Could a drop in natural gas prices spur additional market share growth?

As we swing into spring earnings season, Q1 earnings are coming fast, along with questions surrounding the state of natural gas and oil prices.

In a non-oil and gas realm, Arch Coal Inc. (ticker: ACI) released Q1 results this week. The coal giant reported a net loss of $113 million, or $0.53 per diluted share, in the first quarter of 2015 compared with a net loss of $124 million, or $0.59 per diluted share, in the first quarter of 2014. Revenues totaled $677 million for the three months ended March 31, 2015, down 8% from $736 million for the first quarter of 2014.

Other coal suppliers have experienced similar declines.

“U.S. coal giant Peabody Energy Corporation [ticker: BTU] reported a 5.5 percent drop in first-quarter revenue due to falling prices and slowing Chinese demand,” reported the International Business Times. “The St. Louis company also lowered its projections for U.S. coal demand and production in 2015, citing stiff competition from cheaper natural gas.”

Electric Generation: Swapping Coal for Gas

Some of the revenue drop could be related to the falling natural gas price. There is a substitution effect of swapping coal use for the less GHG-intense natural gas by companies generating electrical power. It is driving market share away from coal. But how much is price driven and how much is driven by government regulation?

Based on the way U.S. electricity is consumed, coal has historically played the base supply role. It has been relied upon for years as one of the primary sources of electrical power for much of the globe. Thermal coal is plentiful and it’s cheap. However, natural gas has been creeping in plant-by-plant during the past few years, taking away market share from the coal producers as the fuel of choice.

Pricing and costs have always, and will always, play a large role in the decision making process.

Pricing and costs have always, and will always, play a large role in the decision making process.

In regions with competitive wholesale electricity markets, the generation price generally follows the natural gas price. The price of electricity in wholesale markets is determined by the marginal cost of energy—the cost of serving the next increment of demand for a determined time period. Natural gas fuels the marginal generators during most peak and some off-peak periods in many regions, says the EIA.

When coal is trading at a discount to natural gas, the logical fiscal choice is to utilize coal as your fuel source (EPA and other federal regulator pressures notwithstanding). However, when the prices get closer and coal and natural gas begin to trade at an energy equivalent basis, coal price can set a floor for gas prices. Said differently, if natural gas prices trade at a discount to coal, there is an economic incentive to switch to natural gas.

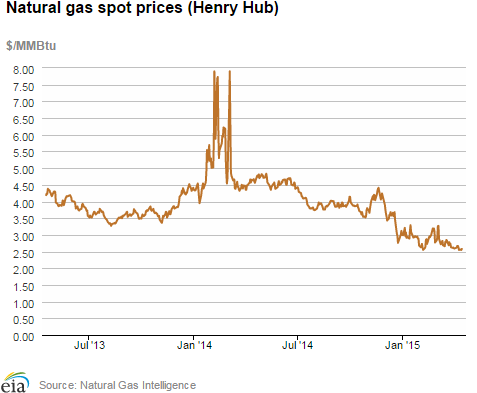

An October 2013 article entitled “Coal Displacing Natural Gas Already” that was published by the Energy Policy Forum said, “We can now safely assume that nat gas is priced out of the market for electricity generation somewhere between $3.50-4/mcf.” Natural Gas prices ended the day at $2.575/mcf on April 21, 2015, a year and a half later. But would significantly rising natural gas prices cause operators to jump back to coal?

Viewed through a political lens, “clean natural gas” replacing “dirty coal” sounds and looks good and with a focus on reducing emissions, strict federal regulations have been slapped on the coal industry. Also, politicians like to tout the benefits of lower energy costs, and with natural gas at an energy equivalent discount to coal, the savings can be passed on to the consumer.

Arch Coal and other coal producers believe they are under attack by regulators. Arch has been vocal about the EPA’s proposed greenhouse gas regulations on electrical generation plants, and with up to 20% of the country’s coal-fired power plants facing retirement, it’s not a surprise.

Logistically speaking, coal fired plants are cumbersome, difficult to turn off and on, and natural gas fired plants have generally played the role of “on demand” supply for the grid. Natural gas plants are quicker to turn on and off (for one the gas is supplied through pipeline, not rail car). This is one of the several reasons that the demand curve for natural gas over time has seen relatively large fluctuations.

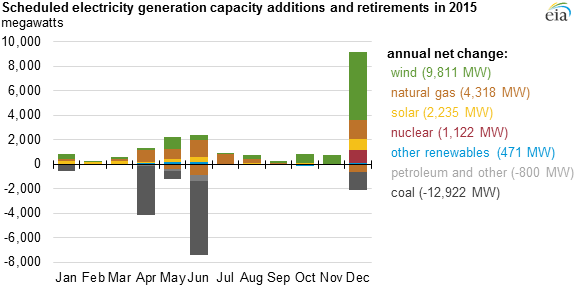

This substitution effect can happen only if there is capacity on the natural gas side. There needs to be ample capacity to support the change. As seen in the chart from EIA below, additions are being made to the capacity of natural gas, and there is a significant downturn in the capacity of electrical generation from coal.

This substitution effect can happen only if there is capacity on the natural gas side. There needs to be ample capacity to support the change. As seen in the chart from EIA below, additions are being made to the capacity of natural gas, and there is a significant downturn in the capacity of electrical generation from coal.

Additionally, EIA reports: “The additions are dominated by wind (9.8 GW), natural gas (6.3 GW), and solar (2.2 GW), which combine to make up 91% of total additions. Because different types of generating capacity have very different utilization rates, with nuclear plants and natural gas combined-cycle generators having utilization factors three to five times those of wind and solar generators, capacity measures alone do not directly show how much generation is actually provided by new capacity of each type. Nearly 16 GW of generating capacity is expected to retire in 2015, 81% of which (12.9 GW) is coal-fired generation.”

According to the EIA, the coal-fired units planned to be retired are smaller and operate at a lower capacity factor than average coal-fired units in the United States. The to-be-retired units have an average summer nameplate capacity of 158 MW, considerably smaller than the 261 MW average for other coal-fired units. Based on 2013 data, the retiring units have a weighted-average capacity factor of 24%, which is much lower than the average capacity factor of 60% for all coal-fired generators over the same time frame.

EPA’s MATS Rules Accelerate Coal Plant Retirements in 2015, 2016

“The large number of coal-fired generator retirements is primarily because of the implementation of the Environmental Protection Agency’s Mercury and Air Toxics Standards (MATS) this year, although some units have been granted extensions to operate through April 2016.

“The large number of coal-fired generator retirements is primarily because of the implementation of the Environmental Protection Agency’s Mercury and Air Toxics Standards (MATS) this year, although some units have been granted extensions to operate through April 2016.

“MATS requires large coal- and oil-fired electric generators to meet stricter emissions standards by incorporating emissions control technologies in existing generating facilities. Some power plant operators have decided that retrofitting units to meet the new standards will be cost-prohibitive and are choosing to retire units instead,” the EIA report said.

With nearly 13 GW of coal burning electricity generation capacity expected to be retired in 2015, the stage is set for natural gas to scoop up further market share.

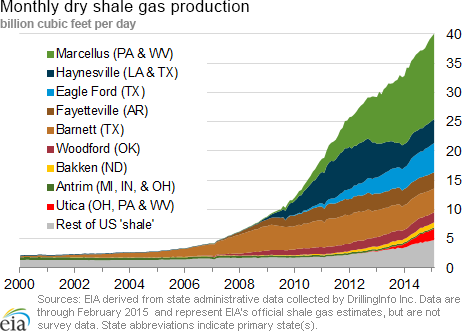

This is obviously good news for the natural gas producers, as a switch from coal to gas represents a long term capture of market share. With the addition of the cleaner burning capabilities of natural gas and the shale revolution in the U.S., led in large part by natural gas producers like Range Resources (ticker: RRC) in the Marcellus shale region, natural gas will look to overtake coal for electrical generation.

Natural Gas will Overtake Coal: EIA

In its Annual Energy Outlook 2015, the EIA concludes that dry natural gas production will be the largest contributor to total U.S. energy production through 2040 in all cases, giving it a 34% share in the Reference Case.

In 2013, dry natural gas accounted for 30% of total U.S. energy production, according to the EIA. Coal’s share of total U.S. energy production remains slightly above 20% of total U.S. energy production through 2040 in the EIA Reference case.

In 2013, coal made up 44% of total generation fuel costs, and natural gas made up 42%. In 2040, coal makes up only 35% of total fuel costs in the Reference case, compared with 55% for natural gas. Oil, which is the most expensive fuel for generation, accounted for 6% of the total generating fuel costs in 2013 and from 2019 through 2040 accounts for only 3% of the total. Nuclear fuel accounts for 6% to 8% of electricity generation fuel costs throughout the projection period, according to the EIA outlook.

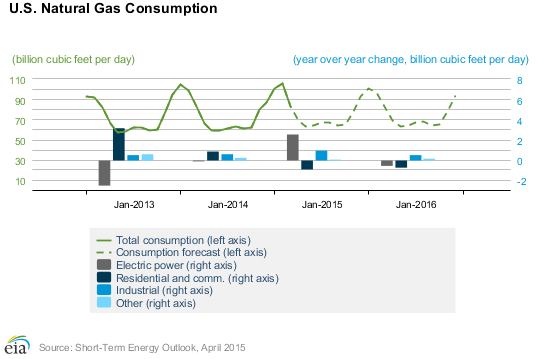

Natural gas consumption in the AEO2015 Reference case increases from 26.9 quadrillion Btu (26.2 Tcf) in 2013 to 30.5 quadrillion Btu (29.7 Tcf) in 2040. The largest share of the growth is for electricity generation in the electric power sector, where demand for natural gas grows from 8.4 quadrillion Btu (8.2 Tcf) in 2013 to 9.6 quadrillion Btu (9.4 Tcf) in 2040, in part as a result of the retirement of 40.1 GW of coal-fired capacity by 2025.

Natural gas consumption in the AEO2015 Reference case increases from 26.9 quadrillion Btu (26.2 Tcf) in 2013 to 30.5 quadrillion Btu (29.7 Tcf) in 2040. The largest share of the growth is for electricity generation in the electric power sector, where demand for natural gas grows from 8.4 quadrillion Btu (8.2 Tcf) in 2013 to 9.6 quadrillion Btu (9.4 Tcf) in 2040, in part as a result of the retirement of 40.1 GW of coal-fired capacity by 2025.

Natural gas consumption in the industrial sector also increases, rapidly through 2016 and then more slowly through 2040, the EIA report projects, benefiting from the increase in shale gas production that is accompanied by slower growth of natural gas prices. Industries such as bulk chemicals, which use natural gas as a feedstock, are more strongly affected than others. Natural gas use as a feedstock in the chemical industry increases by about 0.4 quadrillion Btu from 2013 to 2040. In the residential sector, natural gas consumption declines from 2018 to 2040 and it increases slightly in the commercial sector over the same period.

Coal use in the Reference case grows from 18.0 quadrillion Btu (925 million short tons) in 2013 to 19.0 quadrillion Btu (988 million short tons) in 2040.

But the EIA warns: “As previously noted, the Reference case and other AEO2015 cases do not include EPA’s proposed Clean Power Plan, which if it is implemented is likely to have a significant effect on coal use. Coal use in the industrial sector falls off slightly over the projection period, as steel production becomes more energy efficient.”

Shift Requires Construction of Natural Gas Pipelines: Study

The North American Electric Reliability Corporation published the findings this week from its new grid reliability study, reporting that the EPA’s Clean Power Plan would require a “transformative shift” in energy infrastructure to meet the EPA goals.

The rules in the EPA’s Clean Power Plan would force the nation away from coal-fired power generation beginning in the next five years, and toward natural gas.

“The shift from coal to natural gas would require the construction of more gas pipelines to fuel gas-fired power plants, which can’t be done under EPA’s current timeframe,” the Washington Examiner reported.

“The shift from coal to natural gas would require the construction of more gas pipelines to fuel gas-fired power plants, which can’t be done under EPA’s current timeframe,” the Washington Examiner reported.

Will Coal Ever Come Back?

The EIA released its Annual Coal Report on April 23, 2015, reporting data for 2013.

Highlights for 2013:

- For the first time in two decades, U.S. coal production fell below one billion short tons to 984.8 million short tons in 2013 from 1,016.5 million short tons in 2012 (3.1% lower than 2012).

- Production in the Western Region, which represented about 53.8% of total U.S. coal production in 2013, totaled 530.2 million short tons (2.4% lower than 2012).

- S. coal mine productive capacity decreased 2.5% to 1,252.0 million short tons in 2013, a decrease of 32.4 million short tons compared to 2012.

- Average number of employees at U.S. coal mines decreased 10.5% to 80,396 employees, a decrease of 9,442 employees compared to 2012.

- U.S. coal consumption increased 4.0% to 924.4 million short tons, an increase of 35.3 million short tons.

- The electric power sector consumed about 92.8% of the total U.S. coal consumption in 2013.

- Average sales price of coal from U.S. mines decreased from $39.95 per short ton in 2012 to $37.24 per short ton in 2013 (6.8% lower than 2012).

The EIA’s Annual Energy Outlook 2015 makes it pretty clear. “Coal-fired capacity declines from 304 GW in 2013 to 260 GW in 2040 in the Reference case, as a result of retirements and very few new additions. A total of 40 GW of coal capacity is retired from 2013 to 2040 in the Reference case, representing both announced retirements and those projected on the basis of relative economics, including the costs of meeting environmental regulations and competition with natural gas-fired generation in the near term.

“As a result of the uncertainty surrounding future greenhouse gas legislation and regulations and given its high capital costs, very little unplanned coal-fired capacity is added across all the AEO2015 cases,” the EIA concludes.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.