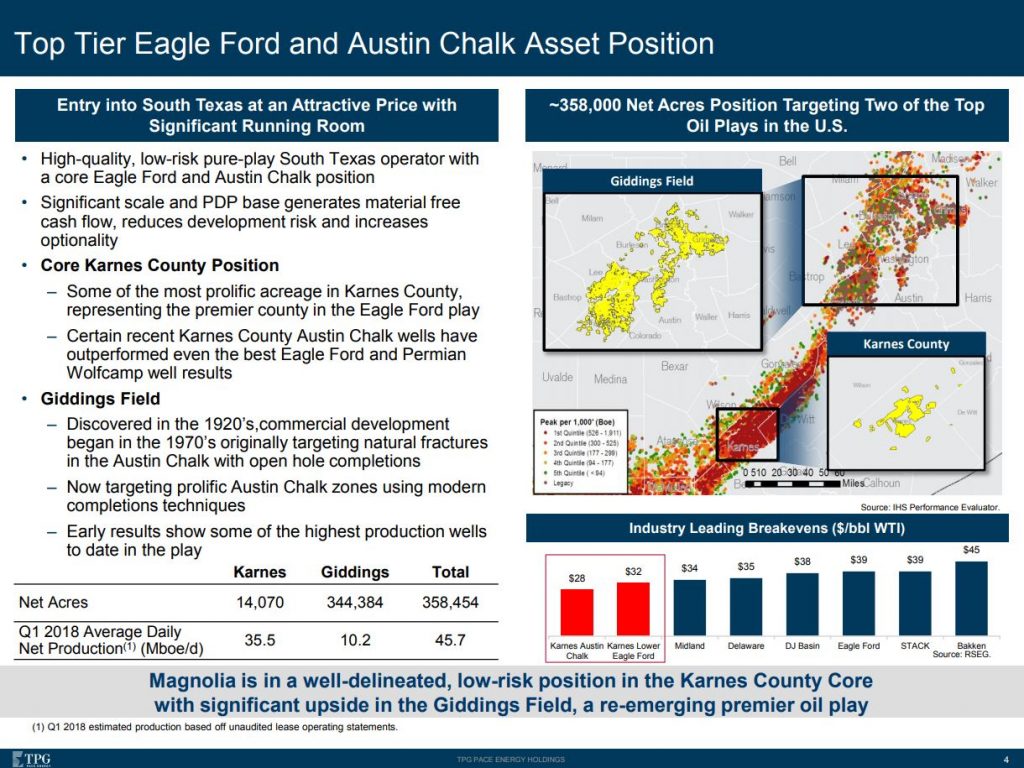

TPG Pace Energy Holdings Corp. (ticker: TPGE), an energy-focused special purpose acquisition entity led by former Occidental Petroleum Corporation CEO Steve Chazen, disclosed certain financial and operating results for the first quarter of 2018 for the Karnes County and Giddings Field assets (the Magnolia assets) that TPGE is under definitive agreements to acquire from affiliates of EnerVest, Ltd.

The Magnolia assets performed as follows for Q1 2018:

- Operating revenue of $193.3 million

- Pro forma EBITDA of $152.2 million

- Free cash flow of $66.3 million

- Average daily net production of 45.7 MBOEPD (62% oil, 78% liquids)

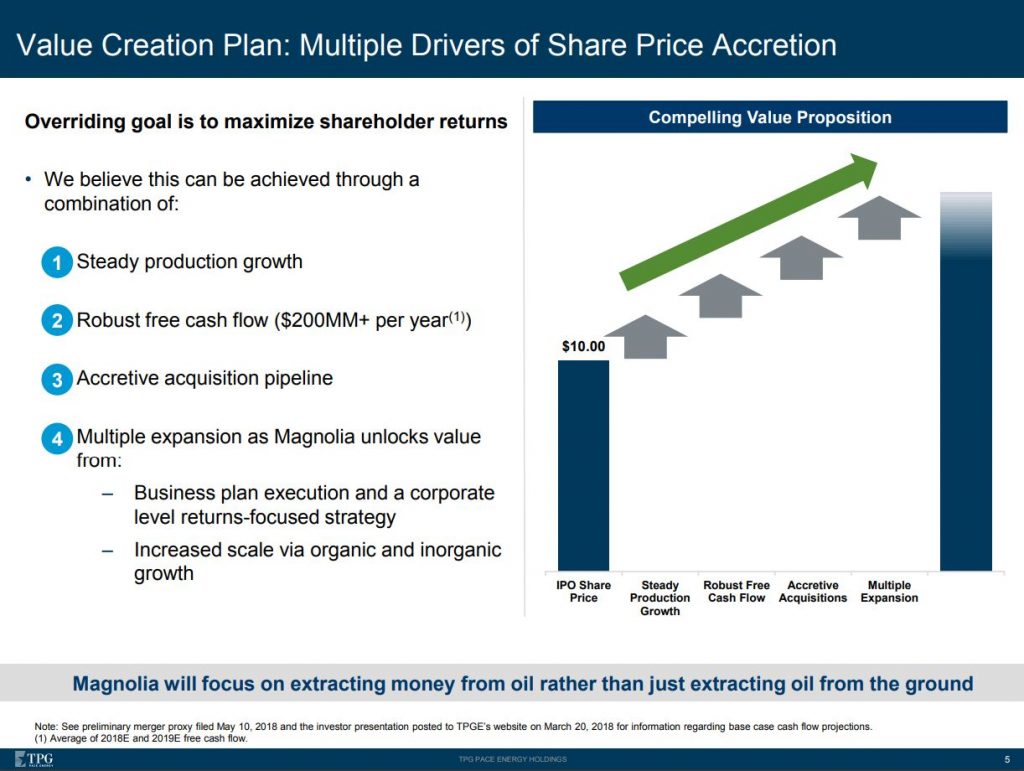

“These strong results were above our expectations for production and realized prices in the first quarter of 2018 and confirm that the Magnolia assets are an excellent match with our desire to build a large-scale company that can generate steady production growth, strong pre-tax margins and significant free cash flow,” TPGE Chairman and CEO Steve Chazen said.

In the proposed transaction, TPGE expects to acquire the Magnolia assets, which represent substantially all of EnerVest’s South Texas division, to create Magnolia Oil & Gas Corporation. EnerVest will receive a combination of cash and shares of Magnolia’s common stock in the transaction and will retain a significant ownership stake in Magnolia at closing.

Following closing, Magnolia’s Class A common stock and warrants are expected to trade on the NYSE under the ticker symbols “MGY” and “MGY.WS”.

The transaction is structured as an asset purchase with an effective date of January 1, 2018.