Increased drilling efficiencies keep Concho Resources’ assets profitable

It wasn’t that long ago that oil reached above $50 per barrel. Then the recovery faltered as production reentered the market after the unplanned supply interruptions in Nigeria and Canada had started prices on the upswing. With the price settling in near $40 per barrel, producers are coming to grips with the new normal, but Concho Resources (ticker: CXO) looks to be well prepared for the $40 price environment.

When asked about how the company’s asset portfolio looked at today’s price-point, Concho Chairman and CEO Tim Leach said the company has several decades’ worth of inventory to drill at the pace it’s currently going.

Concho currently holds approximately 250,000 net acres in the Northern Delaware Basin, 125,000 net acres in the Southern Delaware Basin, 110,000 net acres in the Midland Basin, and 100,000 acres in the New Mexico Shelf.

Commenting on high-return assets, Leach said “I think you could actually raise the bar above 20% (IRR) and still have multi-decades type of inventory at this year’s pace.” Previously, Concho said it believed around 30% of its assets showed 20% IRRs or better at $40 oil, but Leach said during the conference call that “if it was 30% before, that number is higher [now], somewhere between 30% and 50%.”

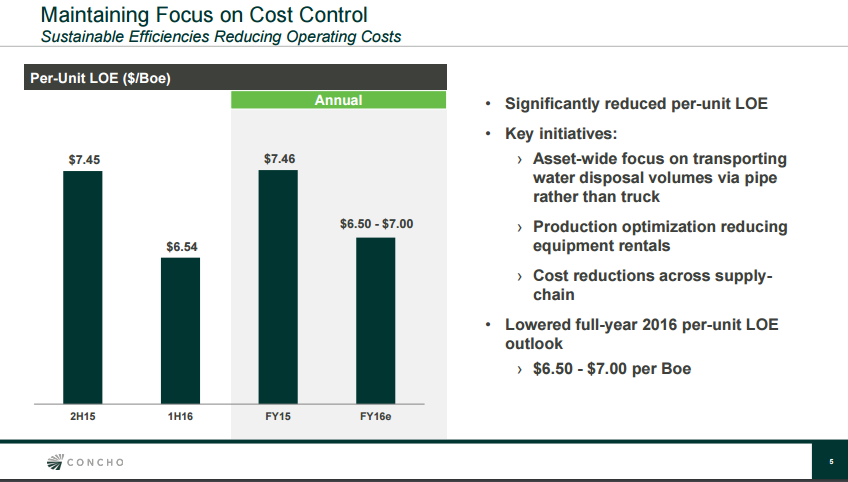

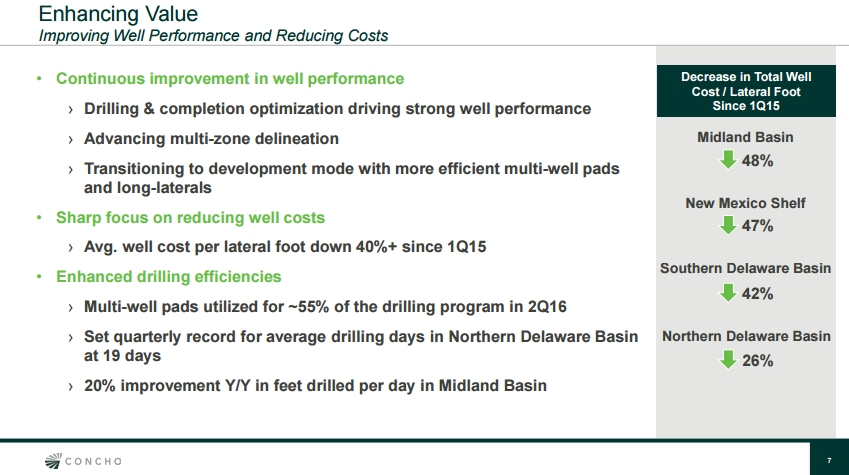

These improved numbers were thanks in large part to improved operating efficiency, Concho’s management said. In the company’s second quarter filing, the company reported production growth guidance for the full year at 0%-2%, up from 0% while simultaneously lowering operating costs. G&A was down $0.15 at its midpoint, while LOE was down $0.75 at its midpoint, both on a per BOE basis.

Most of those savings were coming from efficiencies, and not lower service costs, Leach added. “We still have continued to experience lower cost from the service industry. The rig count hit a bottom in the Permian Basin of I think 130 or 140 rigs, and now it’s up to 190. So, we’ve seen some increasing activity out here.

“But at the same time, the Permian Basin’s kind of where everybody wants to be. So, there’s been equipment and people moving in here from other basins. So, I think we’ve got plenty of spare capacity in all respects. And so, I don’t think we feel any cost pressure on the upside, and there may still be some room to move lower.”

Drilling where everyone wants to be

“The Southern Delaware Basin is very early as far as getting enough information on wells to delineate all the productive zones,” said Leach. “And so, I think there’s still a tremendous amount of work to be done there. And so, we like the Delaware Basin, and the top tier areas of the Delaware Basin continue to grow.

“And the Midland Basin … there’s lots of companies with lots of data, and it’s probably further along the industry’s understanding of what works and what doesn’t work and where the Wolfcamp works best, where the Spraberry works best. But, in general, I think for both the Midland Basin and the Delaware Basin, it’s still the early innings.”

During the company’s conference call Leach said Concho currently has 16 rigs operating across its assets. In the company’s investor presentation, the slides indicate that there are currently four rigs in the Northern Delaware Basin, four in the Southern Delaware Basin, six in the Midland Basin, and two drilling in the New Mexico Shelf.

“I think the enhancements we’ve seen in the Midland Basin, namely water delivery system—the ability to drill long laterals—have allowed that asset to compete with the Delaware,” said Concho CFO Jack Harper.

“Going forward, when I look at the allocation this year, it’s about 25% to the Midland Basin. That’s a pretty good proxy going forward. As Tim said, we’re looking for a balance between the Midland Basin, the Southern Delaware and the Northern Delaware.”