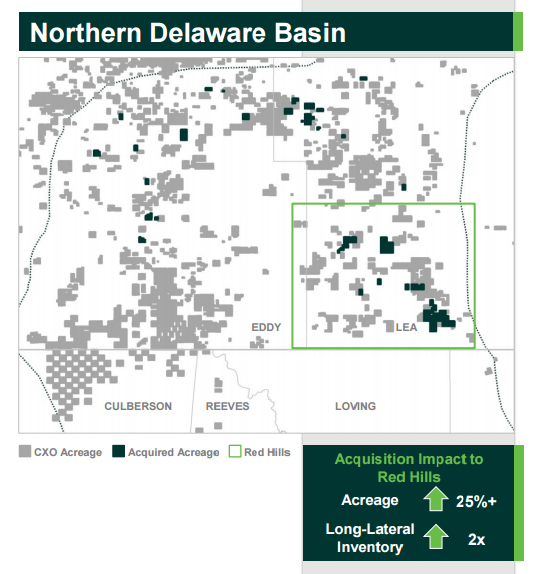

Concho Resources doubles long-lateral inventory with Red Hills bolt-on

Concho Resources Inc. (ticker: CXO) announced Monday that the company has added approximately 24,000 gross (16,400 net) acres to its norther Delaware Basin assets through a $430 million deal with an undisclosed seller. The acquired acreage is producing approximately 2.5 MMBOEPD (69% oil) and doubles the company’s long-lateral drilling inventory in the Red Hills area of the Northern Delaware Basin from which the company has posted strong drilling results in the past.

“The Red Hills area is an oil-prone fairway generating exceptional returns at current commodity prices,” Concho said in its press release Monday. “With more than 5,000 feet of resource-rich hydrocarbon column, this area is highly prospective for multi-zone development. The acquisition more than doubles the company’s long-lateral drilling inventory in Red Hills and enhances its ability to drill long laterals on existing Concho leasehold.”

Prior to Monday’s bolt-on acquisition, CXO held approximately 250,000 net acres in the Northern Delaware Basin, 125,000 net acres in the southern Delaware Basin, 110,000 net acres in the Midland Basin, and 100,000 acres in the New Mexico Shelf.

Assuming Concho paid approximately $40,000 per flowing BOE, the deal works out to about $20,000 per acre, which is materially lower than recent Northern Delaware transaction at approximately $30,000+ per acre, notes a report from SunTrust this morning.

Concho Chairman, CEO and President, Tim Leach commented, “This transaction is an opportunistic bolt-on in the Red Hills area where we are consistently delivering strong well performance. Our evaluation provides for multiple opportunities to enhance value through increased density development on multi-well pads as well as additional zones beyond the Avalon Shale, Wolfcamp Shale and the emerging Wolfcamp Sands. With a continued focus on driving capital efficiency gains and actively managing our portfolio, this acquisition further strengthens our position in the Permian Basin and reinforces our ability to deliver differentiated long-term growth.”

Consideration for Monday’s Delaware Basin deal includes $150 million in cash and 2.18 million shares of Concho’s common stock (1.5% dilution). The company said it expects to fund the cash portion of the transaction with cash on hand, borrowings under its $2.1 billion credit facility and potentially non-core asset sales.

Concho upgrades full-year 2017 outlook while maintaining previous capex budget

Along with news of the company’s acquisition today, which is expected to close in January, Concho also updated the company’s full-year outlook following the deal. As a result of the bolt-on, CXO expects to grow oil production volumes by more than 20% year-over-year in 2017 and total production by 18% to 21%, up from a previously disclosed guidance range of 17% to 20%. Concho plans to operate an average of eight rigs in the Northern Delaware Basin during 2017, up one from its previous guidance.

The company does not plan to change its previously announced capital budget to achieve this increased production, however. Concho will maintain its capital expenditure plan of $1.4 billion to $1.6 billion for next year, it said in its press release. CXO expects to fund its 2017 capital program within cash flow. The capex plan excludes acquisitions and is subject to change depending “on a number of factors, including prices and industry conditions,” the company said in its release.

Following the announcement today, Stephens said it is still modeling leverage “remaining conservative with YE17 net debt-to-EBITDAX of ~2.2x” for the company.

Permian assets offering 20% IRRs at $40 oil

Low oil prices have force E&P companies to improve efficiencies wherever possible, and Permian operators like Concho have seen a great deal of success, explaining the flight of capital to the play. Concho believes that, even at $40 oil, it has multiple decade’s worth of inventory with greater than 20% internal rates of returns (IRRs) in the Permian.

Speaking during a conference call in August, Leach said between 30% and 50% of the company’s Permian assets offer IRRs above 20%. These high returns were thanks in large part to improved operating efficiency and not lower service costs, Concho’s management said.

“The Permian Basin’s kind of where everybody wants to be. So, there’s been equipment and people moving in here from other basins,” Leach said during the call. “So, I think we’ve got plenty of spare capacity in all respects. And so, I don’t think we feel any cost pressure on the upside, and there may still be some room to move lower.”