As the No. 2 U.S. coal miner emerges from bankruptcy, a report in Europe warns of trouble ahead for the U.K.

Arch Coal, Inc. (ticker: ARCH) said last week that it has successfully completed its financial restructuring and emerged from court protection with more than $300 million of cash on its balance sheet and a debt level of $363 million—7% of what it was prior to restructuring. The company said its projected capital spending is $55 million in 2017 with projected debt service of approximately $33 million. Arch said it has third-party surety bonds in place covering 100% of its reclamation bonding requirements.

Coal under siege in U.S. and abroad

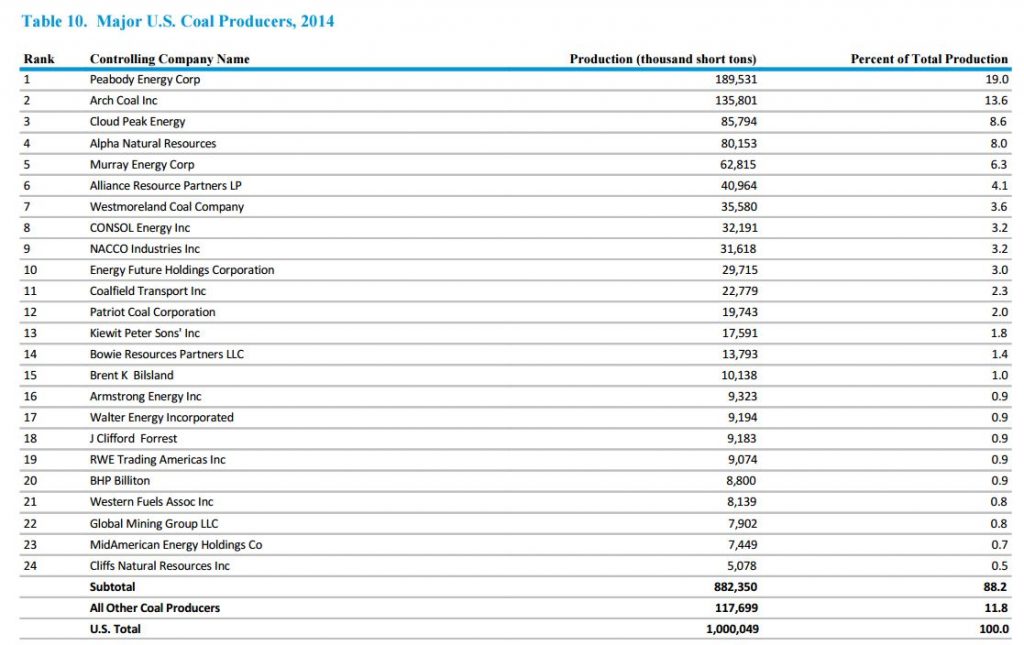

Arch isn’t the only coal miner to file for bankruptcy. The largest producer, Peabody Energy, along with dozens of others have filed in the past two years. The list includes Patriot Coal, Walter Energy, Alpha Natural Resources and many other well known coal miners.

Coal-fired generating capacity in the United States has fallen 15% over the past six years, dropping from 317 gigawatts (GW) at the end of 2010 to 276 GW in April 2016. This decrease is primarily attributable to the competitive pressure from low natural gas prices, which lowers the marginal cost of natural gas-fired generation, and the costs and technical challenges of environmental compliance measures, the EIA reported.

Since reaching a high point in 2008, coal production in the United States has continued to decline with production from the Appalachian Basin falling most. Low natural gas prices, lower international coal demand, and environmental regulations are the primary contributors to declining U.S. coal production. The EIA said power sector coal consumption was at the lowest level since 1988.

Ripples across the Atlantic

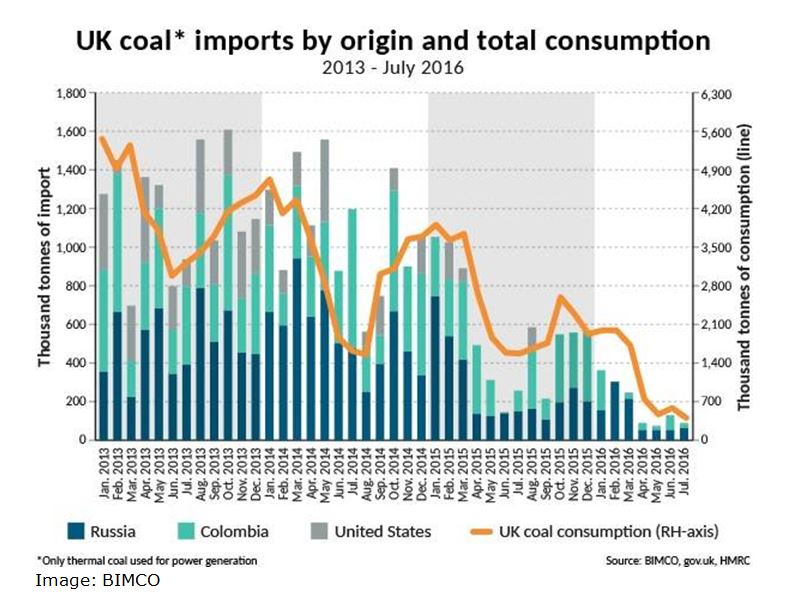

MarineLink reports that the main exporters of thermal coal for coal-fired power plants to the U.K. have experienced a heavy decline in seaborne cargo volumes in 2016, caused when the U.K. almost doubled its Carbon Price Floor (CPF), according to the Baltic and International Maritime Council (BIMCO).

“Since the U.K. increased their CPF to £18 per metric ton of CO2, the exports from the three main exporters [Russia, Colombia and the U.S.] during the first seven months have declined 69 percent compared to last year, and the U.K. total import of coal for coal-fired power plants is down 64 percent for the same period,” the report said.

According to the report, U.K. coal consumption has been falling for four years and that the increase of the CPF level in 2016 caused a decline of 56.7 percent year-on-year for the first five months of 2016. A total of 6,839 thousand metric tons was consumed in the first five months, compared to 15,800 thousand metric tons in the year before.

Analysts believe the U.K.’s domestically produced supply of electricity will struggle to meet peaks in demand for power due to the reduction in coal imports, making the U.K. dependent on importing electricity from other European countries. But coal is being priced out of other countries as well.

“France, importing the fourth largest share of coal for European countries (8 percent) in 2016, has already imposed a CPF on €30 per metric ton of CO2 planned to be introduced in January 2017,” said Peter Sand, Chief Shipping Analyst at BIMCO.