All segments up sequentially, year-over-year results mixed

Baker Hughes (ticker: BHGE) announced third quarter results today, in the second earnings release since the company merged with GE.

Baker Hughes reported a net loss of $92 million, or $(0.07) per share, on revenue of $5.8 billion. This represents a decrease of 3% in revenue and drop in net earnings year-over-year, but an improvement sequentially.

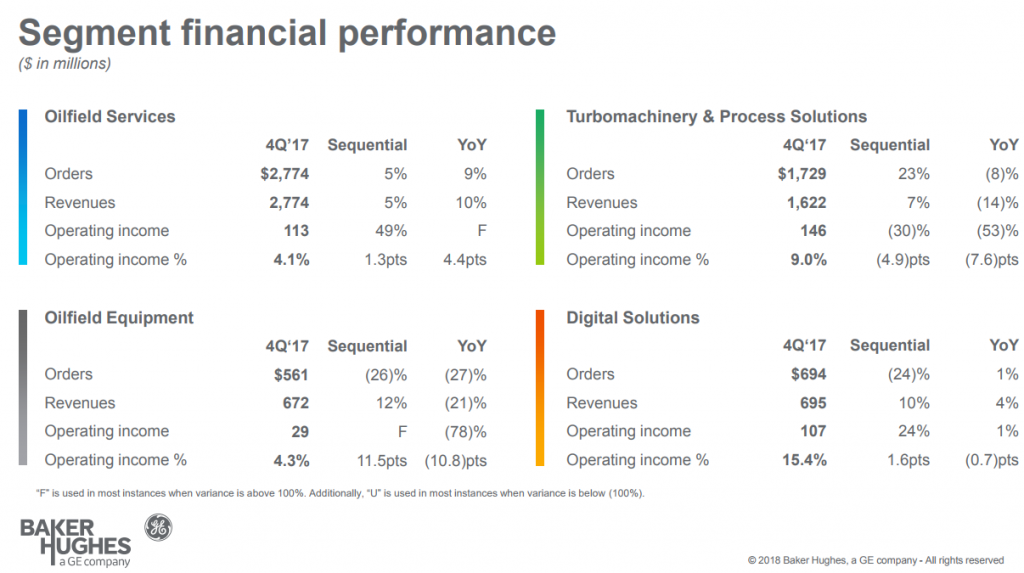

The company reports each major segment saw sequential revenue growth, but only Oilfield Service and Digital Solutions grew year-over-year. Turbomachinery & Process Solutions and Oilfield Equipment saw revenue contract by 14% and 21%, respectively.

Baker reports its largest-ever turbine contract

All product lines grew in North America, where the shale resurgence is going strong. International activity, though, is much more mixed. The Middle East has seen roughly flat activity levels, but Baker did receive a three-year well construction contract in the region this quarter.

Baker also secured the largest-ever Turbomachinery & Process Solutions contract this quarter, providing turbine generators for PetroChina at the Halfaya oilfield in Iraq.

Synergies continuing, targeting $700 million in 2018

BHGE chairman and CEO Lorenzo Simonelli reports the company is still integrating operations, and delivered $80 million in synergies in the quarter. If integration is fully realized, the company estimates it will realize a total of $700 million in synergies in 2018.

This earnings call comes during a period of uncertainty for Baker, as GE is reported to be considering selling its stake in the company.

Simonelli addressed this possibility directly during his prepared remarks, saying “As you know, GE is evaluating exit options for its stake in our company. While GE reviews its position, we remain fully committed to what matters the most; delivering for our customers and for our shareholders. We are well positioned for any changes ahead, as we already operate independently with a strong governance structure in place. We are focused on our execution and on delivering the synergies from the merger of our two companies. As I stated earlier, our synergy targets remain intact with only a minor portion of the savings tied to the direct GE involvement.”

Short-term outlook is encouraging

Overall, Baker Hughes’s 2018 outlook is positive, as Simonelli discussed. “Early indications of customer capital spending are encouraging,” Simonelli said, “particularly for our short cycle businesses. The recent strengths in commodity prices underscore this view. However, we do expect markets for our long cycle businesses to continue to lag. We expect strengths in our Oilfield Services business driven by our well construction product line and increased completions activity as operators work down the drilled but uncompleted well inventory in North America.”

“International activity remained stable and we are seeing signs of activity increase both from volume and size of tenders for new workers. Customers feel more confident about their operating costs and commodity price stability. The subsea market continues to be challenging and activity remains low, with prices continuing to be pressured. We expect activity in the LNG space to gain traction through 2018, as customers position to make decisions on new capacity coming online from 2022 onwards.”

“Looking at 2018 and beyond, it’s clear that coming out of the most recent downturn the market and our customers’ expectations have structurally changed. Oil and gas service providers have and will continue to look at ways of improving efficiency and costs for customers, regardless of where the price of oil and gas may move.”

Conference call Q&A

Q: I want to go ahead and kind of hit the elephant in the room head on, if you will. The GE ownership interest in Baker Hughes, could you remind us what their options are in terms of exiting the ownership of BHGE? And then more importantly, could you talk more about what changes as if and when GE exits their ownership position, especially given the contracted agreements that you have in place that already envisioned some sell down at some point?

Lorenzo Simonelli: Thanks for the question and good to hear from you. As you stated, GE announced a strategic review of its position of BHGE which remains ongoing. So, from that standpoint, we’ll keep you updated as we hear more. There is a, contractually a two-year lock-up in place. What I can assure you is that I run a strong independent company with a focus on executing our strategy for the benefit of our customers and all of our shareholders.

The synergies remain on track at $700 million for 2018. And the majority of the value creation is within our control and we feel very good about that. So, the dependence from a GE perspective to achieve those is minimal. We’ve got a strong governance and operating model in place and we’re well positioned to execute and deliver our commitments to shareholders in any structure going forward. So, I think at this stage, really it’s – we’ll keep you informed as we hear more.

Q: And then, I believe and correct me if I’m wrong here, but I believe even if and when they exit, there are certain contracts that still allow you some of the access to say the GE store or things like that for a certain number of years, is that correct? And so, there would be, well, I recognize the synergies are all within your control, but some of the other maybe somewhat benefits would still be in place?

Lorenzo Simonelli: That is very much correct. And, in fact, when we created BHGE, we ensured that we have the capability to access technology from General Electric and that would be ongoing, irrespective of the relationship and the ownership structure. So we’ve got commercial arrangements in place.

Q: So far, all of the big three oilfield service companies have noted that one of their primary strategic objectives, if not the primary objective, is to grow market share. It strikes me when the three biggest players in the sector all go after market share aggressively at the same time, something suffers and it’s usually price. In the Middle East, you’re gaining work in Iraq where some companies choose not to go or at least increase activity, and that’s one way to gain market share. What are the levers that you guys have to pull that will make your market share push successful? And can pricing really go up if you’re all shooting each other?

Lorenzo Simonelli: Yeah. First of all, just I think when you look at our strategy and we’ve mentioned the growing share. First of all, we’ve got the benefit of the synergies that are coming through from a cost perspective as we’ve brought together the companies. So we’re bringing down the cost of our products and we’re looking for margin accretion to continue within the OFS business. We’re also looking to continue to expand on the relationships we have with our existing customers and that’s the benefit of the bringing together of the two companies. The scale and presence we have in these areas of the wealth, we’re able to definitely benefit from that. And that doesn’t necessarily increase our cost; it actually helps us from a volume perspective.

So, look, we’ve seen that we’ve been able in North America to again outpace rig count. And you’ve seen the margin improvement take place within the business segment. Also within the Middle East, you’ve seen us be able to win some key awards, and again that volume is over the installed base that we have. So we feel good about these key pillars that we have. I can’t speak to how the competition is doing it, but we clearly are looking at margin improvement.