Anadarko Deepwater GOM cash flow will fund Delaware, DJ growth

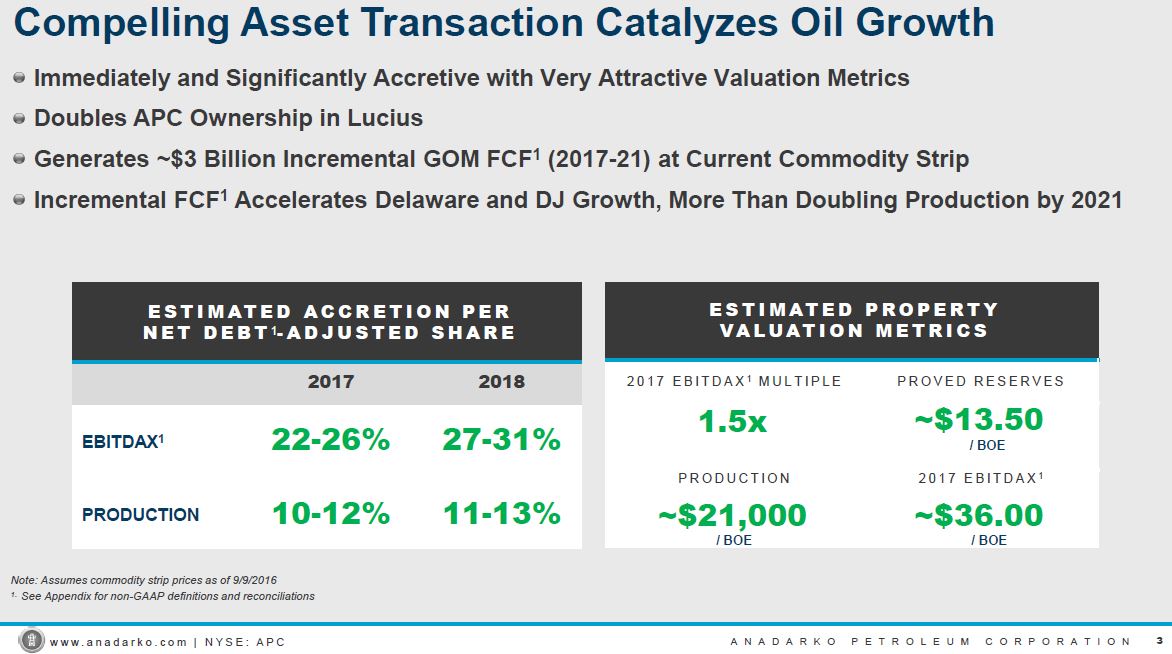

In exchange for production of 80,000 net barrels of oil equivalent per day (BOEPD), Anadarko Petroleum (ticker: APC) will give Freeport McMoRan Oil & Gas Company (ticker: FCX) $2 billon in a deal that Anadarko calculates could deliver $3 billion of incremental free cash flow over the next five years to Anadarko (at current strip prices).

On the other side of the deal, Freeport McMoRan said the deal brings its 2016 asset sales to more than $6 billion, as the mining company seeks to divest its oil and gas business interests and concentrate on being the world’s largest copper miner.

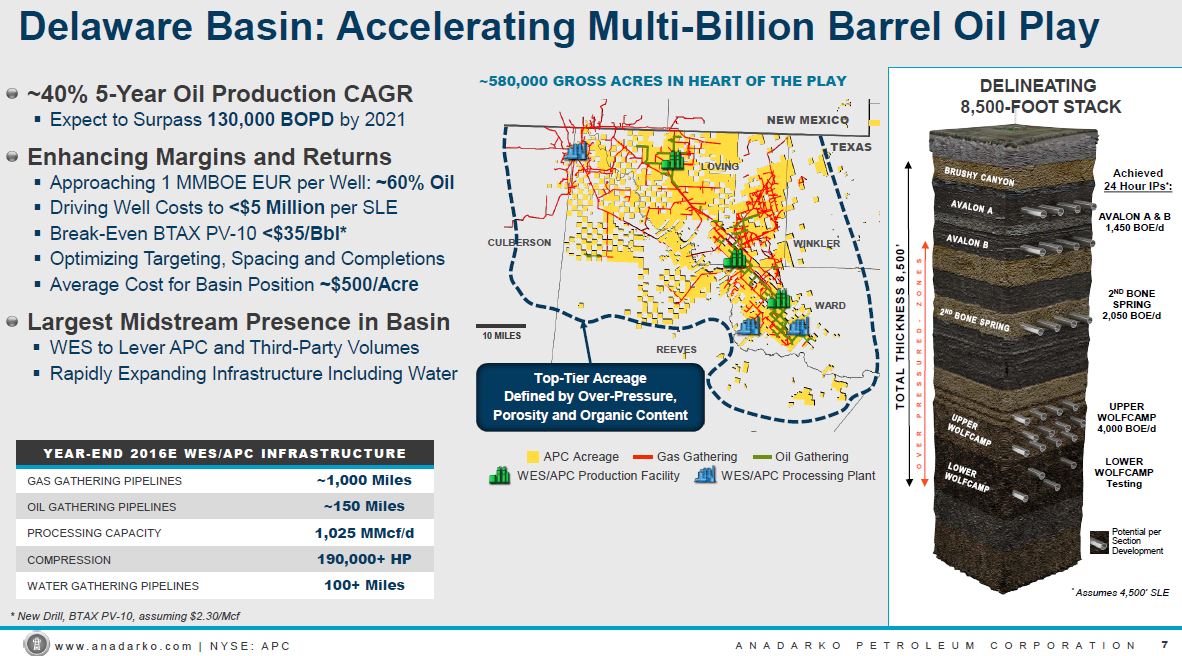

The impetus for the FCX GOM property acquisition, according to Anadarko Chairman, President and CEO Al Walker, is to enhance “our ability to increase U.S. onshore activity in the Delaware and DJ basins.”

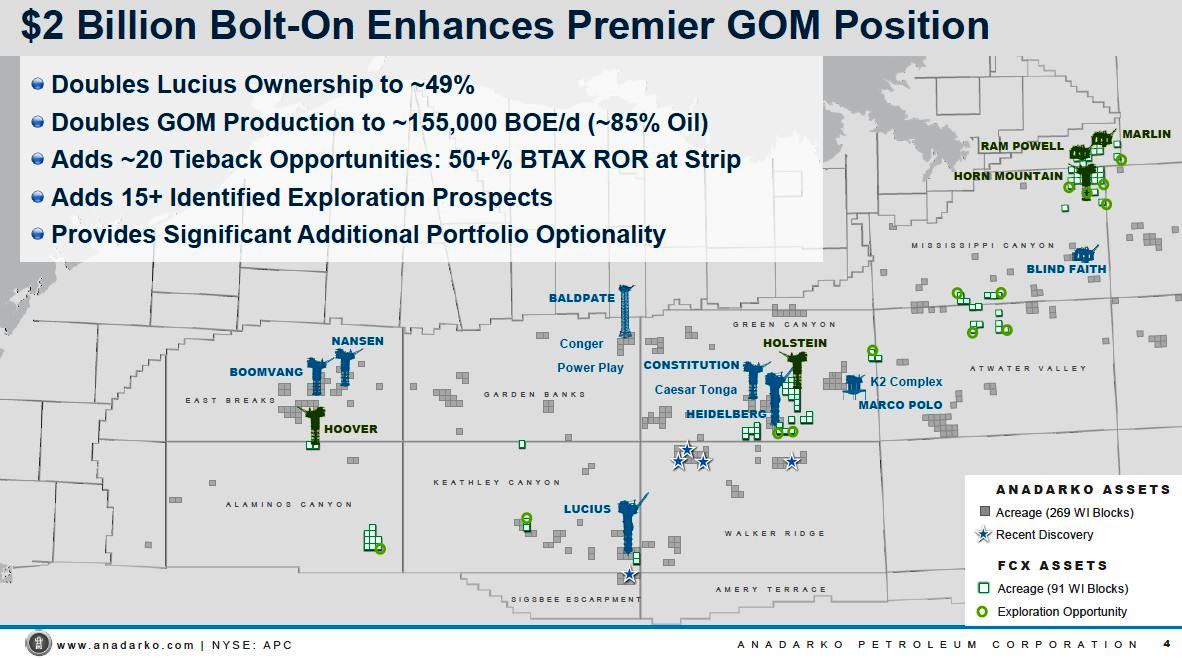

“The company’s Gulf of Mexico position, with the addition of these properties, will have net sales volumes of approximately 155,000 BOE per day, comprised of approximately 85-percent oil,” Walker said in a company press release. The Freeport McMoRan assets will add about 91 working interest blocks to Anadarko’s deepwater position in the Gulf, which the company lists as 269 working interest blocks.

Anadarko said that the acquisition and development cost of the acquired properties, excluding a total of approximately $300 million of materials inventory and seismic, is approximately $13.50 per BOE for the estimated proved reserves to be acquired. “The assets are being acquired at an estimated EBITDAX multiple of 1.5 for the expected sales volumes over the coming 12 months, using the current futures strip price for oil and natural gas,” the company said.

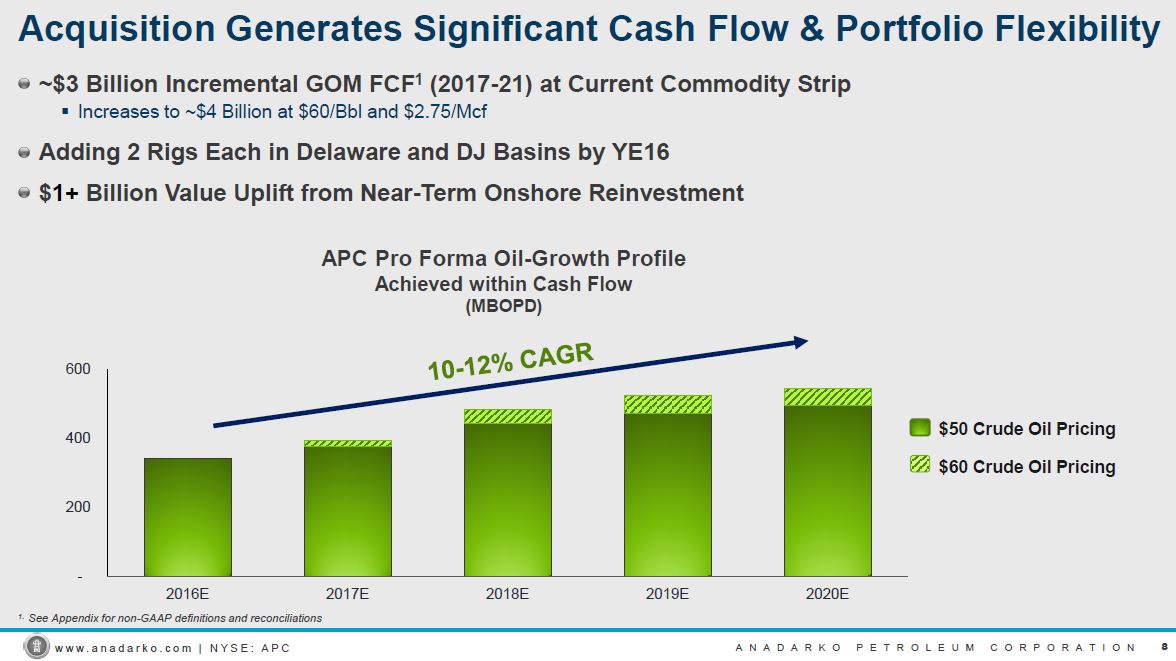

Anadarko said in its release that it expects to increase its 2016 full-year capital guidance, not including the acquisition, to a range of $2.8 to $3.0 billion, “primarily reflecting the increased activity in the Delaware and DJ basins.” In the conference call, Walker said the goal was to position the company to “more than double production collectively from these two basins to over 600,000 barrel equivalents per day.”

Funding the GOM acquisition with equity

In a subsequent press release Anadarko said it would fund the acquisition with proceeds from a new public offering of 35,250,000 shares of its common stock, representing total gross proceeds of approximately $1.9 billion. The company said JP Morgan Securities is the sole underwriter for the offering. The company expects the common stock offering to settle and close on Friday, Sept. 16, 2016.

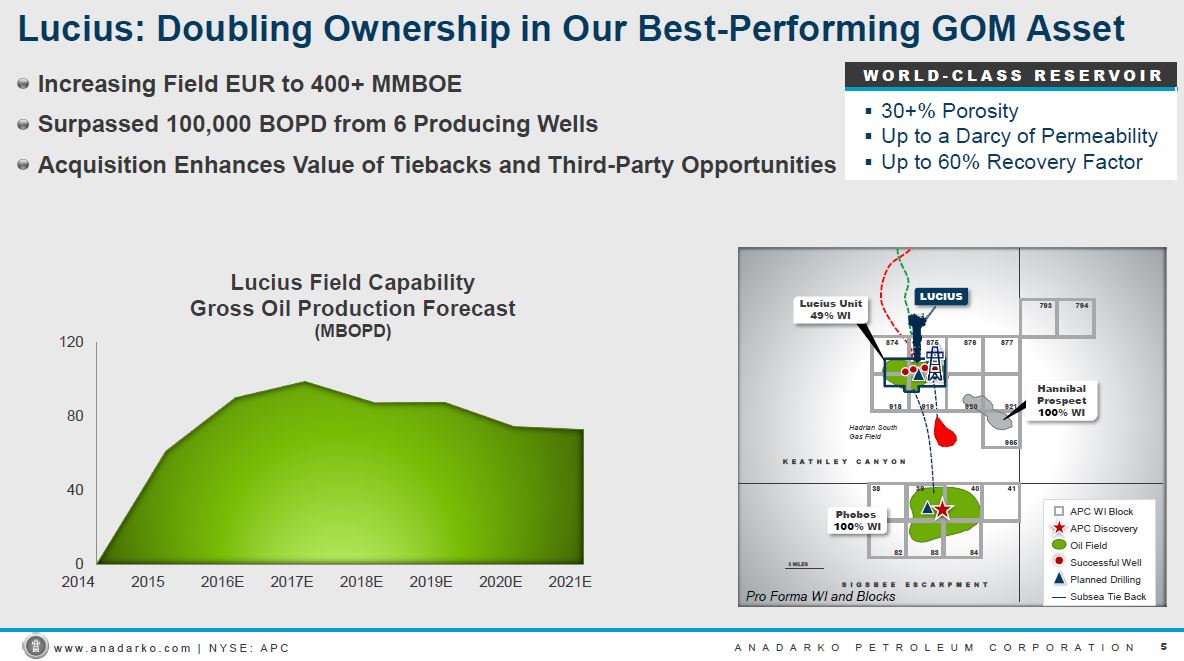

In the call intro Walker said that Anadarko had “purchas[ed the] assets at a very attractive price for a motivated seller. Adding to our ownership in APC’s best performing Gulf asset Lucius is also something we see having further upside.”

Lucius already best performing GOM asset of Anadarko

Regarding its operated Lucius facility in the deepwater Gulf of Mexico, Anadarko said that it is increasing the estimated ultimate recovery (EUR) of the field to more than 400 million BOE from its previous estimate 300-plus million BOE. The company said gross oil sales volumes through the facility recently surpassed 100,000 BOPD. The company said it will increase its working interest in Lucius to approximately 49 percent from its previous 23.8-percent ownership.

The Anadarko management team responded to questions on the conference call. To a question about the amount of capex Anadarko planned to spend on the Lucius asset in the Gulf, Anadarko executives said they didn’t expect they would spend more than maintenance CapEx on the GOM assets. “[We see a] very good line of site growth in the next two to three years from the capital that Freeport has spent for the last several years.”

“Lucius’ spending is behind us; Lucius is a linchpin of the acquisition, it brings a lot of free cash flow with us immediately, and then it helps to support the marginally lower spending year-over-year at the other assets. So, it’s really the timing of this acquisition relative to the good work that Freeport and the management team there has been doing over the last few years. We’re buying it, in my opinion, at just the right time to be able to benefit, as Al said, from past spending and then also have a growth profile over the course of the next few years.”

Q: Does this change your view at all on any of incremental asset divestitures?

APC: No, actually it didn’t. I think we still believe that properties in our portfolio have to compete for capital. And to the extent they don’t compete for capital over reasonable time horizon, they are candidates. Bob has been working quite diligently in that area, and I might let him address some of the specifics.

APC: I think there is nothing really to update you on versus our last quarterly call. Everything is still on track. Our expectations remain consistent with what we’ve said in the past. And as Al said, a lot of this boils down to not necessarily the need for capital or to address balance sheet issues, but the Delaware and the DJ are world class assets, they’re crowding out capital elsewhere in our portfolio.

The Gulf of Mexico competes very attractively. We’ve talked about the economics and the tiebacks in particular, the brownfield development. And so, beyond that these are – it puts us in a position where we have the luxury of seeing if the market is interested in these assets and making decisions on whether or not to transact based on the environment that we find around individual assets.

And that means that we’re not going to be selling everything, but those three assets, but those are going to be three places that are going to be tough to compete for capital. And if we can then sell assets and redeploy capital or build a little bit of cash position to enhance our flexibility over time, we’re going to do so. And that’s why we chose to go ahead and fund this transaction with equity.

Q: How did the deal come about? Can you provide any color about how long you’ve been working on it, and just a little bit of background?

APC: I think you probably are well aware, they filed an S-1, they went through a process associated with that, they then went through a process of trying to sell the properties. Our view was, there were certain other assets that made sense for us. If they ever came around or wanting to isolate just the deepwater assets, we had the conversation, that eventually took place and then it took a while after that to get to where we were yesterday. … I think we had a very motivated seller, who has publically talked about the fact they want to be more of a mining stock. And therefore, being in the oil and gas business was inconsistent with that. And when the opportunity came to just isolate the deepwater assets, we were ready to go.

Q: Does this transaction alter your appetite for further acquisitions in there, particularly you see an ability to add in the Delaware Basin?

APC: Well, you can imagine, Bob is very active, not just as a buyer, as a seller. I think we have a pretty good sense for the market. I think we’ve been pretty darn consistent for a while that DJ, the Delaware, and the Gulf of Mexico is where we would be a buyer of assets. And Bob, please add to that.

APC: I mean the key is, they’re looking at that bolt-on opportunity, that’s one thing we like about this. It was sized in a way that’s material enough to be meaningful to accompany our size, but it’s also something where integration and consolidation with what we do today is a very straightforward path. A lot of it comes down to price. What we have chosen not to do very specifically is to chase pricey transactions in a place like the Delaware. There are things we look at in the Delaware all the time, and we obviously would love to find an opportunity to right-size and fit to our existing portfolio.

We have a footprint there today, as we’ve talked about in this press release, that gives us running room for a long time become a tremendous growth opportunity. But it’s a place where we think we could leverage further off the infrastructure; and for the right assets it would fit really well. The thing you don’t want to do is, chase something where your cost of entry is so significant that it’s unclear have you ever going to make money there. And so, by buying assets at the right price and having a path forward where you can drive material oil growth inside of cash flow is pretty darn attractive and it’s hard to compete with that.

So when we start looking at organic opportunities or acquisitions like the one that we have just announced, paying a premium price for a transaction that’s not going to provide free cash flow to the portfolio for many years to come is just a bit of a challenge. So we’re in the market. We’re looking at those kind of things. But those opportunities are going to be fewer and far between. And hopefully, we’ll be able to find one or two of them. But we’ll continue to look and then we’ll try to stay disciplined around that decision-making process and focus on things that we think have real transparent value like this one.

Q: On the Gulf of Mexico assets you just bought. And you all have talked in the past about tieback opportunities offsetting operating expenses. And particularly at Lucius, you had almost no cost at one point. Can you talk to us about what the operating cost structure is currently and then how that flows forward in your next five-year plan on the acquired properties?

APC: I would look at the cost associated with these new assets are probably within the range of our, maybe a little bit more. But I think there is an opportunity as we look at the additional drilling we can do out here because a lot of it’s a function of throughput because there’s so much fixed cost in the offshore structures. And so we think there’s really an opportunity to get that cost structure down. And as we look at the bigger picture and the synergies associated with our existing properties, particularly in transportation and those things, we think there’s going to be some opportunities to reduce that cost as well.

Q: The reserves life at a 1P level on this acquisition looks quite low. I realize that’s not a really meaningful metric. Can you talk a bit about the proven and probable reserves that you believe are associated with the acquisition? Thank you.

APC: Yeah. I think we truly look at this more on the 2P basis. And so that’s really sort of doubling that 1P life. And so again, we think it’s going to be out there a while. But don’t discount the opportunities that are in front of us because there’s a big possible component to this too particularly when you think of things like Lucius. And so one of the things we really like about this whole acquisition is that because of the opportunities, we’re going to be out there a long time in all these producing assets. And the assets themselves in terms of the structure, they’re in good shape. So we feel good about this thing.

APC: A lot of the 2P here is just associated with a higher recovery factor. So there’s not associated capital with it. And a lot of that relates to Lucius, something that we know extremely well and feel quite comfortable about our assessment of the reservoir.

APC: But the other thing, don’t discount the fact that we have picked up exploration opportunities in this as well. And a lot of those are going to be in and around the infrastructure. And so it’s hard to say just how far out you push this infrastructure. But I think there’s a huge opportunity set here to extend the reserve life of what we just purchased.

Q: You’ve clearly stated that the free cash flow generation is going to be used for greater growth onshore U.S. Can you talk a little bit about, firstly, that decision and the economics and oil price assumptions you’re making in that decision? I know you’ve said that, essentially, it’s a question of prioritizing returns and they’re superior. But could you just indicate at what price perhaps we would begin to grow this Gulf of Mexico stuff more aggressively? And could you also layer in a comment on debt and the decision to go after growth as opposed to debt paydown?

APC: Okay. Well, as we will and have continued to be, we will always compete within our portfolio with places to apply capital. So as oil prices come up, which we have stated previously that we think that’s very likely in 2017, these assets we acquired, if there are opportunities for development that can compete with capital associated with the DJ and the Delaware; we’ll consider that because we’ll have additional cash flow and flexibility to think about where we would put it.

I think as we’ve pointed out on the slides, we see a lot of free cash flow with oil at a $50 to $60 range. Obviously, as it moves further towards $60, there’s more of that. And the ability for the acquired assets to compete for capital with the two principal onshore basins, I’d say, is a to-be-determined but not a problem. It’s sort of a good problem. I do think, without question, the Delaware Basin today, if it’s not the finest oil play in North America onshore, I’d be surprised if somebody could make a counter-comment to that. Given as I’ve said earlier, we have a 60% oil cut with the production mix. We have a lot of existing infrastructure and the ability to build it out with third-party volumes. We have a business here that makes a lot of sense for our shareholders. And I think the Delaware Basin has tremendous opportunity beyond what we see just in the one zone associated with the Wolfcamp.

And the DJ, I think we’ve talked many, many times about what we see there. And the ability to put more rigs back to work there is going to be quite attractive. And these two basins will likely compete for a lot of capital. Now, as we continue to do the things that Bob made reference to earlier around the asset sales and additional cash, we’ll have a lot of flexibility as we continue to move assets today into cash that we don’t believe that we can deploy capital to in the next five years. So I think the need to do any debt financing associated with any development, I can’t imagine a scenario by which that would occur. I think, if anything, we’ll be in more of in a debt reduction mode.

“Our credit metrics are getting a lot better with this transaction”

APC: I think when you acquire material cash flow, material production and material reserves and you equity-finance the transaction; I think it’s unambiguously clear that our credit metrics are getting a lot better with this transaction. We felt that even absent this transaction, our 2017 debt metrics are going to be attractive to begin with. And that’s driven by continuing our asset sales, executing on the repayment of our remaining $750 million of debt that matures in 2017 that we’ve been pretty clear in the past that we’re going to pay down out of cash at a point in time prior to maturity, probably do a little bit of liability management work. Hopefully, I’m cleaning up some of our smaller debt issuances at the same time. And I think we’re always working against a moving target in managing debt to cash flow as a particular metric. And we think over time, driving cash flow up even at strip, let alone if we’re able to be correct on our prices moving toward $60; I think that metric gets better quickly.

And so I think it’s fair to say we’re comfortable with our overall pro forma leverage position and we’re doing things organically and then the acquisition just benefits. And so we’ll continue to do so. And I agree with Al. There’s no anticipation we do any debt financing of any of the work we’re talking about. All the growth characteristics or all the growth metrics that we put in the presentation and talked about in the press release is all driven through spending within our cash flow and not aggregate cash flow, asset sales and free cash flow, but rather within free cash flow from our operating activity. So we feel like it’s a low-risk transparent growth plan that also has an improving balance sheet alongside of it.

Q: If I could go back to one comment you made earlier, you mentioned that pref rights would be in play with Ram Powell and Hoover. Is that also the case with Lucius and if so, why or why not?

APC: The pref rights here are quite limited really across the acquired asset portfolio. Specifically and very importantly, pref rights are not in effect at Lucius. The JOA stipulates that a selling party that sells all of their deepwater assets in a transaction where they sell all their deepwater assets, pref rights are not triggered and we are buying all the deepwater assets of the seller. And so pref rights are not triggered there nor at Heidelberg.

In addition, most of the acquired properties from Freeport are 100% owned where by definition there, there’s no potential for a preffing party. There are a few assets, the two that we mentioned and some exploration including Vito, some exploration inventory including Vito where pref rights are in effect. And as we get pref notices out and see what partners are interested in doing, we’ll have a better idea of which properties get preffed. I think it’s important to think about this though that saying that the pref properties are the ones that we ascribe very little value to. And accordingly, whether we’re preffed or not preffed doesn’t change really anything that we’ve talked about this morning other than potentially reducing the ARO obligations associated with those properties.

Q: So it really just comes down to differences in the JOA languages across those assets?

APC: Yeah, and the way they were treated. Obviously, that was critical to us. As we looked at this, it was very clear we wanted Lucius. And in order to get Lucius without pref rights, we knew we were going to buy all the deepwater assets here. And so we spent a lot of our time in due diligence focusing on the assets we were less familiar with and seeing how well they fit with our portfolio and our operating strategy in the Gulf. And the great answer was they fit exceptionally well.

Q: Going back to one of the themes early in the Q&A about the EBITDA and the free cash flow profile of just these acquired assets. You give us great detail in the press release saying 1.5 times EBITDA is what you bought these for, and that $3 billion EBITDA over five years. That can only suggest that you’ve got $700 million in CapEx in next year to give you $600 million of free cash flow. Can you talk about whether that’s going to grow or shrink over the five-year timeframe and whether that’s just based on proved or if you’re also rolling in exploration and tiebacks there?

APC: We’ve got tiebacks. We’ve got a little bit of development work there, but very little. A lot of it’s

Lucius and a lot of that spending is behind us as we mentioned earlier. I think it’s fair to characterize it that CapEx goes down over that period and EBITDA climbs through 2018-2019 and then starts to decline through that period. If we start to then spend more development work on tiebacks or on development of some of the broader 2P portfolio, then obviously we would extend that production guideline but at the cost of higher capital. So we think that the net approach even though it’s not linear of each of those five years, the net approach – by giving you the net free cash flow over the five-year period was, we thought, the best way to articulate where the majority of the cash flow is going to come from over the life of the assets without taking it to the next leg of development and exploration.

Q: A couple of follow-ups to previously asked questions going back to the free cash flow point of $3 billion to $4 billion. Just very big picture. Do look at this as providing $3 billion to $4 billion of capital, all of which you would invest onshore, $3 billion to $4 billion of capital where you could have the flexibility to invest more than that amount offshore because the balance sheet can accommodate it, or should we expect that you use some of this free cash flow for debt paydown and then the rest of it to reinvest in the onshore?

APC: We aren’t looking at it as debt paydown. Obviously, it depends on what the future commodity price environment is that we’d find. If we find a commodity price environment that we feel like a little bit of debt reduction or a little less investment is appropriate, that’s what we’ll do. But I think our base case assumption here is the debt-free cash flow that’s kind of growing through 2019 in the Gulf of Mexico is largely going to be redeployed into the U.S. onshore assets as we articulated because we’ve got tons of running room and absolutely superb economics. That said, we’ve got a number of tieback opportunities and very high – they competes for capital well in the Gulf of Mexico as we’ve articulated on our own portfolio over the last few months. So we’re going to have some moderate investment in the Gulf of Mexico. We’re going to have material investment in the U.S. onshore. And we’re going to continue our asset monetization program that we’ve articulated previously that gives us a lot of flexibility around debt reduction or accelerating U.S. onshore growth in particular beyond the free cash flow that we’ve talked about.

Q: Going back to the tieback strategy, can you add some specificity into perhaps what level of CapEx we should expect committed for tiebacks, what production uplift that that would generate over the next couple of years and how oil price sensitive that would be?

APC: We’re not ready to talk to about that because obviously, we’ve got to close these things later in the year. And as you might imagine, the universe of people that are inside the tent on this has just grown a lot inside our firm. And so now we’re in a position where we get to utilize the skills and experience of a whole lot of people to make sure that we optimize our capital allocation. Over the course of the next two years to three years, we know we’re going to growing. We put that out there. We put a five-year plan forward which we haven’t done for a few years. I think, in and of itself, that ought to show the confidence we have in the direction that we’re going in. But how we fine-tune where we spend the capital exactly and what opportunities is going to be driven by a whole lot more work to really do what we do well and that is have a very refined capital allocation program.

CAGR at $50, $60 Oil