One-on-One meeting requests deadline approaching for registered investment professionals

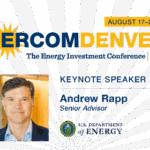

(Oil & Gas 360) – EnerCom is excited to announce that registered institutional investors, family office investors, high-net-worth individuals, private equity professionals, research analysts, portfolio managers, CIOs, and other investment professionals can now request One-on-One meetings with senior management teams of participating companies. Deadline to submit requests to presenting companies is August 8, 2025. The 30th Annual EnerCom