Heavy oil transporter Pembina to acquire Veresen: combined EV of $33 billion creates one of the largest Canadian infrastructure companies

Western Canada heavyweight Pembina Pipeline (ticker: PPL) announced the acquisition of Veresen (ticker: VSN) today, a $9.7 billion deal.

This transaction will create one of the largest energy infrastructure companies in Canada, with a total enterprise value of about $33 billion.

Pembina is offering to acquire all Veresen shares for either stock or cash. Upon completion of the transaction, Pembina shareholders will own about 80% of the combined company, while Veresen will own about 20%. Assuming Pembina assumes all of Veresen’s debt and preferred shares, the transaction is valued at C$9.7 billion.

Pembina

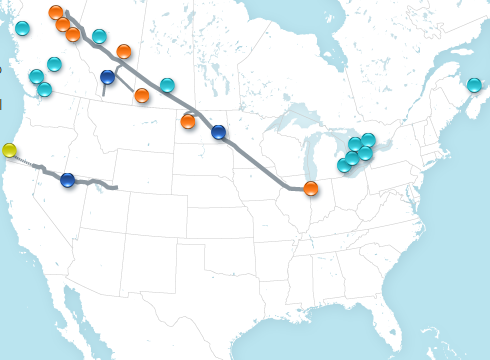

Pembina is a major midstream company with assets in the Western Canadian Sedimentary Basin. The company owns more than 7,000 miles of pipelines, primarily in Alberta. Pembina’s heavy oil pipelines run from Fort McMurray and the Pelican heavy oil sites to refineries in Edmonton, with a total current contracted capacity of 975 MBOPD. The company has been in the conventional oil pipeline business since 1954, and has grown that business line to over 6,000 miles of pipe. In total, Pembina transports about half of Alberta’s conventional crude production, about 30% of Western Canadian NGL and nearly all condensate produced in British Columbia, with plans to grow further.

Veresen

Veresen owns significant gathering infrastructure in Alberta, focusing on the Montney formation. The company also has a 50% interest in the Alliance Pipeline, an 1,800-mile pipeline transporting 1.325 Bcf/d of gas from Alberta to Chicago. The company has interests in 13 power facilities, with gas, hydroelectric and wind generation.

Veresen also is the owner of the proposed Jordan Cove LNG export project. This project is a 1 Bcf/d LNG export terminal located in Coos Bay, Oregon. The $7.5 billion facility was originally rejected by FERC in March 2016, but was recently approved for pre-filing. A 235 mile pipeline will connect with the interstate Ruby line to supply Jordan Cove.

The merger between the two companies may make this project more likely to succeed. Pembina President and CEO Mick Dilger expressed interest in Jordan Cove in an interview with the Financial Post. According to Veresen President and CEO Don Althoff, the post-merger company will be large enough to fully support the project.