PetroQuest is targeting record production growth in 2017

Today’s announcement from PetroQuest Energy (ticker: PQ) delivered a clear signal that PetroQuest will hit the accelerator on growth starting now, anchored by a Texas drilling program that could deliver an attractive 2017 for the GOM/East Texas-focused E&P headquartered in Lafayette, Louisiana.

PQ Manager of Corporate Communications Matt Quantz was in a positive disposition this morning following the company’s announcement that it has finalized the east Texas joint venture (JV) agreements, allowing it to restart drilling its Cotton Valley assets in December.

Why the JV?

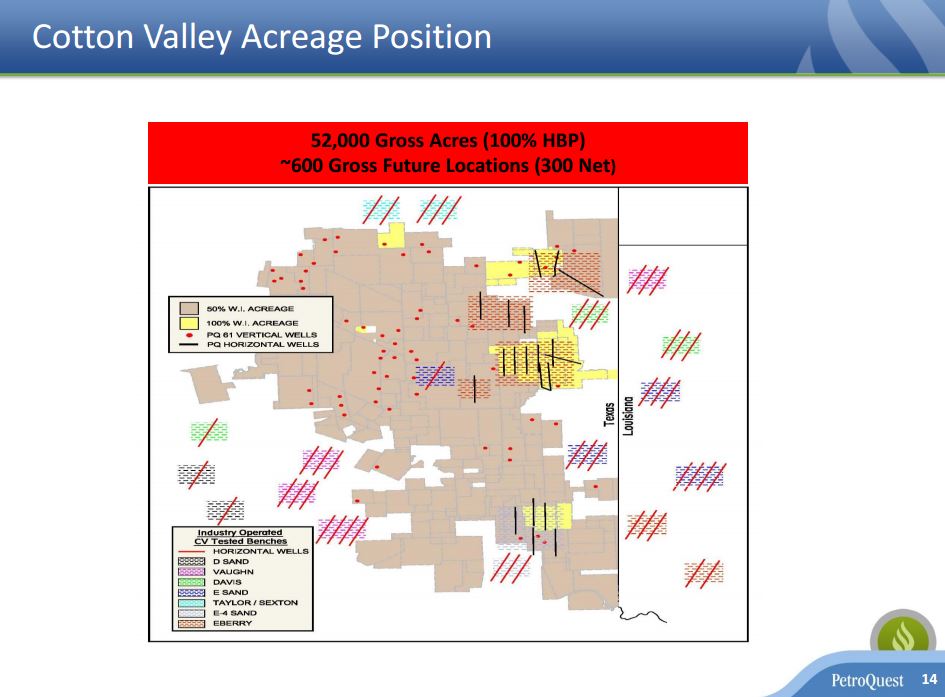

The Texas JV provides new sources of capital and some balance sheet breathing room for PetroQuest, allowing it to launch and maintain an ongoing horizontal development drilling program on its 6,400 gross acres targeting the Cotton Valley formation in east Texas.

Quantz told Oil & Gas 360® that the one-rig Cotton Valley development program will be funded from JV partners’ cash payments in concert with PetroQuest’s anticipated cash flow from operations.

The JV is structured whereby a group of investors who are PetroQuest’s east Texas JV partners has acquired an approximate 20% working interest in the PetroQuest 6,400 gross acre project area.

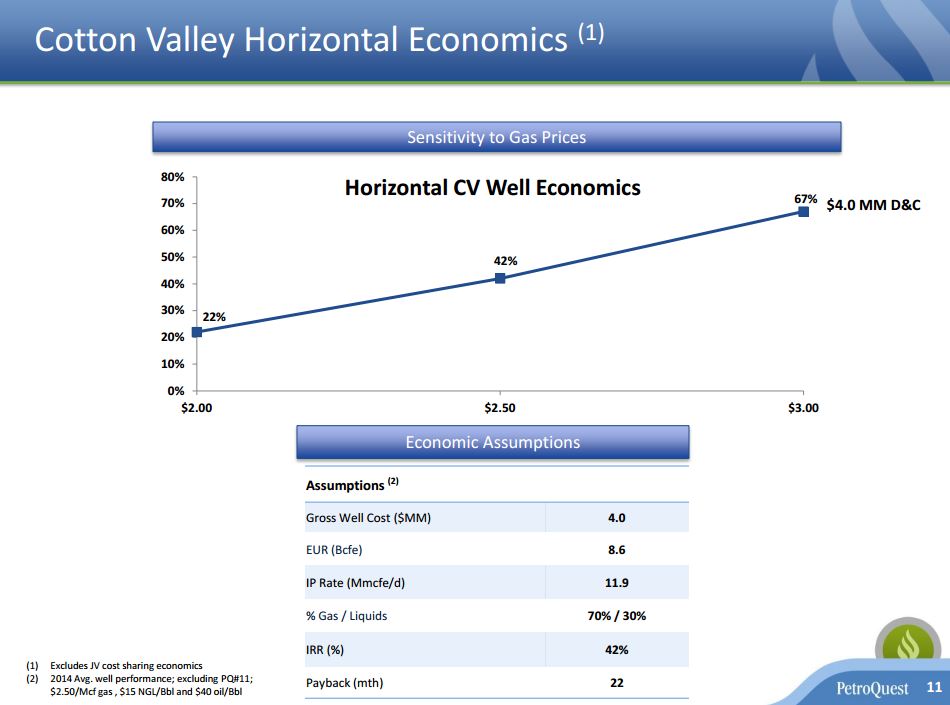

The JV partners will pay approximately $12 million in participation fees over the first 12 months of the program (subject to a one-time partner election to continue participating in the program after the 7th well). This capital will fund a portion of the development costs. In addition, the partners will pay approximately 24% of the drilling and completion costs relative to their 20% working interest. The Company is evaluating interest from other potential partners that could increase the working interest sold by up to an additional 5% on the same terms as described above.

The joint venture does not include existing vertical and horizontal producing wells within the defined project area, the company said.

PetroQuest said that in addition to the partners described above, it has an existing 5% working interest partner that will have the option to participate in up to the next eight wells drilled in the project area. This partner will pay 7% of the drilling and completion costs relative to its 5% working interest, the company said.

Based on the existing partner’s participation, the company expects to pay approximately 69% of the drilling and completion costs for a 75% working interest in the initial joint venture well. PetroQuest plans to spud the first JV well in December.

The Cotton Valley program

PetroQuest Chairman and CEO Charles Goodson, during last week’s Q3 conference call, gave some detail regarding the new Texas drilling program that his company is about to kick off.

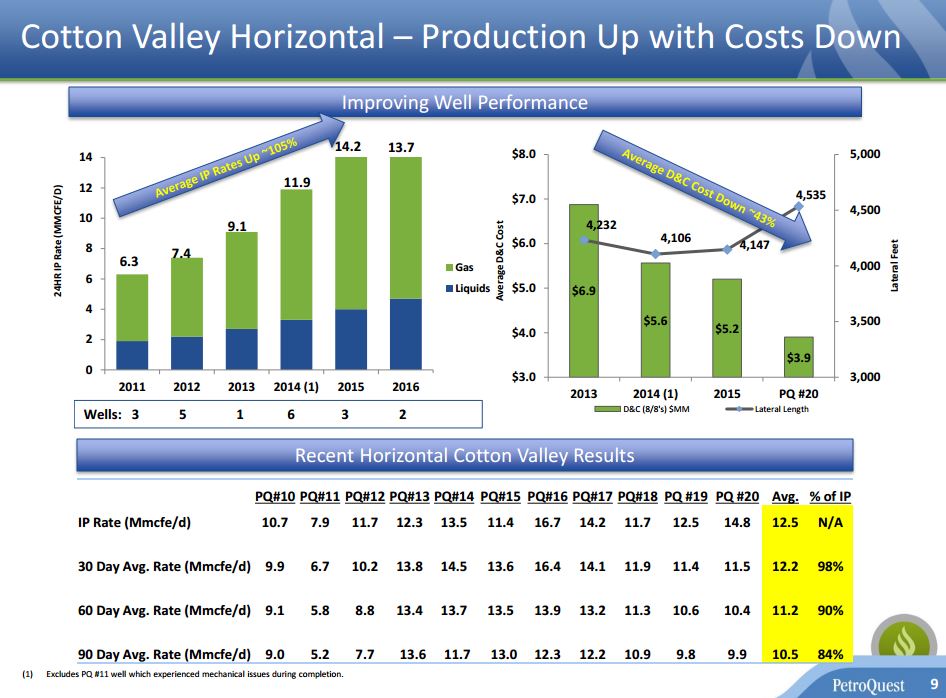

“We recently signed a six-month contract for a new generation, AC drilling rig with all the bells and whistles, for approximately $16,000 per day,” Goodson said on the call. Goodson pointed out that the upgraded AC drilling rig the company recently contracted carries the same dayrate as it was paying for a basic mechanical rig in 2014-15.

“In addition to securing a rig, we have commenced construction of several multi-well pad sites throughout the project [area] and are in the process of permitting future drilling locations. As you can probably tell from our actions, we’re planning to have a continuous rig running in the area for the foreseeable future.

“We’re very excited to get back to development mode at the Carthage field , which we believe is one of the top assets in North America,” Goodson said.

The first phase of the joint venture is focused on drilling up to forty-seven horizontal Cotton Valley wells with an expected average lateral length of approximately 5,600 feet, the company said in a statement. PetroQuest expects to spud the first joint venture horizontal Cotton Valley well in December, with the idea of drilling and completing 8-10 gross wells during 2017 under the joint venture.

How Cotton Valley is unique

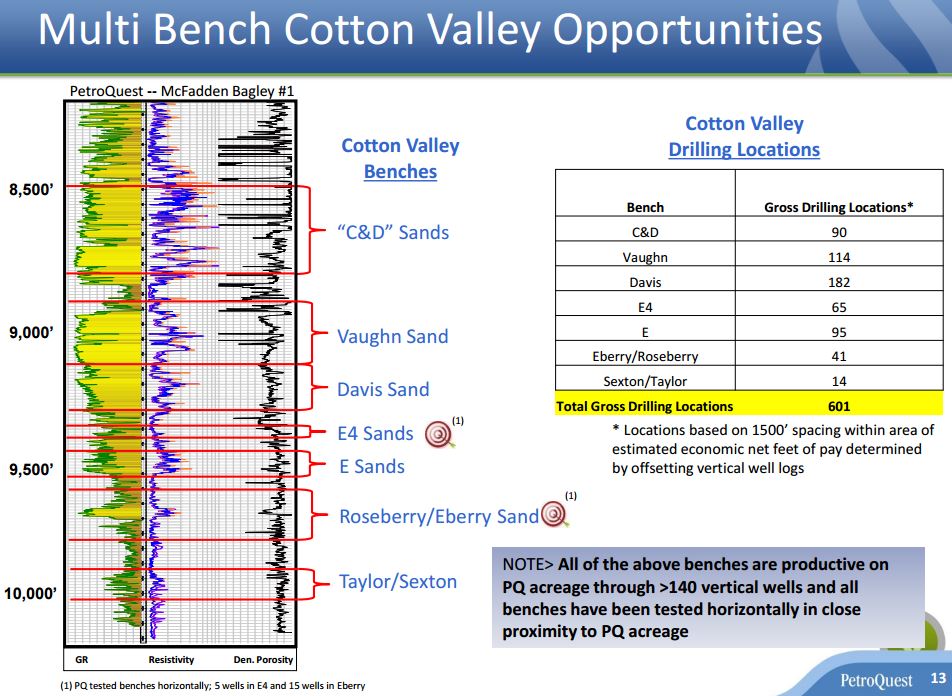

Goodson said that several unique characteristics set the asset apart from others. “First, there are highly permeable tight sands present here, versus the significantly lower permeability shales that are found in most unconventional gas plays. And two, our Cotton Valley sand packets consist of seven currently defined and productive benches. In total, the sand column is over 1,400 feet thick.”

“On our acreage, there are numerous cores, hundreds of vertical wells and 26 horizontal wells with years of production history. We’ve not only de-risked this area, but we have provided valuable information about the geology and engineering needed to proficiently develop these tight sands.

“Those last few words are what sets our Cotton Valley asset apart. Vertical wells simply drain virtually no area. If you look out, say, five miles to the east, south and west, there are hundreds of late vintage horizontal wells drilled by others, successfully testing all seven benches; to the north and west is the Carthage field, which continues to be a significant East Texas Cotton Valley producer, having already accumulated over 4 Tcf.”

PetroQuest CFO Bond Clement discussed the idea of longer laterals. “We’re going to have the ability to drill some longer laterals than we’ve ever drilled out here,” Clement said on the Q3 call, “particularly with some of the acreage that we put together in the northern section of our 100% acreage. We can see lateral lengths approaching 7,000 feet. So we’re excited to [drill] longer laterals in the Cotton Valley just to see what kind of EUR per lateral foot we can generate,” he said.

PetroQuest’s EVP Operations and Production Art Mixon discussed operational efficiencies during the call. “We’ll be doing multi-well pads and I think there’ll be some built-in efficiencies both on the drilling and operations side, as well as on the completion side.

“As far as enhanced completions, we are going to be continuing to look at proppant densities, all the efficiencies and all the things that we think are going to make a good completion including lateral length, number of stages—all those will be looked at in this program,” Mixon said.

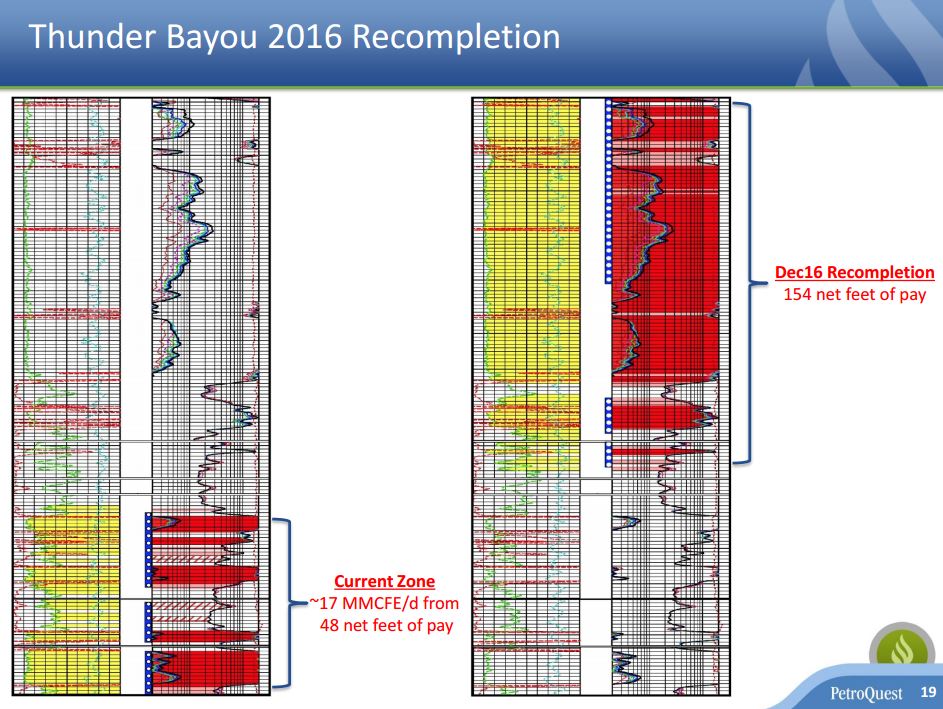

Matt Quantz took a broad look at the 2017 horizon. “With the Texas joint venture finalized, the anticipated liquidity savings from the 9% PIK options on our senior notes that we will begin to realize starting with our spring 2017 interest payment, plus the Thunder Bayou recompletion, 2017 is setting up to be a record year for production growth for PetroQuest Energy,” Quantz told Oil & Gas 360®.

Thunder Bayou

In the Gulf Coast, the Thunder Bayou well is currently flowing from the initial completion in the lower section of the Cris R-2 formation (48 net feet of pay) at approximately 18 MMcfe/d (NRI-37%), the company reported in its Q3 earnings announcement. The daily production rate of the well continues to decline as expected. As a result, the Company’s production guidance for the fourth quarter of 2016 assumes the well will be shut-in for the month of December due to the Company’s planned recompletion into the upper section of the Cris R-2 formation (154 net feet of pay). Thunder Bayou is forecasted to be back online in January 2017.

Analyst Commentary

From CapitalOne Securities

PQ Enters East Texas JV

$3.19, Overweight, $5.00 Target, Tullis

· Positive since the agreement should allow PQ to benefit from drilling efficiencies from running a continuous Cotton Valley drilling program that should also help generate solid y/y production growth. As expected, PQ has struck a JV in the Cotton Valley. The partner group will receive a 20% WI in the project area consisting of 6,400 gross Cotton Valley acres located in Panola County in exchange for $12MM in participation fees plus 24% D&C costs with a potential 5% WI increase for the existing partner (for 7% drilling cost share). The JV will initially focus on drilling 47 wells with an average lateral length of 5,600 ft beginning with the first well spudding in December. The JV partners have a one-time election to continue participating in the program following the 7th well.

· PQ expects to drill and complete 8 – 10 gross wells via the JV in 2017 (PQ would hold 75% WI if all partners & working interest owner participate in all wells for a 69% D&C cost participation). This would work out to slightly below the 8.4 net wells that we currently estimate for PQ in the Cotton Valley next year, but we also did not factor in the $12MM participation fee or the expected 6% drilling cost carry.

From SGS Energy Research

· PQ comments – Announces Cotton Valley JV; re-starting Cotton Valley D&C in December, setting up for significant FY17 production growth ($3.19; Buy; $7.00 PT): Cotton Valley JV covering up to 6,400 gross acres provides a creative solution to enhance liquidity and jump-start a significant production growth trajectory. Under the terms of the agreement, the JV partners will pay $12MM in participation fees over the first 12 months and front 24% of D&C costs to acquire a 20% working interest. In FY17, PQ plans to drill 8-10 gross wells under the JV – with momentum for Cotton Valley D&C and a high-impact/low-cost recompletion at Thunder Bayou pegged for early FY17 (which is expected to ultimately produced >22 MMcfepd, or put differently, >50% of PQ’s Q4 guidance); we see PQ poised for strong FY17 production growth from within cash flow (potential for ~50%+ growth exit/exit). Also nice to see the deal done at >$9K/acre which provides a positive read to PQ’s Cotton Valley position.