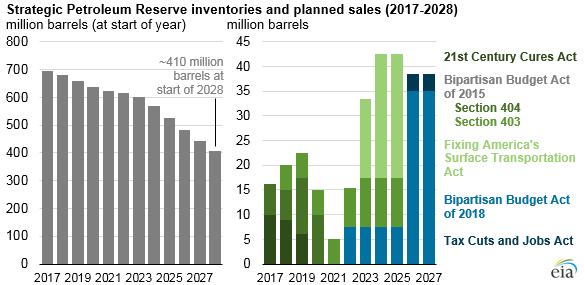

Recent U.S. legislation has directed the sale of more than 100 million barrels of oil from the Strategic Petroleum Reserve (SPR) in government fiscal years 2022 through 2027.

Based on legislated sales established in multiple acts of Congress, the SPR could decline by about 40% in the coming decade while still meeting requirements for petroleum import coverage, the EIA said.

Assuming no other legislation is passed over this period, the SPR could decline from 695 million barrels at the start of 2017, to about 410 million barrels at the start of 2028.

High SPR inventory level prompts sale

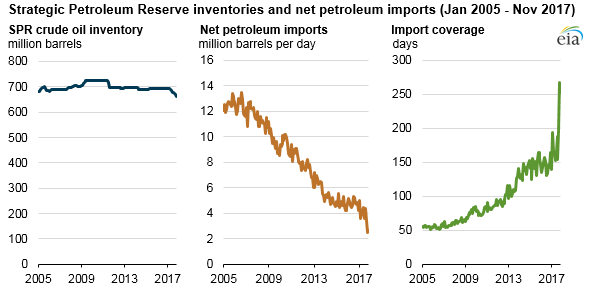

The SPR inventory level is at 97% capacity and has remained constant for several years, the EIA said. Out of 713.5 million barrels capacity, 695 million barrels of that capacity has been filled-up.

Based on November 2017 levels of net crude oil and petroleum product imports, the SPR holds crude oil stocks equivalent to 252 days of import protection. Private (commercial) stocks of crude oil provide an additional 452 million barrels, equivalent to another 172 days of import protection.

Three bills enacted in 2015 and 2016 collectively call for the sale of 149 million barrels in FY 2017 through FY 2025. Most of these sales set volumetric requirements, and revenues from those sales go to the U.S. Department of Treasury.

A section of one of those bills—Section 404 of the Bipartisan Budget Act of 2015—included authorization for funding an SPR modernization program by selling up to $2 billion worth of SPR crude oil in FY 2017 through FY 2020. In that act, the sales are based on revenue targets that must be authorized by Congress.

Two recent congressional acts collectively call for the sale of 107 million barrels of crude oil in FY 2022 through FY 2027:

- The Bipartisan Budget Act of 2018, enacted in February 2018, calls for the sale of 30 million barrels over the four-year period of FY 2022 through FY 2025, 35 million barrels in FY 2026 and 35 million barrels in FY 2027

- The Tax Cuts and Jobs Act of 2017, enacted in December 2017, calls for the sale of 7 million barrels over the two-year period of FY 2026 through FY 2027