Determining the fair market value of offshore assets

Since 2012, the Bureau of Ocean Energy Management (BOEM) holds a handful of auctions for offshore blocks, or tracts, for oil and gas development. These sales take place in two phases, each used to ensure that the BOEM is receiving fair market value for the property it is auctioning off.

According to the BOEM’s Summary of Procedures for Determining Bid Adequacy at Offshore Oil and Gas Lease Sales, “Phase 1 includes evaluation criteria for accepting high bids on some tracts and determining what other bids will receive further evaluations in Phase 2. Phase 2 uses an independent government evaluation and bid adequacy rules based upon the mean range of values (MROV), delayed mean range of values (DMROV), adjusted delayed value (ADV) and revised arithmetic average measure (RAM).”

Phase 1 of BOEM sales is separated into three categories:

- Tracts with three or more bids, on which competitive market forces can be used to assure fair market value;

- Tracts which Mineral Management Services (MMS) identifies as being nonviable (the risk associated with producing from the tract outweigh the probable market value of the expected resources); and

- Tracts identified as being viable and on which the government has the most detailed and reliable data, including tracts classified as drainage or development.

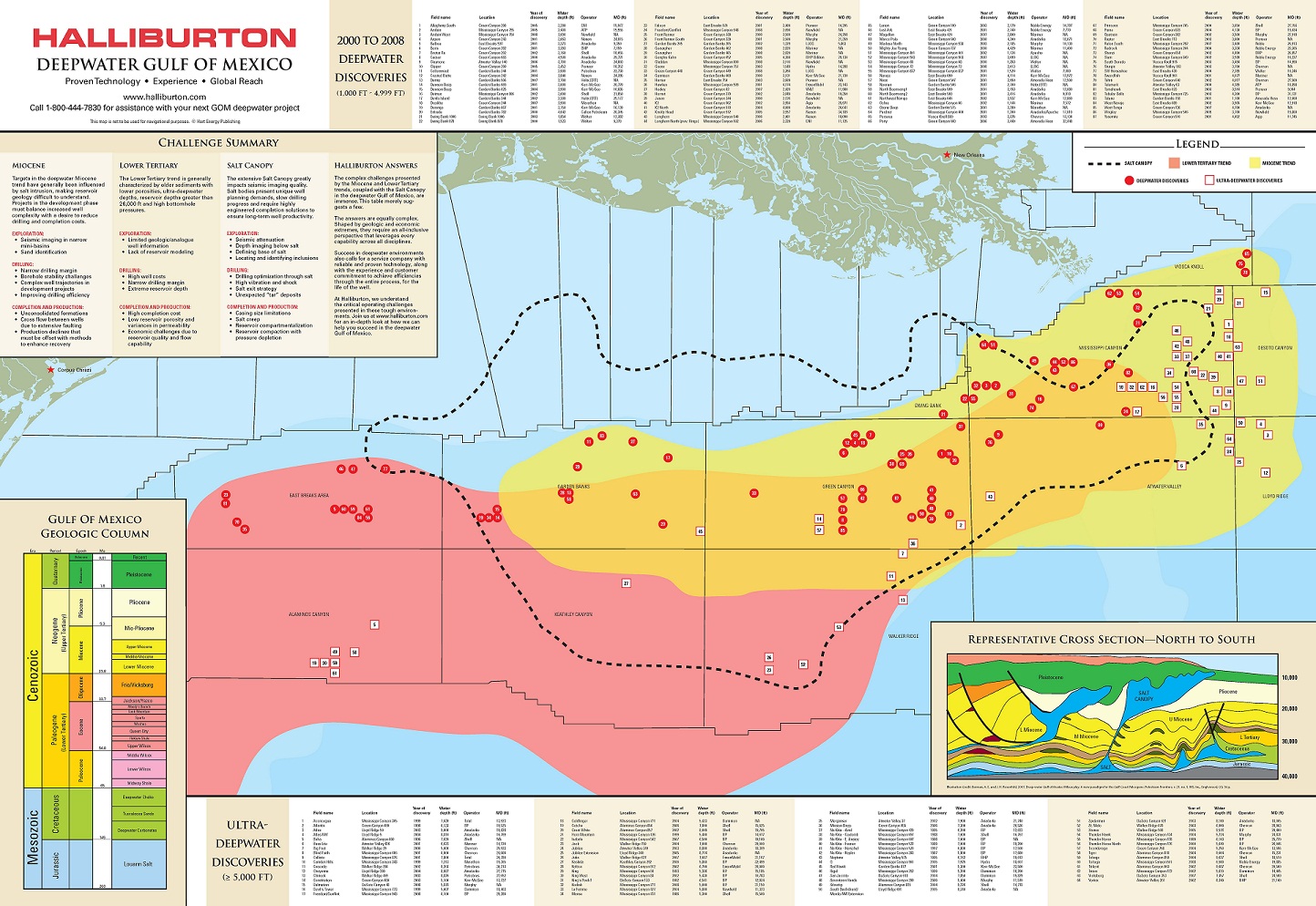

Based on those categories, the BOEM accepts the highest qualified bid on viable confirmed and wildcat tracts receiving three-or-more qualified bids if the third largest bid on the tract is at least 50% of the highest qualified bid, and if the high bid per acre ranks in the top 75% of high bids for all three-or-more tracts within a specified water depth category. In the Gulf of Mexico (GOM), water depth is divided into two categories; less than 800 meters and 800 meters or more.

The BOEM also accepts the highest qualified bid on all tracts determined to be nonviable by the MMS during Phase 1.

All tracts that require further evaluation to determine the viability or tract type, all drainage and development tracts, all viable confirmed and wildcat tracts with one or two bids and all viable confirmed and wildcat tracts that received three-or-more bids, but the third lowest bid was not at least 50% of the highest bid or a high bid that ranks in the lowest 25% of high bids for all tracts in the same water depth, are all moved to Phase 2 of bids.

Phase 2 bidding usually takes 21 to 90 days to complete, but can be extended at the discretion of the regional director in charge of the sales. The second phase is designed to further analyze whether or not the BOEM is receiving the fair market value for the tracts being sold. During Phase 2, the BOEM conducts further mapping and/or analysis to review, modify and finalize viability determinations and tract classifications. All tracts identified as viable must undergo an evaluation to determine if fair market value has been received.

After the additional analysis is carried out, all the bids are accepted on the same basis of Phase 1 bids if applicable. A range of fair market values is determined for the remaining blocks and the highest bid that is at or above the low end of that range is accepted.

The next Gulf of Mexico sale

The next BOEM offshore lease sale will take place on August 19, 2015, in New Orleans, Louisiana. Lease Sale 246 will auction off Outer Continental Shelf tracts in the Western GOM Planning Area. A list of the blocks available for leasing will be released in early July and will include approximately 4,067 blocks, or about 21.8 million acres, according to the BOEM.

To date, more than 60 million acres have been purchased for development at total bid revenues of $2.4 billion in seven separate auctions.

Preparing for a boom or screeching to a halt?

Offshore projects are incredibly expensive when compared to onshore production, but their high returns and long lifespans have kept some projects moving forward. In January 2015, Imran Khan, a deepwater Gulf of Mexico analyst at Wood Mackenzie, predicted 2015 offshore GOM production would increase 21% year-over-year, putting Gulf volumes on track to reach record production levels.

However, low prices have made other analyst less optimistic about a coming boom off the coast. Praveen Narra and J. Marshall Adkins from Raymond James expressed a more pessimistic outlook in a recent note. “Despite our below consensus assumptions on incremental demand, the current contracting rate trends well below our estimate as the desire to pursue further activity skids to a halt.”

The estimates are not unreasonable: the latest Central GOM lease sale yielded only $539 million in high bids, while a sale in the same region in 2014 resulted in more than $1.0 billion in high bids.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.