Consolidation Will Create a Services Company “Ideally Positioned to Grow in any Market”

Baker Hughes (ticker: BHI) will merge with GE’s (ticker: GE) oil and gas segment, forming a new company called Baker Hughes, A GE Company, with $32 billion in revenues, the two companies announced today.

Today’s news follows the unraveling of BHI’s attempted merger with Halliburton (ticker: HAL) in May.

The resulting company is expected to be more cycle-resistant, according to the executives. “This transaction creates an industry leader, one that is ideally positioned to grow in any market,” Jeff Immelt, GE’s chief executive, said on the conference call, adding “The transaction assumes a slow recovery, really $45 to $60 per barrel through 2019, and this seems reasonable.”

Baker Hughes shareholders will receive a special one-time cash dividend of $17.50 per share and 37.5% of the “New” Baker Hughes, with GE shareholders holding the remaining 62.5%.

GE Offers Subdued Recovery Forecast

During the call Q&A an analyst asked a question about the recovery assumptions.

Q: You guys have said many times that you don’t want to underwrite an oil and gas recovery. So, can you talk a little bit more about your assumptions that you’re making in this deal around market growth moving forward? We know you’re saying that you only assume a modest recovery in oil. But how important is market recovery to your return on this investment?

Jeffrey S. Bornstein [SVP and CFO for GE Company]: “We’ve assumed that oil has a very modest recovery, beginning in 2017, $50, low $50s, maybe mid-50s in 2018, and then, by the end of 2019, something that’s approaching $60. I think we’re well inside of what industry consensus is, and we think it’s a reasonably pragmatic case.

“As Lorenzo talked about earlier, the way we thought about underwriting the risk in this, we’ve got Baker Hughes EBITDA getting back to 60% of 2014 peak by 2020. I think industry consensus, for instance, on Schlumberger and Halliburton is to be 100%, or over 100%, at that point in time. So we’ve tried to take what I would describe as a reasonably pragmatic approach on how we thought about the recovery. Martin, do you want to add anything?”

Martin Craighead [CEO Baker Hughes Inc.]: “I think we’ve had a pretty consistent and correct view of how this market’s been evolving. Overall, the decline curve is very real, and our customers are battling that. We’ve had a crushing reduction in investment which is going to catch up with the business, and you have this nuanced issue in North America where you have a high-grading of the portfolio and recovery factors and production numbers have been a little bit more buoyant than all the talking heads or experts have been indicating. But at the end of the day, you can’t fight the decline curve, it’s real and it’s coming.

“So, as we said, we continue to see a slow grind-up in North America through probably the next couple quarters. And subsequent to that, offshore will – there’s no denying that they’re the most prolific fields in the world, and our customers will continue to figure out ways to monetize it. But that’s also what precipitates this combination, is being able to get that cost basis down for our customers.

“We obviously underwrote a downside case as well, where essentially oil does nothing for the next three or four years. And even in that case, largely driven by the synergy value that’s created here, we’re better off as a company having done the deal than not doing the deal. And we still think we create value, even in a sideways market. So we did consider the fact that there would not be any oil recovery, and we still thought it made financial sense for the company.”

“We see short-term growth in the North American unconventional markets and LNG. And over the long term, we know that larger production fields will be developed offshore,” Immelt said on the call.

A “Fullstream Digital Industrial Services Company”

In the joint press release, the new company was positioned as a “fullstream digital industrial services company” that will have the capabilities to move from being an oilfield equipment and service company to a provider of oil and gas productivity solutions,” according to Lorenzo Simonelli, president and CEO of GE Oil & Gas.

Oilfield contractors are increasingly forming partnerships to help cut costs and expand their offerings and distribution channels amid the oil price downturn. The moves have come into favor as their customers — exploration and production companies — seek ways to improve efficiency and get greater value out of the technical services and equipment needed to extract hydrocarbons out of the ground.

“The oil and gas industry spent close to $800 billion in 2015,” Simonelli said in a statement, “and we believe that our new company will serve roughly 20% of this market.

BHI CEO Martin Craighead said in his remarks on the conference call that the two companies together will create “an end-to-end provider of technology, equipment and services across the full spectrum of the oil and gas value chain, upstream, midstream and downstream.”

“As an example, the efficiencies gained from integrating our R&D and manufacturing capabilities will allow the company to sustain and continue robust investment in innovation throughout every phase of the industry cycle,” Craighead said.

Source: Baker Hughes

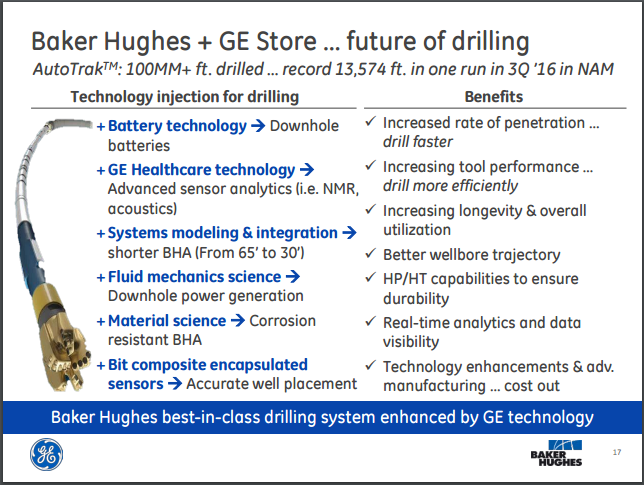

“Through the GE Store, each business can share and access the same technology, markets, structure, and intellect. These expertise in imaging, sensors, electrical science, software and analytics, material science, advanced manufacturing, and computational fluid dynamics, all powered by Predix and GE’s digital offerings, will make us better positioned to win,” he said.

Source: Baker Hughes

Simonelli cited the AutoTrak curve rotary steering system as an example of how GE technology could further enhance Baker Hughes products. “Both teams are confident that through GE technology, we can add capabilities to make it even better by applying material sciences, 3D printing, data optimization, rotating equipment, and sensing and measurement controls. We expect to deliver an even better performance to drill faster, more efficiently, and with better precision.”

Q&A from today’s conference call:

Q: Obviously there is a serious transformation underway in the oil and gas business, certainly to what you guys see as solutions-based services, digitalization, and we’re a big believer in unlocking big data here. I’m curious, from the customer standpoint, in speaking with our contacts in West Africa, in the Middle East, in Latin America, there seems to be this growing desire for GE to get bigger in the services business. We’ve heard this over and over again, especially when Baker and Halliburton were tied up in their failed transaction. How much of this was a driver?

Martin Craighead: When Lorenzo and I first started talking, probably four to five months ago, it centered around the customer need around better analytics, data management, and mining that opportunity set. There’s no secret that this industry needs to change its returns, its deployment of capital, from our customers’ perspective. And then when we started looking at that, the opportunity set just continued to grow.

I have been extremely impressed with their Predix Operating System. And as we started to look at the application of that, as we start to migrate it into well construction, well production, and ultimately improving the recovery factor and moving that decline curve further right, there are so many experiences that we can bring to play here that I think is going to completely change the conversations that any player in this industry has ever been able to have with the customer. Lorenzo, do you want to [comment?]

Lorenzo Simonelli: Customers have been urging us to continue to expand within the oil and gas sector, and this has been very much a customer-focused transaction.

When you look at the portfolios, very complementary, and in fact, we’re terming now the use of it as full-stream because we can really go wing-to-wing along the value chain, and we can incorporate the aspects of the GE Store capabilities further upstream. So we can get closer to our customers, help them develop the fields, and extract the maximum resource, and that’s what our customers have been asking us to do. And when you look at this combination, it provides them the productivity and the outcomes that they’ve been looking for, bringing down the cost per barrel, driving efficiencies, and allowing them to exploit the opportunities they have.

Q: Martin, when we visited this summer, you seemed fairly excited about the opportunity to build new and more diverse sales channels. And so as you think about the Baker Hughes portfolio from advanced drilling services to logging evaluation to completion systems to protection optimization, which of those are you most excited about in terms of the opportunity to accelerate the go-to-market strategy?

Martin Craighead: I have a hard time figuring out which one I’m not excited about. Again, as we look at what the GE Store can bring to bear on the legacy GE in terms of engineering let’s say cost out of the products, a big part of the synergy number here that Lorenzo referred to, and I think he gave a great example on the Lufkin pump. As we build these new sales channels, obviously if you can provide leading technology, which we’ve continued to do, and that’s only going to be accelerated, if you can do it at a price point in some of these products, then we’ll continue to actually capture more of that margin opportunity. So it goes the whole span, completions, logging equipment, AutoTrak drilling assemblies, VertiTrak, artificial lift, it’s a magnificent opportunity to drive those local service companies and those new sales channels even faster than – frankly, than we ever imagined.

Lorenzo Simonelli: I think also the complementary nature of this transaction will result in Baker Hughes being able to take advantage of the government-to-company contracts that are in place, our presence that GE has in the scale in Saudi Arabia, in Brazil, in China, and other countries if you look at being able to provide incremental growth opportunities for what are great products at Baker Hughes into new sales channels. And that’s what we’re looking to do as well, and you can see those through the revenue synergies. And we feel very confident that the GE Store, just from a commercial standpoint, is going to add a tremendous amount of capability.

Q: Could you maybe talk a little bit about the opportunities that you see between the GE subsea and surface portfolio and combining it potentially with some of the products from Baker Hughes? How do you think about that and the opportunities you see for the combined companies?

Martin S. Craighead: This has all been precipitated based on looking through the lens of our customers. What are the challenges? It’s all about getting the cost per barrel down, get the recovery factor up. And we look at the ability – you talk subsea. So here we have the world’s leading drilling and completions business, which is all below the mud line. Then you look at the separation, compression, electronic, BOP capabilities on the mud line. And then you look at the boosting capability of Baker Hughes in terms of ESPs [Electrical Submersible Pump], and then you look at the pipeline commissioning capability.

Now you picture a Deepwater operator that now has the ability to have a conversation with the new Baker Hughes to take that dollar per barrel way down, manage the risk, and leverage again a world-leading technology organization.

This just hasn’t happened before, and this is why we’re so excited about what that opportunity is. And I could go on and on. Whether it’s the Deepwater or whether it’s the unconventionals, it’s really just an incredibly opportunity-rich environment.

Lorenzo Simonelli: Martin, I think you stated it very well. And just to further complement what Martin said, if you look at each of the segments, it be on the offshore, it be on the onshore, we’ve got opportunities to combine the capabilities and really provide across the value chain. And it’s bringing together the strength of what GE Oil & Gas has from an equipment perspective, also from a power generation perspective, all the way down to the mud line and being able then to integrate it through data analytics, and that’s where productivity can further be enhanced in the future.

When we talk about the cost out, we talk about the synergies, all of this is normal day-to-day things we’ve done before. As we go forward, also through data analytics, there’s tremendous incremental opportunity within the new Baker Hughes.

Martin S. Craighead: As we were exploring this opportunity, a term, power to lift, kept coming up. And as we build out the North American ESP business and we begin moving into the SCOOP and the STACK, the outer fringes of the Bakken, the grid, the electrical infrastructure is weak.

And here you have the capabilities of putting power as part of the entire lifting conversation with our customers. Before, here you had the world’s leader in electrical submersible pumps, but the conversation couldn’t go as to how we help the customer generate that infrastructure to run those pumps. Now our sales teams are going to be able to provide a broader solution. And there’s no one that can do that except us, full stop.

Q: Can you talk about the challenges of gaining share in a market that’s already seen a lot of consolidation? How difficult do you think it will be to get there, and how important is growth in Predix to help in the market share equation?

Lorenzo Simonelli: First of all, I think it’s very achievable. And when you look at the technology basket that we have readily available in both of the companies, we’ve been investing over the downturn, and the NPIs are going to be introduced in the marketplace. That’s outside of Predix, just the enhanced capabilities of artificial lift. When you look at the different elements of, again, completing wells, there’s a lot that the companies have been investing in, but from a product introduction, you’ll see that increase.

Then as you look at revenue synergies, there’s a complementary nature of the portfolio, being able to aggregate from a package perspective to give a better outcome. You had the example of power to lift. As you look at also the offshore completion, being able to take from the mud line all the way to the surface, being able to connect the value chains, nobody else in the industry can do that. And so we’re able now to provide that portfolio.

And the third element, as you say, Predix, data analytics and the opportunity to reduce some planned downtime, to increase efficiencies, we’ve already started to see that take place within the industry. As you look at uptime that we’ve been able to achieve on our rotating equipment, we’re now going to take that across the value chain. So it’s really those three elements put together that provide us confidence in the revenue synergies and the relationships we have with customers, which at a broader level of also General Electric and the GE Store, is very complementary.

Jeffrey R. Immelt: Let me also add to what Lorenzo and Martin have said. Look, I’ve had the chance to be with every oil and gas CEO in the world over the last years. Baker Hughes has an awesome reputation around the industry. I think the ability to bring more scale to their reputation is upside. It makes the industry more competitive. It gives customers more options, and I think there’s a tremendous amount of value that’s going to be created by the combination of these two companies.

Q: How long do you guys think it will take before you can take the digital capabilities that you have at GE and fully incorporate them into Martin’s innovative products across the lines and be able to offer the digital solutions company to the industry?

Jeffrey R. Immelt: I would just say, I think the oil and gas industry is maybe the first in terms of driving the industrial Internet. Terms like asset performance management, no unplanned downtime really came from this industry. The customers know how to monetize an extra hour, an extra day better than any other customers in the world. So I think in the end, that’s what this is all about. And again, what I would just say is the combination of let’s say an analytical operating platform on top of an oil field services capability, that’s precisely the competitive advantage in the industry, so very exciting.

The transaction is expected to add approximately $.04 to GE EPS in 2018, $.08 by 2020,” Immelt said in a statement.

Links to the conference call presentation, webcast, and press release are provided.

Analyst Commentary

From Capital One:

Very positive. BHI and GE have reached an agreement where GE's oil and gas business will combine w/ BHI to form "new" BHI that will be publicly traded. BHI shareholders will own 37.5% of the new company and will receive a $17.50/sh special dividend while GE will own 62.5% of the company. The transaction is expected to close in mid '17, and GE oil and gas CEO Lorenzo Simonelli will serve as the CEO of the new entity w/ Martin Craighead becoming the Vice Chairman. Conf erence call at 7:30 AM Central.

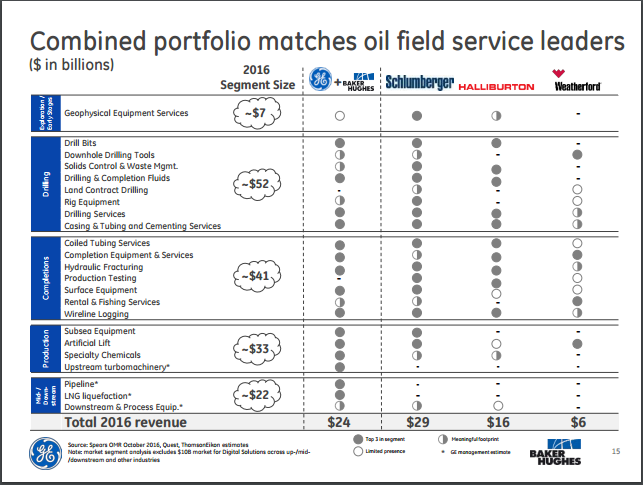

Combined company: The new company had ~$32B of revs in '15 w/ a fairly equal split b/t BHI and GE oil and gas, and the combination will create the second largest player in the oilfield equipment and services industry. GE's fullstream oil and gas manufacturing and technology solutions across subsea and drilling, rotating equipment, imaging, and sensing will complement BHI's main product lines of artificial lift, directional drilling, chemicals, and completion equipment. Initial synergies are pegged at a run rate of $1.6B by 2020.