Optionality in Capital Spending and Marketing a Key Benefit of Memorial Merger

In its 3Q 2016 earnings call, Range Resources (ticker: RRC) CEO Jeff Ventura discussed the positive outlook for Range following the closing of its merger with Memorial Resources in September and the integration of the Terryville complex of Northern Louisiana.

Ventura highlighted five key positive attributes that the post-merger company offers, including “a high quality, low cost asset base in two complementary basins, improved capital efficiency, and a strong marketing effort able to sell products in multiple markets.”

Ventura also cited “top tier operational execution” and “a strengthened balance sheet with strong liquidity and a strong hedge position for the remainder of 2016 and 2017.”

The company expects natural gas pricing to improve through the end of the year and into 2017 on the back of declining U.S. production and increasing demand from Mexican exports, power generation, and LNG exports, and petrochemicals.

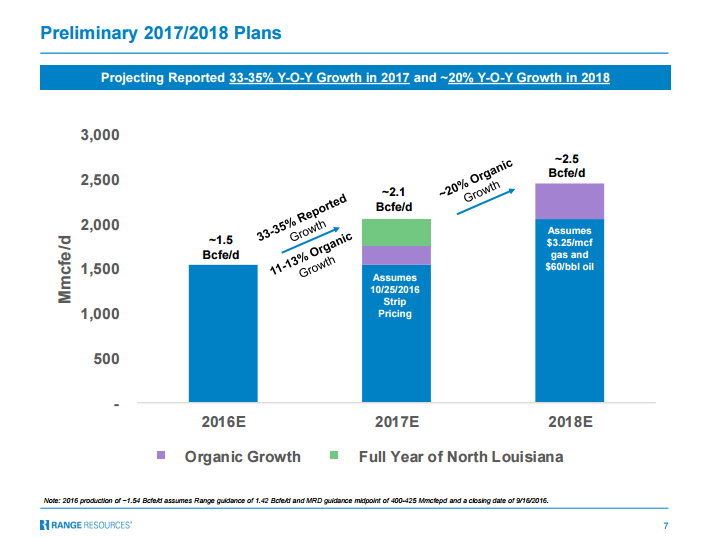

~34% Production Growth in 2017 with Louisiana Assets

Production and capex for the remainder of 2016 was unchanged, with 4Q production guidance at 1,850 Mmcfe/d. Although a capital plan for next year has not been announced, the company is expecting organic production growth of ~12% (2,100 MMcfe/d) in 2017 and 20% (2,300 MMcfe/d) in 2018 at current strip prices. In response to analyst questions, Ventura stated that capex spending would be “at or near cash flow levels.”

The company expects to average nine rigs running in 4Q 2016, with five in the Southern Marcellus Division and four in the newly formed Northern Louisiana Division. In the Marcellus, 23 wells were turned on line in 3Q with 99 expected to be completed by year-end, 13 lower than prior guidance. Sixteen wells were turned online in Terryville with 3 completions expected by year-end.

Louisiana Assets and Gulf Coast Proximity Improve Marketing Options

On the infrastructure front, all gas pipelines the company is contracted on are expected to be completed on schedule. The completion of the Gulf Markets Expansion pipeline in early October will allow an additional 150 MMcf/d of Marcellus production to go to the Gulf Coast. The company has also secured capacity on Colombia’s Lee Train Express and ETP’s Rover Phase II, which have received their first final EIS approvals and are expected to be operational in 4Q 2017.

Pricing differentials improved across the board due to increased access and opportunities in Northeast, Midwest, and Gulf Coast markets as well as growing Northern Louisiana production. Corporate gas differentials are expected to improve to $0.46 in 4Q 2016 and $0.33 in 2017.

NGL realizations are expected to increase to over 26% of WTI in 4Q 2016 and 2017. Condensate differentials to WTI are expected to improve to $6 – $7 per bbl below NYMEX in the same period, driven by long-term agreements with Midwest refineries and Gulf Coast proximity.

The company has currently hedged 80% of its expected 4Q16 natural gas production at a weighted average price of $3.32/Mcf and 50% of expected 2017 gas production at a weighted average price of $3.21/Mcf.

Operational Efficiencies Continue, Terryville Assets Show Promise

On the operational front, gains in drilling and completions efficiencies continued to drive peer-leading EURs and well costs in the Marcellus. Year over year, lateral feet per day per rig increased 22% while drilling cost per foot decreased 5%. Significant cost savings were realized by drilling from existing pads

In North Louisiana, the company twice recorded the fastest spud to rig release times in the field to date, while a recent well registered a peer-leading IP30 of 27 Mmcfe/d. Ventura credited “early success refining the targeting and landing in the lower Cotton Valley” as well as “very encouraging” results from three vertical pilot holes in extension areas south of the Terryville field that would provide “additional data that will be rolled into our planning for 2017 and 2018.”

Service Costs Expected be Steady in 2017

COO Ray Walker commented on service costs inflation for 2017. “The way prices on the service and supply side move is going to be very regional. In areas like West Texas and maybe the SCOOP/STACK areas where activity has ramped up more, you could see prices moving up. In the Marcellus per se we don’t see it.” “We focus in what we term long-term relationships, not necessarily contracts, and we don’t see any important or significant price increases going into 2017.”

Range’s Q3 2016 earnings release, presentation, and a recording of the conference call are provided.