Demand growth will drive prices up; APC targets $3.5 billion in divestitures by yearend

Anadarko Petroleum (ticker: APC) said during its conference call today that the company expects demand to surprise to the upside while U.S. production bottoms out around 8 MMBOPD, helping to support prices at $60 per barrel in 2017.

At that price, Anadarko believes it should have the cash margins to “accelerate activity and achieve strong returns,” said Anadarko Chairman, President and CEO Al Walker.

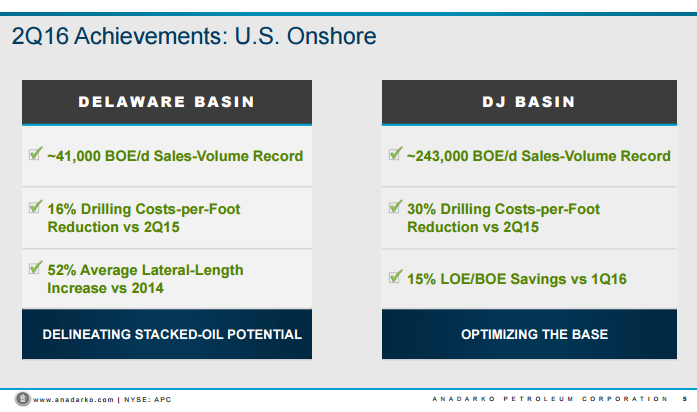

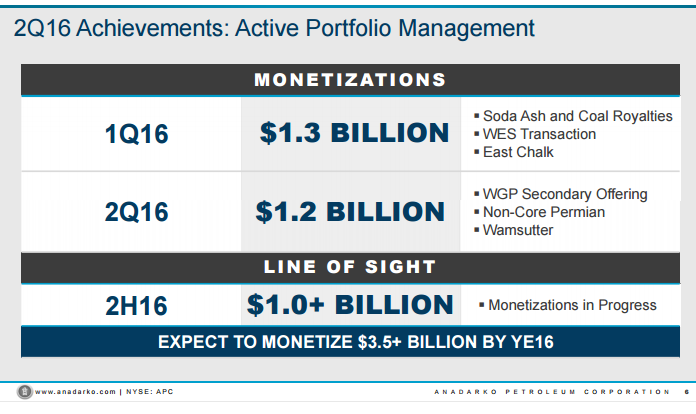

If that scenario comes to pass, Walker said Anadarko would consider using some of the proceeds from the $3.5 billion in asset sales the company hopes to achieve by the end of the year toward its “highest quality U.S. onshore assets later this year.” Specifically, Walker mentioned the DJ and Delaware Basins as potential targets for increased capital investment.

For the time being, the company plans to continue running six rigs. Earlier, Anadarko considered reducing its program down to four rigs, but increased efficiencies have allowed the company to continue drilling with the two additional rigs and stay within their original capital budget.

“For the first time since January of 2015 I think we see a window to better oil prices,” said Walker. “And I foreshadowed this a little bit at the Wells [Fargo] conference a few months ago when I made the comments there that we anticipated we’d have a leg down as the market tried to absorb the 3 million barrels associated with disruptions from Venezuela, Nigeria, and Canada.

“And as the market went through that congestion, we were going to see the leg down that we’re seeing right now. And I think once we get that behind us – to use an economics term, ceteris paribus – we think we’re looking at a sustained $60 oil price environment for next year.

“I think if you think about it as a demand function that improves annually at the cliff of 1.2 million to 1.3 million barrels a day, you can see pretty quickly that in an expanding demand relative to supply, the demand’s going to move up the curve,” Walker added. “And the intersection that creates P will put pressure on prices to move up to a level of around $60 a barrel.”

Anadarko plans to continue paying down debt as prices improve

APC plans to continue paying off its $750 million in debt maturities coming due in 2017, management said during the conference call. If prices climb toward $60, like the company expects they will, the company will begin to reinvest in more activity, but debt repayment will remain key.

“As we approach $60, we’ll invest more than we will at $43-ish in terms of where WTI is today,” said Walker. “So we’re already sort of telling you today that we anticipate with improvements that we think are forecasted, that we will start to reallocate some of our monetization proceeds.”

If prices do not improve, the company will still prioritize debt repayment, said Anadarko CFO Bob Gwin.

“If we’re wrong and prices go down, does that mean we increase debt? Absolutely not,” said Gwin. “In fact, we continue to reduce debt through the asset monetization proceeds.”

The company has so far completed $2.5 billion in divestitures through the first half of the year. Anadarko believes it will be able to make the remaining $1 billion in targeted monetizations by the end of the year.