Penn Virginia (ticker: PVAC) kicked off a new year of oil & gas A&D transactions today, buying acreage in the Eagle Ford.

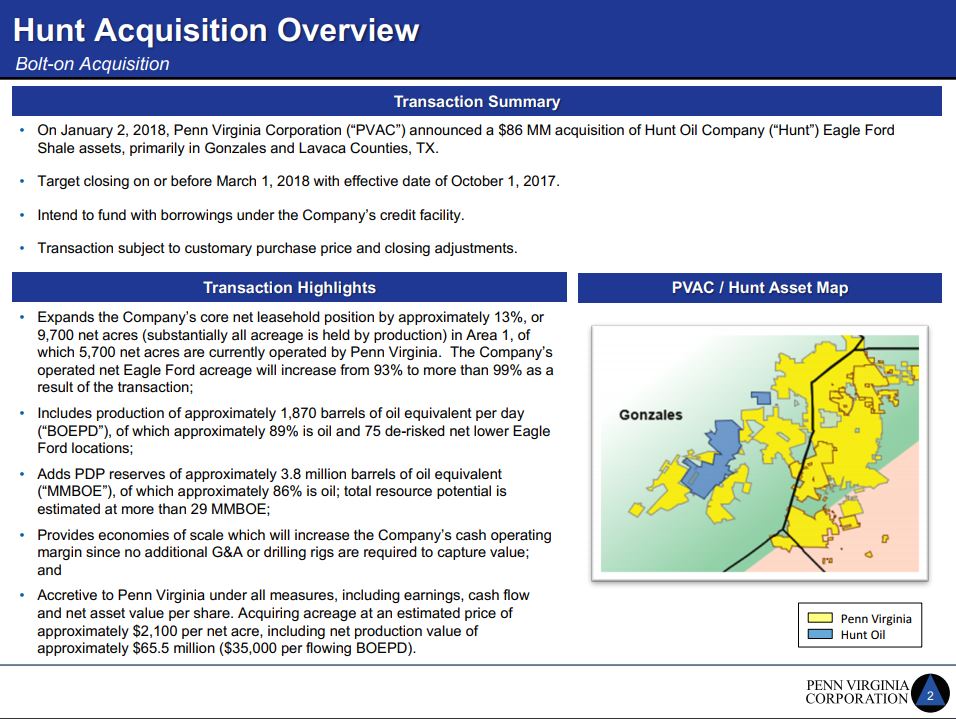

Penn Virginia will acquire assets in Gonzales and Lavaca counties from Hunt Oil Company for $86 million in cash. The acquisition will close on or before March 1, 2018 with an effective date of October 1, 2017. Acquisition funds will be borrowed from the company’s credit facility.

The acquisition expands Penn Virginia’s core net leasehold by approximately 13%, or 9,700 net acres (substantially all acreage is held by production) in Area 1, of which 5,700 net acres are currently operated by the company. Penn Virginia’s operated net Eagle Ford acreage will increase from 93% to mora than 99% as a result of the transaction.

Production of approximately 1,870 BOEPD (89% oil) is included in the acquisition and 75 de-risked net lower Eagle Ford locations. The acquisition also adds estimated PDP reserves of 3.8 MMBOE, of which is approximately 86% oil. Total resource potential is projected at more than 29 MMBOE.

Based on the purchase price of $86 million, Penn Virginia paid an unadjusted $8,865 per acre, or about $2,120 after adjusting for production. The deal values reserves at $22.63/BOE, and equates to $45,990 per BOEPD.

Penn Virginia President and CEO John A. Brooks commented, “This bolt-on acquisition is an excellent fit at an attractive price, increasing our working interest in properties we already own but did not operate. It will establish the company as operator in 99% of its Eagle Ford assets and improve our ability to optimize our development plan across Area 1.”

“The production is nearly 90% crude oil like most of Penn Virginia’s acreage in Area 1, which receives premium LLS pricing as compared to WTI,” Brooks said. “The acquisition will increase our net drilling inventory by 17% while requiring no additional G&A expense. Through the combination of increased production and working interest provided by the acquisition, we anticipate full year 2018 production to grow approximately 120% from 2017, and have revised guidance accordingly.”

Penn Virginia pre-acquisition and post-acquisition

| All numbers are approximate | Pre-Acquisition Penn Virginia |

Acquisition | Post-Acquisition Penn Virginia |

Percent Change |

| Net production (BOEPD) | 12,200 | 1,870 | 14,070 | 15% |

| Oil – percent of BOEPD | 72% | 89% | 74% | 2% |

| Net acreage | 75,800 | 9,700 | 85,500 | 13% |

| Gross drilling inventory | 605 | – | 605 | – |

| Net drilling inventory | 454 | 75 | 529 | 17% |

| Net treatable lateral length | 2.8 MM feet | 0.45 MM feet | 3.25 MM feet | 16% |

Operational update

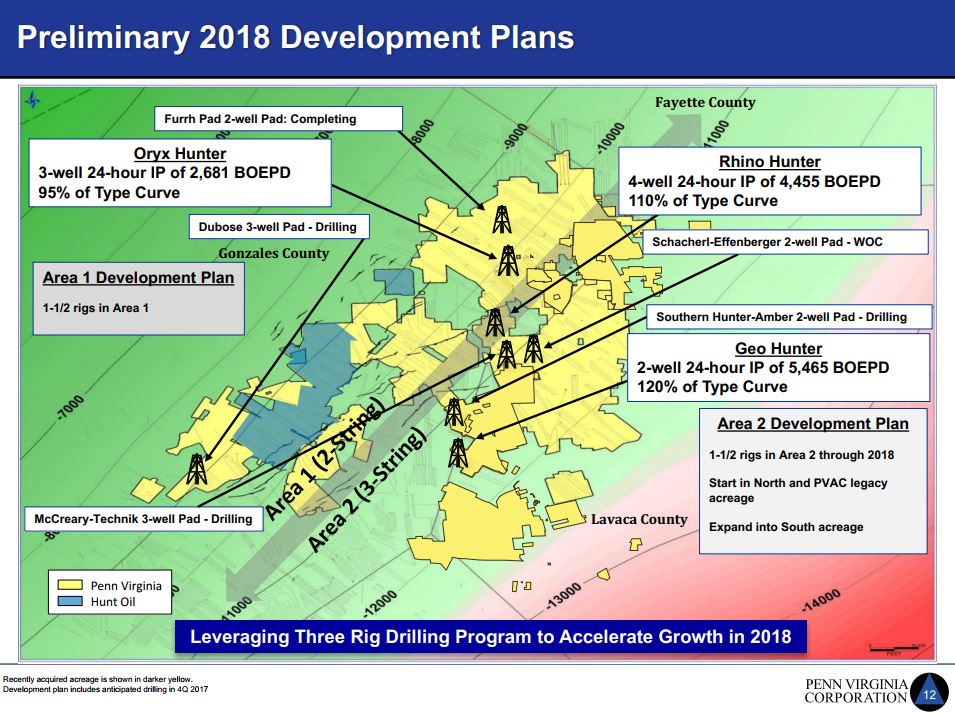

The four-well Rhino Hunter pad was recently turned to sales, with the company holding an 80.5% working interest (post Hunt acquisition). Combined, the four-well pad had a 24-hour initial production rate (IP) of 4,455 BOEPD.

Penn Virginia also turned to sales the three-well Oryx Hunter pad. Combined, the three-well pad had a 24-hour IP of 2,681 BOEPD. The company will have an 81.8% working interest (post Hunt acquisition) in all three wells.

Additionally, Penn Virginia recently turned to sales the two-well Geo Hunter pad, which was Penn Virginia’s second test of its slickwater completion design in Area 2. The two-well pad had a preliminary 24-hour IP of 5,465 BOEPD. The company has a 93.17% working interest in both wells.

The company is currently running a three-rig drilling program and is encouraged by improvements made to drilling times since contracting three new drilling rigs in the latter half of 2017. In Area 1, Penn Virginia is actively drilling its third well on the three-well Dubose pad. Drilling and completion of the pad is expected to be completed in early 2018. Two rigs are active in Area 2, where the company is currently drilling on the three-well McCreary-Technik pad and preparing to commence drilling operations on the three-well Medina pad.

Updated pro forma guidance

| 2018 | |||||||||

| Production (BOEPD) | |||||||||

| Full Year | 22,000 – 25,000 74% oil | ||||||||

| Full Year Capital Expenditures (millions) | $320 – $360 | ||||||||

- Due to the Hunt acquisition, the company’s working interest in Area 1 will increase from 58% to 77% across 39,500 acres. As a result, the company expects production growth for the full year of 2018 to be approximately 120% over 2017 levels. The company’s capital expenditures for 2018 are also projected to be higher due to anticipated drilling on the acquired Hunt acreage.

- The company currently plans to maintain a three-rig drilling program throughout 2018 and expects to spend within cash flow by year-end 2018