Transocean adds 11 existing rigs, two more under construction

The offshore drilling sector showed significant life today, with a major M&A deal shaking up the landscape.

Transocean (ticker: RIG) has agreed to acquire Ocean Rig (ticker: ORIG) in a transaction valued at $2.7 billion, consolidating the sector.

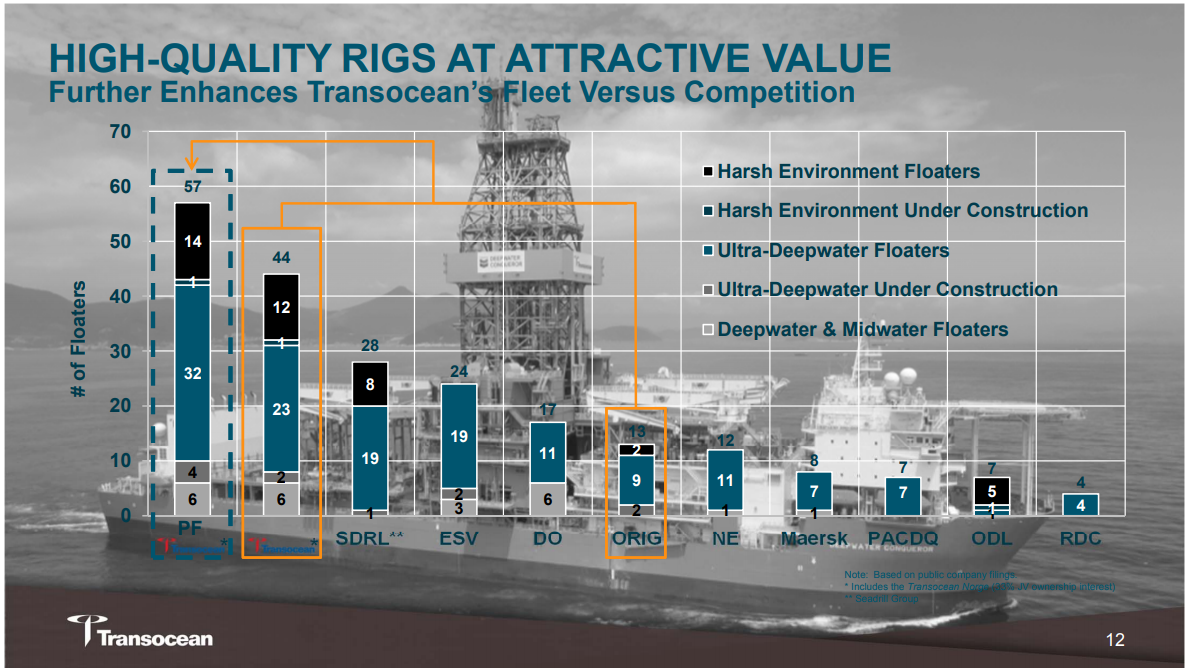

Transocean will primarily be paying for the drillships Ocean Rig owns, which will add to the company’s overall fleet. Ocean Rig owns nine high-specification ultra-deepwater drillships, two harsh environment semisubmersibles, and two high-specification ultra-deepwater drillships currently under construction. These will boost Transocean’s fleet to 57 drillships, giving the company by far the largest drillship fleet among its competitors.

Transocean will also increase its work backlog through the purchase of Ocean Rig, adding to an already large schedule. The company reports its contract backlog will grow by $743 million to $12.5 billion, an industry-high.

These contracts have an average dayrate of $413,000, well below the $800,000 that was seen before the downturn but nearly double the lows seen in the past three years.

Transocean reports that after adjusting the purchase price for the backlog and non-core rigs, the transaction equates to paying $278 million per rig, well below the price of building a comparable fleet through newbuilds, where comparable rigs are often going for $600-$800 million.

Transocean will pay $12.75 in cash and 1.6128 shares of Transocean stock for each share of Ocean Rig, for a total value of $32.28 per share based on Friday’s closing prices. This is a premium of $20.4% compared to Ocean Rig’s recent stock price. The cash portion of the transaction will be paid through a combination of cash on hand and funds from Citi. Upon closing, Transocean shareholders will own about 79% of the resultant company, while Ocean Rig owners will hold the remaining 21%.

The transaction continues Transocean’s strategy of high-grading rigs, a strategy that was prompted by the collapse of the offshore drilling market in the downturn. About 45% of the company’s fleet in early 2014 was made up of ultradeepwater and harsh environment rigs, compared to 86% today. The purchase of Ocean rig would push this share to 89%.

Transocean is betting the overall recovery in oil and gas activity will continue to lift deepwater drilling prospects, and future opportunity appears to be available. The company reports there are 59 rig years to be awarded through 87 different programs, the largest of which are in the North Sea and Brazil.

Transocean President and CEO Jeremy Thigpen commented, “The proposed acquisition of Ocean Rig provides us with a unique opportunity to continue enhancing our fleet of ultra-deepwater and harsh environment floaters, without compromising our liquidity or overall balance sheet flexibility. The combination of constructive and stable oil prices over the last several quarters, stream-lined offshore project costs, and undeniable reserve replacement challenges has driven a material increase in offshore contracting activity. As such, adding Ocean Rig’s premium assets to our industry-leading fleet provides us with an increased number of the modern and highly efficient ultra-deepwater drillships preferred by our customers, and better positions us to capitalize on what, we believe, is an imminent recovery in the ultra-deepwater market.”