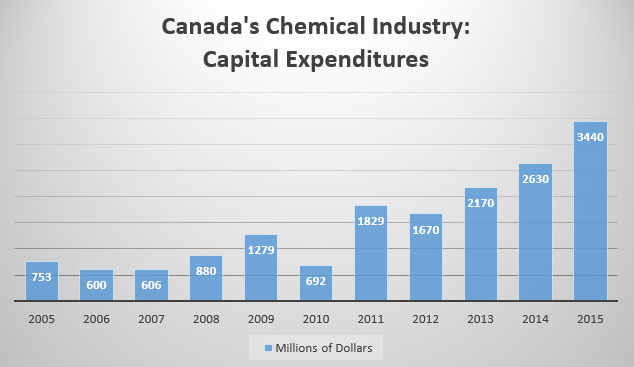

Predicted investment growth of 30% set to come in 2015 for Canadian petrochemical industry

The Chemistry Industry Association of Canada (CIAC) predicts a 30% growth of capital investments in 2015, up to $3.4 billion overall, according to a report from Petrochemical Update. The report cites Canada’s pro-business taxes, ample resources and energy infrastructure as reasons for the increased investment.

David Podruzny, CIAC’s Vice President of Business and Economics and board secretary, says that the tax system in Canada is more favorable to petrochemical development than in competing U.S. jurisdictions. In Ontario and Alberta, the combined federal and provincial rate is 25%, while in British Columbia and Quebec it is 26% and 26.9%, respectively. Research and development is also encouraged with favorable fiscal treatment, says the report.

Approximately 43% of the country’s chemical manufacturing is located in Ontario, where there is an abundance of shale gas liquid. Several global companies operate in Ontario where industry expertise stretches back generations, according to David Moody, project leader for Business Growth Services at Sarnia-Lambton Economic Partnership.

Nova Chemicals, one of the companies with operations in Ontario, recently revamped its Corunna Cracker facility to use ethane from the Marcellus Shale as feedstock. By 2018, its capacity will be expanded by 20% to 1 million tons per annum.

The petrochemical industry in Canada also has an excellent position to export to both North American and Asian markets. “Canada offers foreign investors in this sector strong production economics,” says Michael Atkinson, president of the Canadian Construction Association. “[There is] an established production and transportation infrastructure with 19 refineries and 825,000 kilometers oil pipeline system, and access to one of the largest capital markets for oil and gas companies.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication.