Lenders appear to have a more positive outlook on the future than borrowers

Lenders and borrowers in the oil and gas sector are all anticipating lower borrowing bases in the next round of redeterminations according to the semi-annual survey conducted by Haynes and Boone. 150 respondents took part in the survey this time around, with 41% of respondents saying they expect to see borrowing bases lowered.

On average, those that responded that borrowing bases would be lowered in spring 2016 believed that they would be decreased 20%, with lenders expecting a 16% decrease and borrowers expecting a 29% decrease. Borrowers were also more likely to say that borrowing bases would decrease (44% of borrower respondents) compared to lenders (37% of lender respondents), indicating that lenders are seeing a more positive round of redeterminations than borrowers are expecting, even though they still expect less capital to be available.

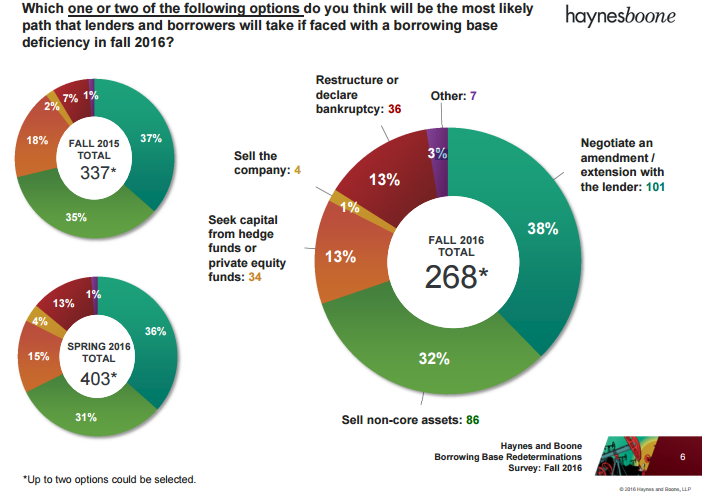

The paths the respondents thought borrowers might take when faced with a borrowing base deficiency remained largely unchanged from the last survey, with most expected to negotiate an amendment or extension with lenders, or sell non-core assets. The number of respondents that thought lenders might seek bankruptcy remained unchanged at 13% from the last survey.

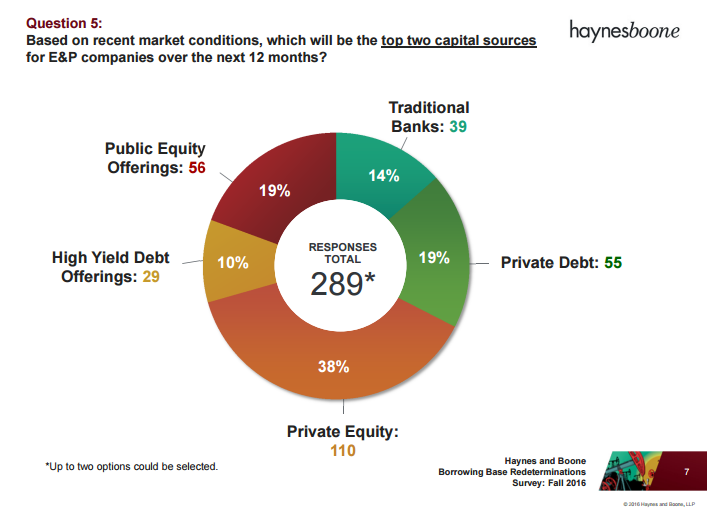

When asked where E&P companies are likely to get capital over the next 12 months, the most common answer was private equity, at 38% of the responses. Traditional banks made up the second-smallest source among respondents at just 14%, just 4% ahead of high yield debt offerings, which many companies are likely to avoid as they look for ways to strengthen their balance sheet.

First to announce Fall borrowing base

As if on cue, Rex Energy (ticker: REXX) announced its borrowing base determination yesterday. Bucking the Haynes and Boone survey majority, Rex announced that its lender has reaffirmed its borrowing base at $190 million. That will stay in place till April of 2017. Rex Energy CEO Tom Stabley said in a statement that the liquidity along with some transactions the company had made will allow Rex to have its core Appalachian Basin acreage held by production by mid-2017.

Bankruptcy Monitor

The energy group at Haynes and Boone keeps a Bankruptcy Monitor in place as well. In the August edition the firm reported that 90 E&Ps and 80 oilfield service companies have filed bankruptcy since the beginning of 2015. The full list of E&P bankruptcies is available here. The oilservice bankruptcy list is here.