(Oil and Gas 360) – Energy Advisors is providing continuing research as events unfold at Coterra Energy in response to pressure from activist Kimmeridge.

Earlier in our report“ The Debate Begins” we looked what a merger between Coterra and Devon would look like. Imagine a Super Independent with 1.6 MMBoepd. Amazingly these volumes would exceed US volumes of Conoco Lower 48 (1.5 MMboepd), EOG (1.3 MMboepd), OXY US (1.2 MMboepd), Diamondback (0.9 MMboepd). And >50% would be in the Delaware Basin and setup a leader with room to execute further consolidation in the Delaware.

Our latest is The Debate Continues which looks at the impact of Kimmeridge’s intent to nominate Scott Sheffield as Coterra Chairman. We view the move as a potential game-changer for flushing out the debate over “pure play” or “Basin diversity“ as the ultimate corporate strategy. Coterra’s pure play strategy would entail selling off the Marcellus and Anadarko to be a Delaware Basin focused company.

Pure plays are the soup du jour with names include Diamondback (Midland Basin), Matador and Permian Resources (Delaware), Chord (Bakken), Mach (Anadarko), Magnolia (Eagle Ford), Comstock (Haynesville), Talos (Gulf) and EQT, Range and Antero (Appalachia).

Simplicity reigns but stands in contrast to a Coterra/Devon tie-up.

Where to from here?

Obviously, Sheffield’s brand is turning operational scale and Basin focus into premium value and likely doesn’t support a “merger of equals” just for the sake of scale. Instead, we expect Scott (if he even gets a board seat) to push for either the “clear, value creative Permian directive” OR a “takeout premium” that closes Kimmeridge’s perceived value gap. Like the investment fund accomplished with Silverbow and Crescent Energy.

Sheffield would bring “heft” to Coterra and experience which would help a diverse “Devonterra” – a name we christened for talking purposes. However, it’s more important to remember Sheffield recently ran one of the most regionally focused pure plays of all time in Pioneer Natural Resources which was recently premium’ed by Exxon for $64.5 billion.

There is also Sheffield’s experience with diversity, when his younger self led Parker & Parsley through the early 1990’s rolling up Damson, Graham, ($557MM), PG&E ($122MM) and Bridge Oil ($330MM) before merging with Mesa Petroleum ($1.6B) in 1997. The Mesa/T. Boone deal set off another wave of pioneering both domestically and overseas when they bought Chauvco, ($1B) in 1997 and Evergreen, ($2.1B) in 2004, (two very, very distinct operations).

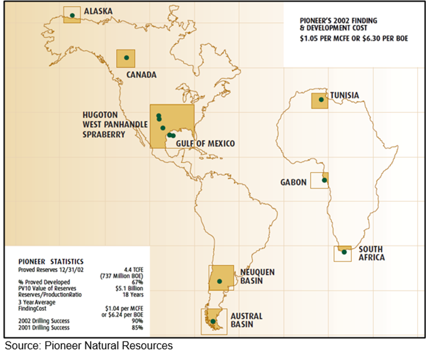

All in all, the 1990’s and 2000’s left the Pioneer scattered from Alaska to Argentina, from Australia to Canada, from Tunisia to South Africa, from India to China, and from Hugoton to Midland. A swath of diversity that kept management busy through repeated boom-bust cycles until Sheffield finally found himself back in Midland by 2020 where time and technology prompted Pioneer’s focus on the pancake intervals of its legacy Spraberry and Wolfcamp intervals.

If you are looking for more perspective for Sheffield’s journey as a pioneer note that at year-end 2002, (before Evergreen) Pioneer held assets all over the globe with volumes of 114,000 Boepd, proved reserves of 737MMboe, and a total PV10 of $5 billion.

See map below for Pioneer’s global footprint in 2002.

Two decades later, Pioneer with assets entirely restricted to the Permian Basin, was producing ~700,000 Boepd and recorded reserves of 2.5 billion BOE all to be gobbled up by Exxon in 2023 in one of the first consolidation moves now driving our industry.

Keeping it Simple (and fantastic rock)—

We doubt there has ever been a more circular route that took an oilman from Midland and back again.

For Coterra, Sheffield is a storied statesman who has managed it all, but his best success seemed to come when he kept it simple.

Pure Play Advantages

- Management Focus. Laser attention on best in class within one’s own neighborhood.

- Operational Efficiencies. One basin focus allows firms to leverage their acreage,

- operational resources and people to drive down costs through shared infrastructure

- Prime Lands. One basin allows land departments to spend capital rolling up and

- aggregating acreage for longer laterals

- Superior economics. Pioneer was extraordinary in driving down costs to as little as $9 per barrel

- Simplicity and attractiveness. Operators can dumb down business and achieve profit and efficiency gains creating a more profitable entity

- Investor Friendly. Pure plays allow the investing community to allocate capital

- according to their insights and expertise across the oil and gas landscape instead of relying on management to do the heavy lifting for capital allocation.

- Pioneer Natural Resources Journey as of 2002. Later transformed to Midland Basin pure play and sold to Exxon for $64.5 billion in late 2023.

Pioneer Natural Resources Journey as of 2002. Later transformed to Midland Basin pure play and sold to Exxon for $64.5 billion in late 2023.

About Energy Advisors oilandgas360.com contributor

Energy Advisors is a leading firm in oil and gas transaction advisory services and thought leadership having served the industry for over 35 years. We trace our roots back to PLS Inc which sold its listing service, research, and databases to DrillingInfo in 2018 and rebranded its advisory and marketing arm as Energy Advisors in 2019.

Contacts:

Brian Lidsky

Director of Research

713-600-0138

Blake Dornak

VP, Marketing

713-600-0123

bdornak@energyadvisors.com

The views expressed in this article are solely those of the author and do not necessarily reflect the opinions of Oil & Gas 360. Please consult with a professional before making any decisions based on the information provided here. The information presented in this article is not intended as financial advice. Contact Energy Advisors for the full report. Please conduct your own research before making any investment decisions.