Bankruptcies abound in America’s oilpatch. So far this year 40 oil exploration and production companies have gone under, according to analysis from lawfirm Haynes & Boone, involving $54 billion in debt. The biggest failure so far, with $11.8 billion in debt remains Chesapeake Energy CHK +1.6%.

More Chapter 11s are coming, says corporate restructuring attorney Ken Coleman at Allen & Overy, and “that’s a good thing,” he says, because it will mean that management teams are finally accepting of the new reality of oil prices stuck at $40/bbl amid a continuing supply glut and pandemic-weakened demand. The world has changed, the debt-fueled fracking binge has come to an end. Many zombie oil companies cannot survive in their current form. “They have to rationalize the balance sheet, convert debt to equity, and sort out the right capital structure,” says Coleman. “That’s what the Chapter 11 system is for.”

No one in their right minds should want to invest new money into oil right now, right?. Demand is weak because of the pandemic, and analyst after analyst warns of global peak oil demand coming right around the corner. America’s output has fallen from 13 million bpd pre-Covid-19, to about 11 million bpd now, as drillers mothballed their rigs and laid off some 200,000 workers. There’s even pain at the safest of credits: ExxonMobil XOM +0.1% has announced its deep layoffs, lost half its value in the past year, and slumped behind Chevron in stockmarket capitalization. Both have now been overtaken in market cap by America’s new energy behemoth — the renewable energy giant NextEra Energy NEE -0.6%.

For contrarians, such abounding pessimism is a natural buy signal. Today’s emerging oil vultures can afford to be picky, and creative in their financings. What matters above all, says activist investor Ben Dell, founder and managing director of private equity fund Kimmeridge Energy, is asset quality. “There’s no point in taking a company through bankruptcy if you’re going to own a low-quality asset,” Dell says. Kimmeridge this month agreed to invest $440 million of new capital into Callon Petroleum (NYSE:CPE), which produces about 100,000 bpd from fields in the Permian and Eagle Ford regions. The Kimmeridge cash will go toward paying down some of Callon’s $3.35 billion in debt and pushing out maturities. In return, Kimmeridge receives $300 million in second-lien secured notes (paying 9%, maturing 2025), plus warrants to buy 15% of Callon’s outstanding shares. Kimmeridge also gets a 2% overriding royalty interest in all of Callon’s oil and gas output. If Callon averages 100,000 bpd for a year, Kimmeridge would get the equivalent of 730,00 barrels, worth about $23 million a year at current prices.

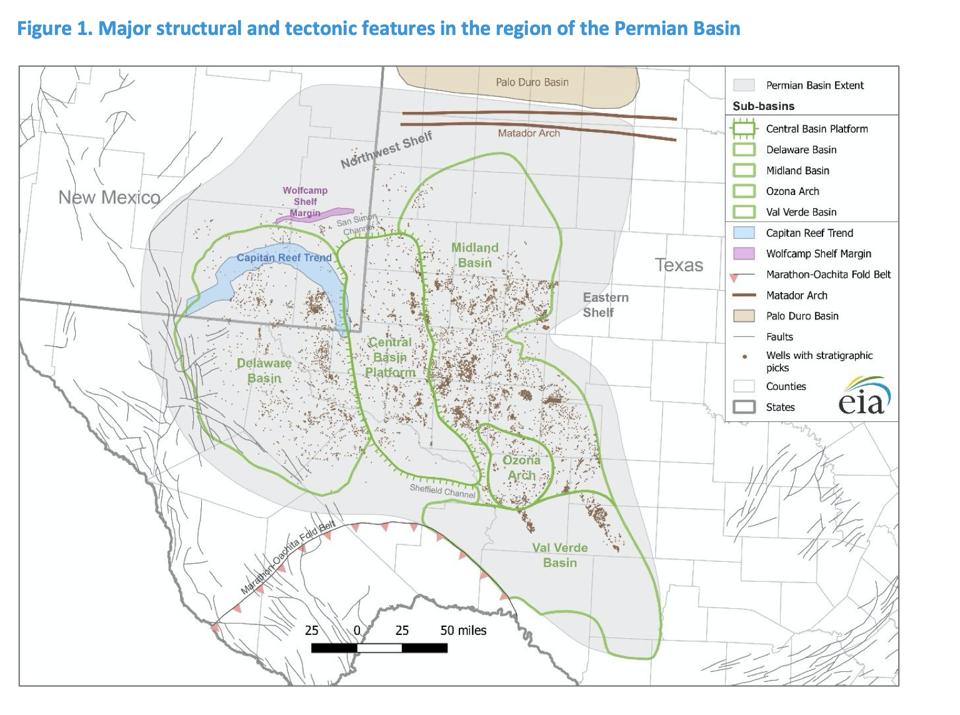

America’s biggest oil province. U.S. ENERGY INFORMATION ADMINISTRATION

“We’ve built a bridge for them,” with a semi-variable, “fixy-floaty” cost of capital, says Dell, who launched Kimmeridge in 2012 after working as an oil analyst for Bernstein Research. He has for years encouraged drillers to curb their debt-fueled fracking celebrations and instead learn to live within their means. That entails recycling no more than 70% of free cashflow into new drilling, while focusing on returning capital to investors, a la Big Tobacco. Callon has years worth of wells to drill on its 200,000 acres in the Central Midland section of the Permian basin that will be profitable even at $40 oil. Dell cautions that he’s just an investor and its up to Callon’s young CEO Joe Gatto to decide how slow to go. Kimmeridge still has several hundred million dollars in dry powder for deals, and is also involved in restructuring negotiations for publicly traded Extraction Oil & Gas, which filed Chapter 11 in June.

At private equity group Lime Rock Partners there’s same enthusiasm for an exit strategy they’ve helped orchestrate for bankrupt Arena Energy. A two-decade old company that had been owned by its founders and employees, Arena is a specialist in drilling overlooked prospects in the shallow waters of the Gulf of Mexico — a region that fell out of favor during the shale boom years. Arena filed for Chapter 11 in August after the plunge in oil prices made it impossible to keep up with payments on $1 billion in debt the company had taken on to acquire Gulf assets from Chevron and others. In restructuring, Arena’s employee shareholders will be wiped out, while secured lenders will be stuck with losses of more $600 million. To recapitalize the company Lime Rock Partners VIII will invest $45 million of fresh cash alongside about $20 million Arena from executives and others. Lime Rock had already been an investor in Arena since 2016 — but instead of holding equity or debt, Lime Rock had acquired from Arena an overriding royalty interest of roughly 2% in Arena’s production volumes. In 2020 these royalties, taken off the top, proved to be the safest place to be in the Arena capital structure. Lime Rock has been growing a portfolio of such royalty interests, and last year was part of a group that paid $300 million for a 1% override on 350,000 acres controlled by Range Resources RRC +3.5% in the Marcellus Shale. Having acquired a broad portfolio of assets including more than 120 production platforms from the likes of Chevron, it was the plunge in oil prices lower than anyone thought possible (-$37/bbl) that did them in. Buying royalty interests is a show of faith in the underlying quality of reservoir rock, which gives Lime Rock reason to believe the reconstituted Arena (now nearly debt-free) will be able to live anew, even amid $40 oil.

The good thing about constraining capital to an industry is that only the best ideas get fresh funding, so subsequent returns often go up. “We are in the sweet part of the cycle in my view,” says Bud Brigham, chairman of publicly traded Brigham Minerals, and a shale-drilling pioneer with Brigham Resources, which he sold to what’s now Equinor for $4 billion. “When our companies have historically optimized our rates of return on capital, by recommencing capital expenditures on top-tier projects at a time when costs are at a cyclical low.”

Austin-based Brigham likes owning royalty interests because you get paid off the top rather than waiting for cash to trickle through an organization long enough to turn into a dividend. But a royalty interest is only worth something if it’s on land that the primary acreage holder is willing and able to drill. Brigham was pleased with Chevron’s acquisition of Noble Energy NBL +1.4% this summer, as 8% of Brigham royalty interests cover land formerly controlled by Noble. This is the “Darwinism of the oilfield,” as (Ayn Rand junkie) Brigham calls it. Better assets end up in stronger hands. He’ll take it; shares in Brigham Minerals are down 50% in the past year.

This oil bust is a minefield, and investors caution that just because something looks cheap or on sale doesn’t mean it’s a good deal. Take for example Sable Permian Resources, which went bankrupt in the summer of 2020 under $1.4 billion in debt. The company, which used to be called American Energy Permian Basin, was founded by wildcatter Aubrey McClendon in 2014 after he was booted from Chesapeake Energy.

Using about $1.1 billion in private equity cash from the Energy & Minerals Group (run by John Raymond, son of former Exxon CEO Lee) plus the proceeds of selling $1.6 billion in debt, McClendon bought about 85,000 acres in the southern Midland basin. The economics of drilling them may have made sense at $80 oil. But they haven’t since. In 2017 the company was recapitalized with $700 million in new money. In October 2019 they recapped it again, and Sable repurchased $2 billion of its own deeply discounted debt and issued $700 million in new first lien notes, reducing annual cash interest expense by $94 million. But it wasn’t enough to survive the Covid-19 oil crash.

In bankruptcy Sable’s lenders, led by JPMorgan Chase, first sought to auction off Sable’s assets, but after no bidder emerged, they canceled the auction and JP Morgan JPM +1.1% took over the assets — as a buyer of last resort. It’s an ignominious end to Aubrey McClendon’s last oil deal, but a powerful signal to the oil industry from a leading bank that the time for them to clean up their mess is now. It’s a move that impressed John Goff, the billionaire oil and real estate investor because it could help get reorganization deals flowing. “JP Morgan is sending the message to the market that they are not afraid to own assets,” Goff tells me. “They are strong and can wait for a better market environment.” Maybe it’s just coincidence that in early October, after taking over Sable Permian, JPMorgan announced that it would work with customers to make deep cuts to carbon emissions and that ex Exxon CEO Lee Raymond would leave his position as independent director on the JPMorgan Chase board.

[contextly_sidebar id=”X5upL5vAuXuNRmH5KYqq5mIyqjr0DyNc”]