Jones Energy, Inc. (ticker: JONE) produced 21,207 BOEPD in Q4 2017, 6.5% above the company’s midpoint guidance. Oil volumes made up 29% of total production at 6,217 BOPD and NGL volumes represented 30% of Q4 production.

For the full year of 2017, Jones produced 21,332 BOEPD. Average oil volumes of 5,378 BOPD comprised 25% of production and NGL volumes accounted for 31% of full year production. For the full year of 2017, the company’s production grew 11% as compared to 2016’s production.

Q4/FY 2017 CapEx

During Q4 2017, the company’s capital expenditures totaled $63.3 million, of which $57.3 million, or 91%, was related to drilling and completing operated wells. The remaining $6.0 million was primarily related to participation in non-op drilling.

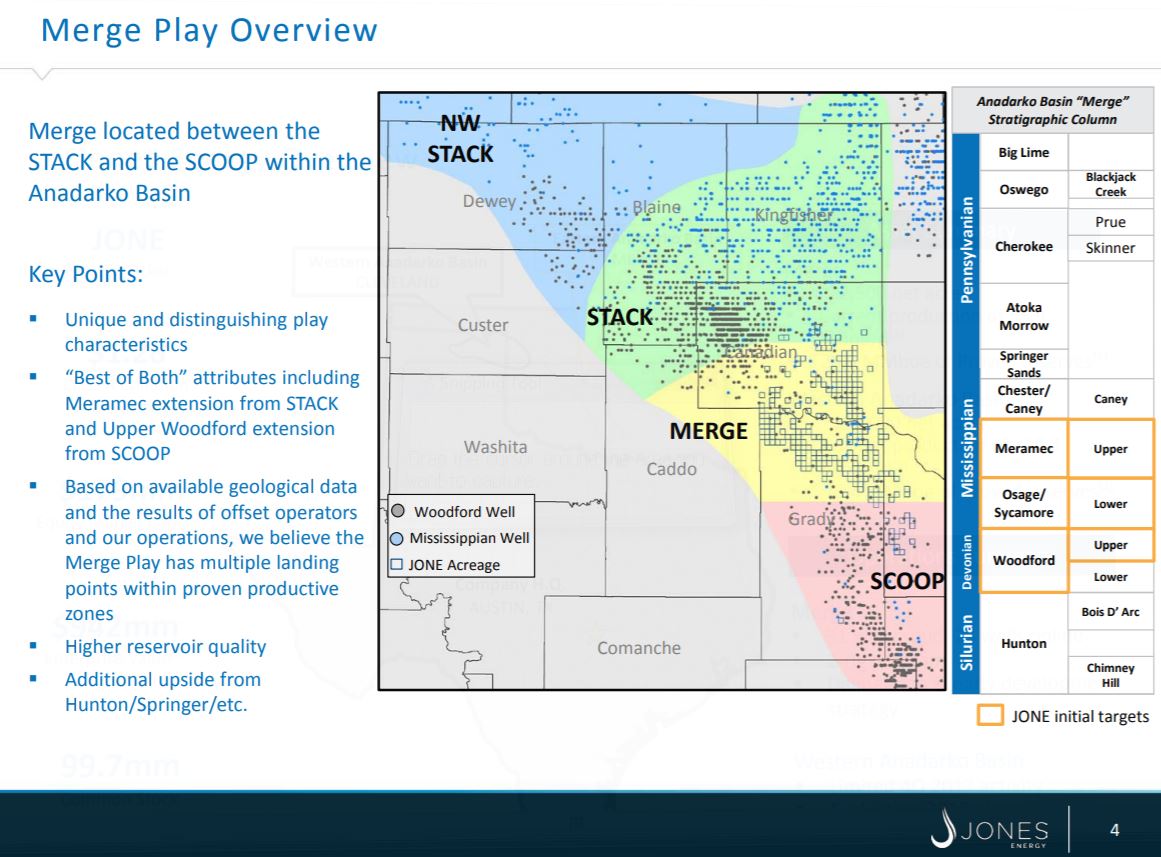

For the full year 2017, total capital expenditures were $248.0 million, of which $205.7 million (or 83%) was related to drilling and completing wells. Total Merge play spending was $126 million for the full year.

2018 CapEx and operations

The initial 2018 budget stands at $150 million, with $119 million dedicated to drilling and completion activities. This budget represents a 40% reduction in capital expenditures from 2017 and is allocated primarily to a development program in the Merge play.

The company is currently running two rigs in the Merge play and plans to drill a total of 20 gross wells in the 2018 program, assuming an average working interest of approximately 65%. The company has also budgeted $11 million for drilling the western Anadarko asset. Jones Energy believes that the 2018 budget will allow it to HBP all sections where it owns a majority working interest position.

2018 guidance

Based-on the initial 2018 capital budget and operating plan, the company is projecting 2018 average daily production of 19,300-21,500 BOEPD. Jones said because the company is drilling both long laterals and multi-well pads, which have longer lead-times and require offset shut-ins for fracs, production is expected to fluctuate throughout the year. A table has been provided below with full year and first quarter 2018 guidance by category:

| 2018E | 1Q18E | |||

| Total Production (MMBoe) | 7.0 – 7.8 | 1.7 – 1.9 | ||

| Average Daily Production (MBoe/d) | 19.3 – 21.5 | 19.2 – 21.4 | ||

| Crude Oil (MBbl/d) | 5.6 – 6.2 | |||

| Natural Gas (MMcf/d) | 46.4 – 51.5 | |||

| NGLs (MBbl/d) | 6.0 – 6.7 | |||

| Lease Operating Expense ($mm) | $43.0 – $46.0 | |||

| Production Taxes (% of Unhedged Revenue) * | 4.0% – 4.5% | |||

| Ad Valorem Taxes ($mm) * | $1.0 – $2.0 | |||

| Cash G&A Expense ($mm) | $22.0 – $24.0 | |||

| Capital Expenditures ($mm) | ||||

| Merge D&C Operated | $108 | |||

| Merge D&C Non-operated | 15 | |||

| Cleveland D&C | 11 | |||

| Other (pooling, leasing & maintenance) | 16 | |||

| Total Capital Expenditures | $150 | |||

* Production and ad valorem taxes are included as one line-item on the company’s consolidated statements of operations

YE 2017 proved reserves

Jones Energy’s year-end 2017 proved reserves based on SEC pricing were 104.8 MMBoe, of which 59% were classified as proved developed reserves. Total proved oil reserves at year-end 2017 were 29.0 MMBbls, an increase of 23% from year-end 2016 reserves of 23.6 MMBbls.

The SEC standardized measure value of the company’s proved reserves was $567 million. Its PV-10 value of proved reserves (a non-GAAP measure) for year-end 2017 was $627 million.

Board changes

Effective February 5, 2018, the company’s board of directors has expanded from five to seven members and three new directors have been appointed: John Lovoi, founder and managing partner of JVL Advisors L.L.C., one of the company’s largest shareholders; Paul B. Loyd Jr., former chairman and CEO of R&B Falcon Corporation and long-time investor in JVL Advisors; and Scott McCarty, a partner at Q Investments, who is joining the board in connection with an agreement entered into between Q Investments and the company, pursuant to which Q Investments has agreed not to nominate a director for the 2018 annual meeting.

In order to accommodate the new directors, Robb L. Voyles stepped down as a director effective February 5, 2018.

Following these changes, the board will be classified as follows:

- Jonny Jones, Lovoi and Loyd will be Class I directors, whose term expires in 2020

- Halbert Washburn and Mike S. McConnell will be Class II directors, whose term expires at the upcoming 2018 annual meeting

- Alan D. Bell and McCarty will be Class III directors, whose term expires in 2019