Oil production rose in 2016, 2017, expected to rise in 2018

Most attention in the U.S. oil and gas industry has focused on unconventionals with the Permian basin being the hottest of the hot shale plays based on operator activity, industry employment and deal flow. However a mere 3,814 miles and 63 hours away by car, lies a conventional oil play haven that hopes to stage a comeback.

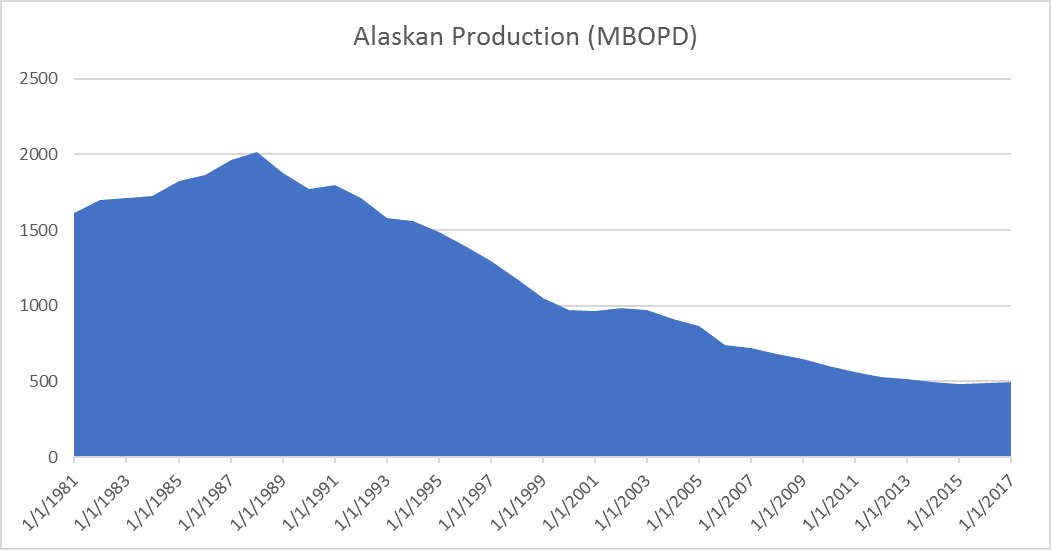

Alaskan production peaked in 1998, when the state produced over 2 MMBOPD, and has generally been in decline since. Production bottomed in 2015, when the state pumped 483 MBOPD. However, recent activity has exceeded expectations, and production has grown in the last two years according to the state’s natural resources governing agency.

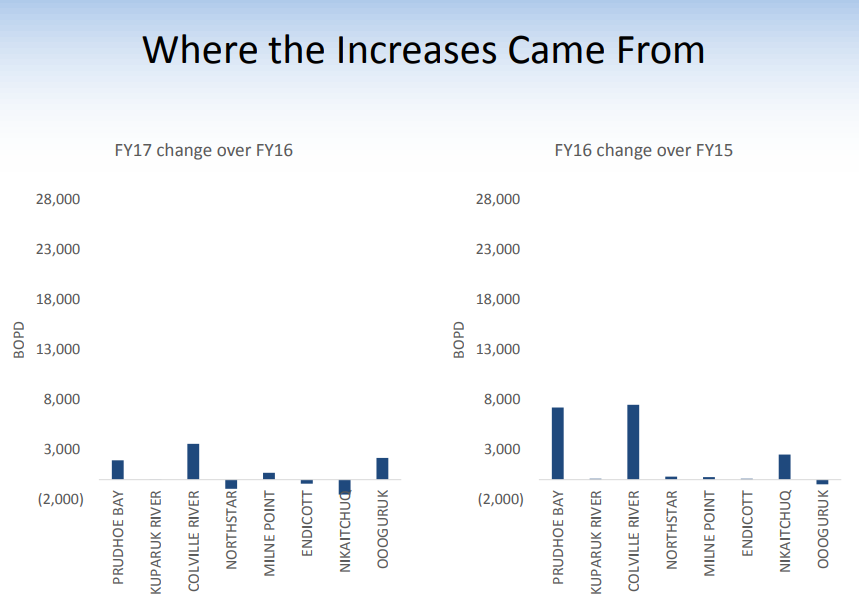

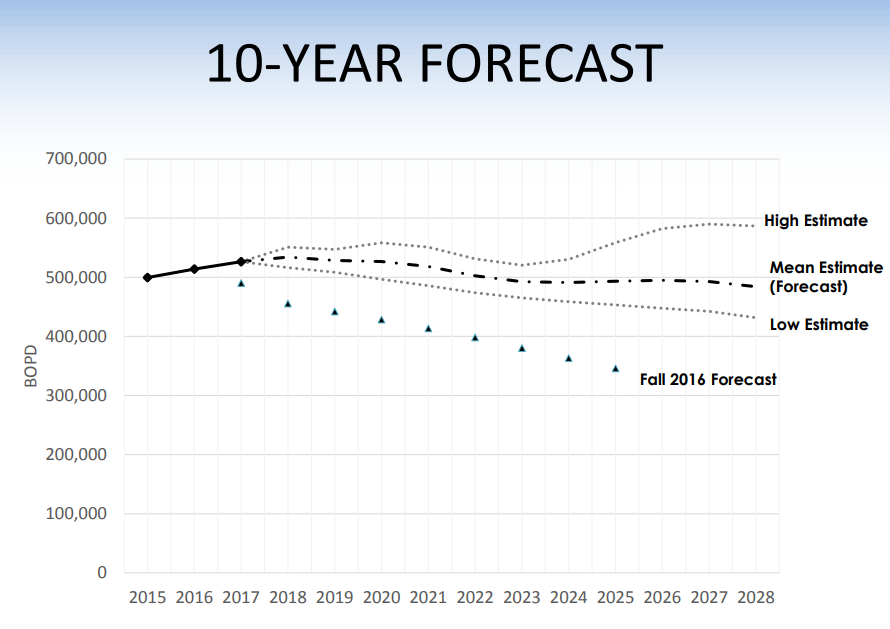

According to the Alaska Department of Natural Resources, oil production growth is expected to continue further, with the department forecasting 2018 production 9 MBOPD higher than 2017. The department identifies three fields that contributed to growth in 2017, Prudhoe Bay, Colville River and Oooguruk.

According to Alaska Public Media, much of the increase from Prudhoe Bay comes from increasing efficiency, as companies improve activities and focus on how to get the most of the assets that are already present.

In some other locations, though, new projects are coming online. ConocoPhillips brought a portion of its field Colville River field on production, giving it a boost to production. Oooguruk, an offshore field in the Beaufort Sea, has begun hydraulic fracturing, allowing its output to grow further.

New fields will be needed to keep production flat

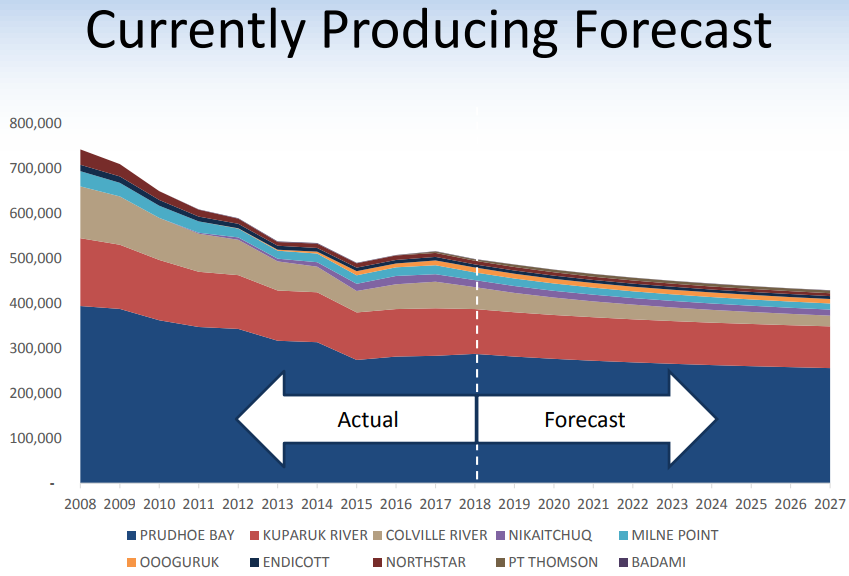

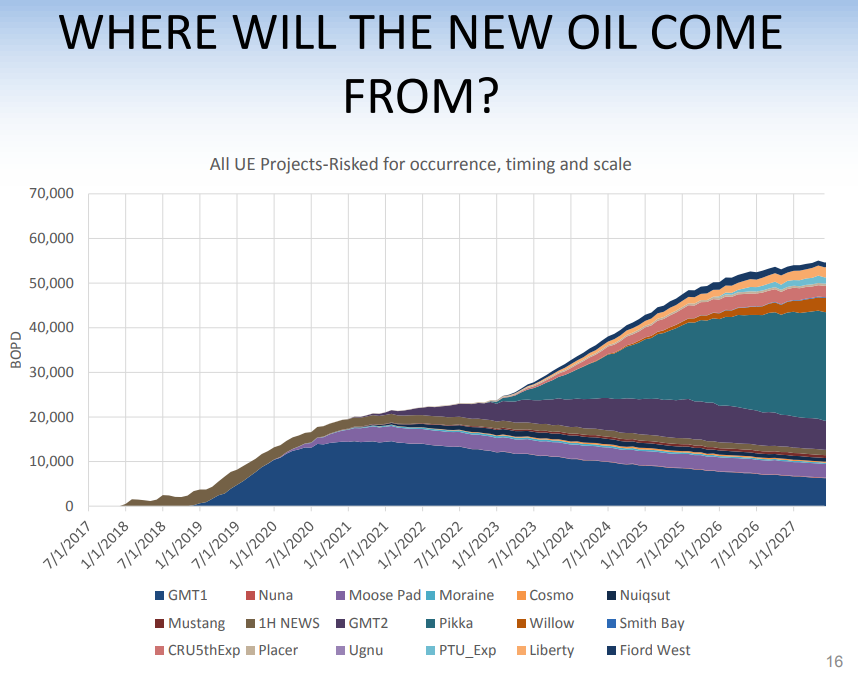

These currently producing fields have added production, but will eventually decline. The department expects Alaskan production will be relatively flat, however. So to stage a production turnaround, new oil will be needed from other projects.

Armstrong plans up to 120,000 BOPD onshore project

One of the largest expected projects comes from Denver’s privately-held Armstrong Energy LLC, which made headlines early in 2017 with the discovery of the largest U.S. onshore conventional hydrocarbons discovery in the past 30 years.

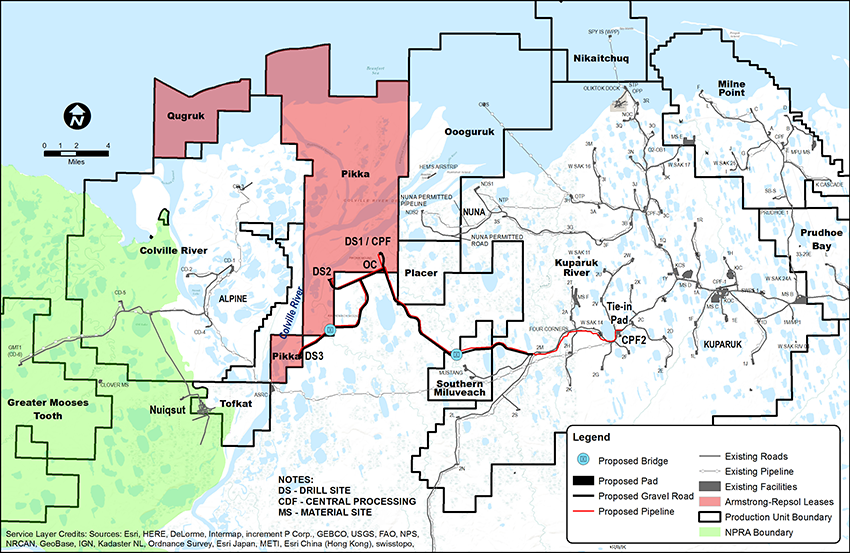

With its partner Repsol (ticker: REP), Armstrong discovered a field with an estimated 1.2 billion barrels recoverable. Drilled during the 2016-2017 winter campaign, the Horseshoe-1 discovery well encountered more than 150 feet of net pay in several reservoir zones in the Nanushuk section. A sidetrack, Horseshoe-1A, also encountered more than 100 feet of net pay.

This discovery is in addition to Armstrong’s previously-discovered Pikka area, which is located directly in between the Colville River and Oooguruk fields. Armstrong and Repsol have big plans for Pikka, and have submitted permits for developing the play. Preliminary plans for Pikka anticipate first production there from 2021, with a potential rate approaching 120,000 barrels of oil per day.

According to applications submitted by Armstrong, the company will continue these plans in 2018. A new well will continue development of Pikka, and will drill from December 2017 to April 2018.

Projects like Armstrong’s Pikka will keep Alaska on the map, as the department now estimates that new developments will be producing about 55 MBOPD by 2028, with Pikka accounting for much of this output.

However, Alaska does not predict an entirely rosy future. The state’s forecasters do not expect oil prices will rise to $75 per barrel until 2027, and most of this increase will be due to inflation, not supply and demand dynamics.