Takeaway from Northeast has tripled in four years

After years of strained capacity and punishing differentials, producers in the Marcellus are finally seeing light at the end of the tunnel. According to the EIA, the Northeast will see record growth in natural gas takeaway this year.

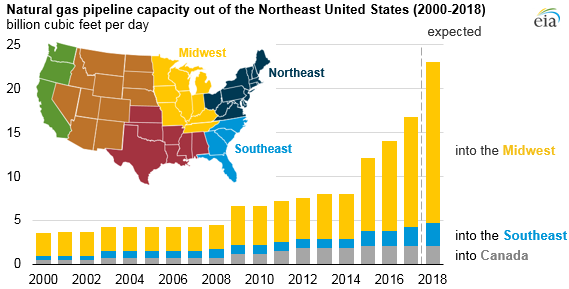

If all projects start operations on schedule, the Northeast will have more than 23 Bcf/d of takeaway capacity by the end of the year, up from 16.7 Bcf/d at the end of 2017. This would conclude four years of rapid growth, as the expected 2018 takeaway capacity is more than triple the takeaway at the end of 2014.

Four large projects account for most new capacity

There are four main projects coming online in 2018, each of which consists of multiple pipelines.

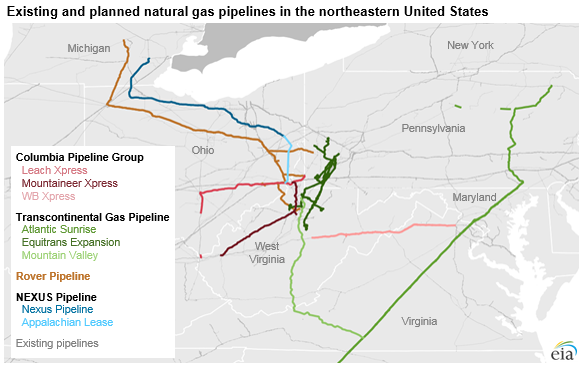

The Columbia Pipeline Group consists of three pipelines moving gas from West Virginia to larger markets. The Leach Xpress and Mountaineer Xpress are expected to add a combined 4.2 Bcf of takeaway capacity, transporting gas to the Midwest. Each of these lines are owned by TransCanada. Leach came online in January, while Mountaineer is expected to begin service in late 2018. The WB Xpress pipeline, also from TransCanada, will not transport gas into a different region, but is expected to bring gas from West Virginia to Maryland, connecting it to mainlines.

The Transcontinental Gas Pipeline has three pipelines expected to come online in 2018, adding more than 3 Bcf of takeaway capacity. Williams’ Atlantic Sunrise is a $3 billion upgrade to the Transco system, increasing the volumes that can be sent south. The Mountain Valley line will take 2 Bcf/d of gas from West Virginia to the Transco mainline, while the Equitrans Expansion project will bring natural gas from Pennsylvania to interconnect with Mountain Valley, coming online in Q4 2018.

ETP’s Rover line is one of the most important lines transporting gas into the Midwest. It is scheduled to expand its capabilities this year. Phase 2 of Rover is expected to bring 3.25 Bcf/d of new capacity into Midwestern and Canadian markets.

The NEXUS pipeline follows a route that is very similar to Rover, and will move 1.5 Bcf/d of Marcellus gas to the Detroit area. NEXUS will be supported by the Appalachian Lease Project, which will transport gas from West Virginia to the main line in Ohio.

Boon to Marcellus producers

This buildout of gas pipelines will be a boon to Marcellus producers, as growth in the basin has always been limited by pipeline capacity. This is a problem that is far more severe in gas operations than in oil.

Permian producers may be currently facing large differentials, but any company willing to pay for rail or trucking transport will be able to get oil to markets. For gas producers, however, there is no other option, pipelines are the only economic way to transport gas over long distances to markets. Recent company announcements from Appalachian E&Ps indicates differentials are already improving, and will likely continue to do so as more pipeline projects come online this year.