Alaska’s revenue forecast, released Wednesday, predicts a deficit of $3.5 billion, an increase of $2.1 billion from what lawmakers expected in April.

The forecast expects unrestricted general fund revenue of $2.6 billion this year, down from $5.4 billion in 2014, reports Fox Business. That, combined with about $200 million in anticipated supplemental budget items like oil and gas credits, accounts for the predicted $3.5 billion deficit, said Jerry Burnett, a deputy Revenue commissioner.

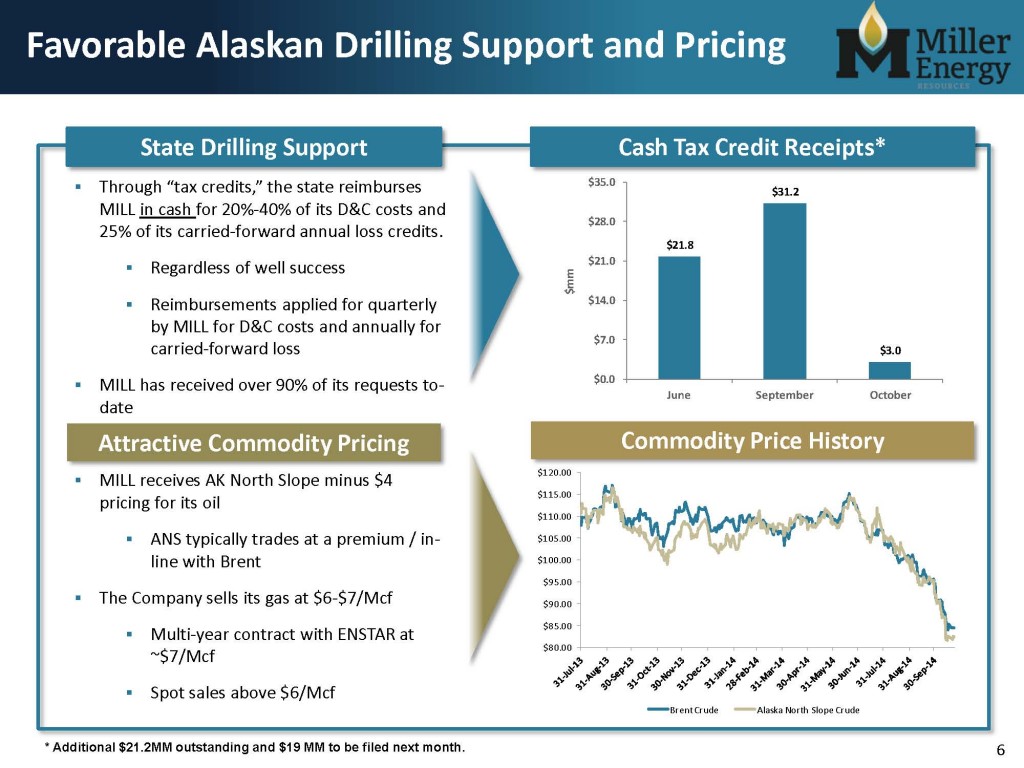

The 250% increase in the predicted state deficit is due to slumping oil prices, said the Revenue Department. The price of oil, forecast at $105 per barrel in the state’s spring revenue forecast, is now expected to average about $76 a barrel for the fiscal year that ends June 30. The price is forecast to dip even lower, to $66 a barrel, during fiscal 2016 before rebounding.

At the time of this article’s writing, WTI was trading $58.11 per barrel and Brent was trading at $62.00.

Alaska oil and gas by the numbers

Alaska has approximately 3,336 million barrels of crude oil reserves, representing 10.9% of U.S. total reserves, according to 2012 estimates from the Energy Information Administration (EIA). The state also has 9,579 billion cubic feet of dry natural gas reserves, which is approximately 3.1% of total U.S. reserves.

In September of 2014, Alaska’s crude production levels were approximately 477 MBOPD, while natural gas production was 338,182 MMcf for 2013, according to the EIA.

Alaska’s North Slope contains more than a dozen of the 100 largest oil fields in the U.S. and several of the 100 largest natural gas fields, reports the EIA. Alaska’s Prudhoe Bay field is one of the largest oil fields in the country, although production has fallen to less than 300 MBOPD from its peak of 1,600 MBOPD in 1988.

The state is the second leading natural gas producer in the U.S., but most of Alaska’s production is not brought to market. Almost 75% of Alaska’s natural gas withdrawals are consumed at the production site as the gas is re-injected into existing oil fields to provide pressure to maintain oil production rates.

Despite a growing deficit, “long-term view is optimistic”

In a news release, acting Revenue Commissioner Marcia Davis said while despite lower oil prices and less revenue in the short term, “our long-term view is optimistic.”

The forecast also includes an increase to oil production in 2016 and 2017, and a drop to a tax credit. The credit is expected to bring in about $310 million in 2016 and $1.2 billion the following year. Approximately 88% of Alaska’s unrestricted revenue in full-year 2014 can be attributed to oil revenue.

“Greater investment by the oil and gas industry on the North Slope and solid performance of state investments makes Alaska’s overall financial health sound,” she said.

Operators in the area, like Miller Energy Resources (ticker: MILL), are bullish on Alaska’s long-term prospects. The company reported year over year production growth of 56% (301,078 BOE from 193,260 BOE) in its Q2 fiscal 2015 report, with dates ending October 31, 2014.,

“We believe firmly that Alaska is one of the best places to build up oil and gas for two reasons,” said Carl Giesler, Chief Executive Officer of Miller Energy Resources, in a conference call following the quarterly results. “First, commodity prices, particularly gas, are favorable relative to other areas. Gas in the Cook Inlet area trades at $6 to $7 per Mcf and that pricing isn’t tied to Henry Hub… Second, Alaska partners with operators, not only from a safety perspective, but frankly from a cash financial and risk sharing perspective. Depending on the type of the well, the state finances with cash, tax credits 35% to 65% of well costs.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.