the expected cliff dive of resource production simply has not happened. The Energy Information Administration estimates total oil production will fall to 8.8 MMBOPD in 2016 from 2015’s average of 9.3 MMBOPD – a decrease of less than 6% even though rig counts for fiscal 2015 are less than half the average of 2014. Core Laboratories (ticker: CLB), an oilservice company specializing in reservoir description and management, estimates U.S. tight oil plays exhibit a 70% decline rate in its first year online, but producers are seemingly fending off the steep declines and continuously finding ways to extend the life of their oil plays.

In a feature article published by Oil & Gas 360® in August, data shows Saudi has struggled to retain its market share even though the kingdom’s primary goal in initiating the supply/demand imbalance was to retain (and even expand) its customer base. The chief OPEC producer is now scrambling to assemble special government divisions with emphases on reigning in spending and accessing international bond markets. The Kingdom is believed to be spending more than $12 billion per month to satisfy its social programs while Brent spot prices hover in the $40s.

That doesn’t even touch the fact that the Saudis have drawn the ire of fellow cartel members by refusing to cut back on production. The general consensus among the entire group is that prices are too low, but it is unlikely any policies will change in the upcoming OPEC meeting (which marks the one year anniversary of the beginning of the oil price slide).

“Saudi Arabia is acting directly against the interests of half the cartel and is running OPEC over a cliff. There could be a total blow-out in Vienna,” said Helima Croft of RBC Capital Markets, in an interview with The Telegraph. Ms. Croft has a background as a former oil analyst at the US Central Intelligence Agency.

Jeb Armstrong, Vice President of Energy Research at the Marwood Group, was short and to the point in his Saudi Arabia outlook at EnerCom’s The Oil & Gas Conference® 20. “I think the Saudis are truly in trouble.”