170 wells will target Marcellus, Utica

Antero Resources (ticker:AR) announced fourth quarter results today, showing a net loss of $486 million, or ($1.55) per share. Overall 2016 results are a loss of $849 million, or ($2.88) per share. After adjusting for derivatives and other special charges, the company reports a quarterly and full year net incomes of $68 million and $209 million, respectively.

Antero reported reserves in early February, showing an increase of 16% in 2016. Proved reserves increased to 15.4 Tcfe at year end 2016, up from 13.2 Tcfe in 2015. These reserves are comprised of 61% natural gas, 37% NGLs and 2% oil. 87% of these proved reserves are from Marcellus shale holdings, while the Ohio Utica accounts for 13%. 3P (proved, probable, and possible) reserves increased by 25% in 2016 to 46.4 Tcfe.

Antero estimates 2017 Capex at $1.3 billion, equal to capital spending in 2016. This will fund the completion of 170 wells, primarily targeting the rich gas area of the Marcellus. Antero expects to operate 4-5 rigs in 2017, and 5-6 completion crews. Antero projects that this activity will fuel 20%-25% production growth in 2017.

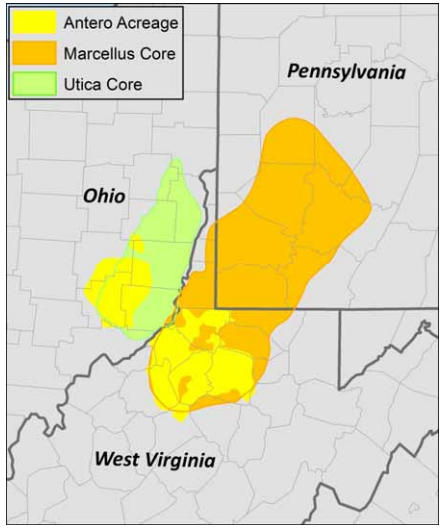

The company has strived to limit its exposure to service cost increases through the use of long-term contracts with providers. Antero owns 624,000 net acres split between the Marcellus in West Virginia and the Utica in Ohio.

Improved completions drive 33% EUR increase

Antero has made several improvements in completion design which have improved overall well results. Since 2013, the company has decreased frac stage length from 280’ to 193’. Proppant and water per lateral foot have both increased by about 60% since 2013. These improvements have paid off, increasing wellhead EUR/1,000’ by 33%. Further increases in frac intensity are planned, with 2,000 and 2,500 lb/ft designs slated for testing in 2017.These designs would represent increases of 25% and 55% over current practice, and could yield more improvements in EUR.

Processing of this development will be supported by the recently announced joint venture between MarkWest Energy and Antero Midstream (ticker: AM). A total of 600 MMcf/d of gas processing capacity will be built in this venture, along with an additional 20 MBPD of NGL capacity.

Q&A from AR Q4 conference call

Q: When we think about the productivity gains, the potential for cost inflation, the new pipelines and associated tariffs coming on, how do you think about your operating cost per Mcfe over the next couple of years, less so in 2017, but just more what’s that trajectory is, given the visibility of production in some of these tariffs?

AR President & CFO Glen C. Warren: We’ve already got in service quite a bit of our FT portfolio, so we don’t expect a large increase in the flow through from FT to operating cost. But, I mean, it goes up by a few pennies over the next few years, so not significant.

Q: On the completion front, you continue to highlight the increases in proppant loading. Can you talk more about your expectations for EURs for the 2,500 pounds per foot laterals that the relationship that you see between proppant load and EUR, and where if at all, do you see constraints proppant loading-wise?

AR Chairman & CEO Paul M. Rady: And that is why we are running the pilots. We’re not sure where the breakover point or point of diminishing returns will be. We’re very early in the 2,500 pound. The expectation of course would be that it’s better than the 2,000 pound, but we don’t know yet.

So, expect to have good results that we shall see, and even we’ll have to see initial rates, and then watch the curves over time. We’re pretty conservative, and we will be watching to see if it’s worth the extra effort. We think it will work. We think it will be good and that’s why we want to do it early, while we still have 3,000 to 4,000 more locations to drill just to figure it out on the early end, but it is early.