Outright Midstream Sale Could Generate $600 to $700 Million

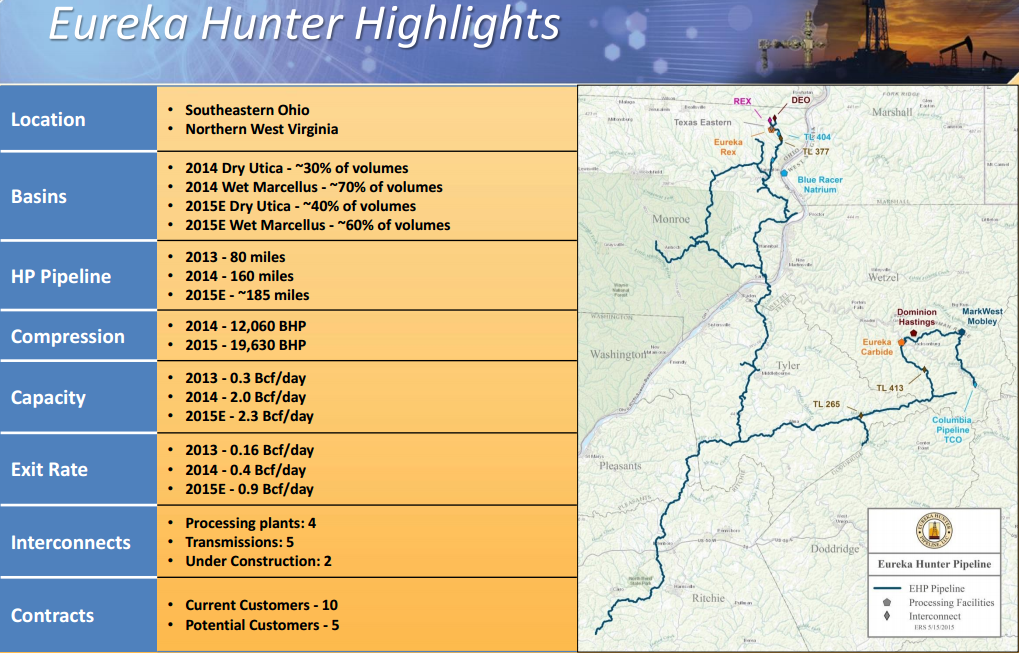

Eureka Hunter Pipeline, a privately owned subsidiary of Magnum Hunter Resources (ticker: MHR), surpassed throughput volumes of 700 MMcf/d on July 2, 2015, according to a company release. Eureka spans nearly 200 miles throughout the Marcellus/Utica region and includes nine interconnects, consisting of transmission and processing plants. Two additional interconnects are currently under construction.

The capital utilized on Eureka Hunter buildout has led to throughput volumes increasing by approximately 31% on a compounded quarterly basis since Q1’13. Its latest record is more than three times the amount of average throughput in Q2’14. Gary Evans, Chairman and Chief Executive Officer of Magnum Hunter Resources, said the company expects throughput volumes to approach 1,000 MMcf/d by the end of 2015.

MHR Capital Raises

Magnum Hunter plans on selling its remaining 45.5% equity interest in Eureka Hunter for expected gross proceeds of $600 to $700 million. “We believe the continued dramatic growth in throughput volumes will enable us to receive an optimal price from potential suitors,” said Evans in the press release.

MHR has been very active on raising equity in recent months. In June, the company sold 5,210 undeveloped and unproven acres in Tyler County, West Virginia, for cash proceeds of $33.6 million. The properties accounted for less than 2.5% of MHR’s leasehold. Additional measures are being considered, including additional sales or the potential for joint ventures on its 208,000 net acres in Ohio and West Virginia.

Assuming Eureka is sold for $600 million, KLR Group forecasts MHR’s 2015 net debt to EBITDA multiple would fall to 6.5x from 17.1x. Its 2016 multiple would drop below 3.0x. Capital One Securities upgraded MHR upon the announcement of a potential Eureka sale, saying the proceeds “should more than fund the ~$150MM operating cash flow deficit that we forecast by YE16 based on CAPEX of $98MM this year and $96MM next year.”

The company’s production volumes continue to grow in the meantime. Its Q1’15 flow averaged 27,261 BOEPD – a 58% quarter-over-quarter increase. Volumes in March averaged 30,832 BOEPD, which was 35% higher than January. Its position in the Appalachia, effective March 31, yields proved reserves of 136 MMBOE (75% gas) for a PV-10 value of $765 million. More than 850 gross potential drilling locations remain, and only 62 had been completed as of June 2015.