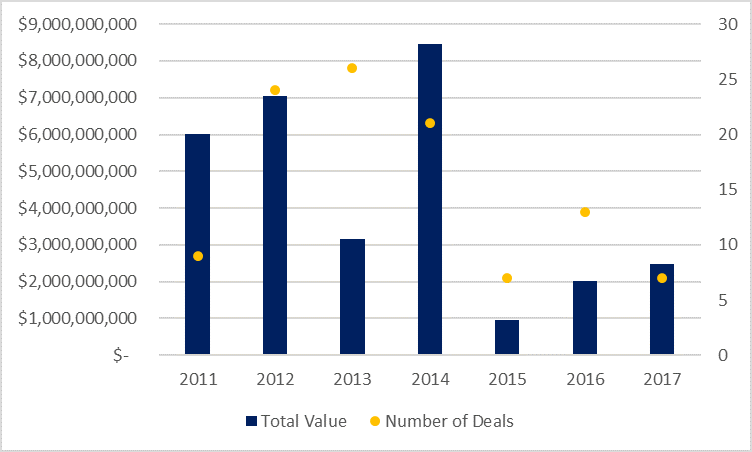

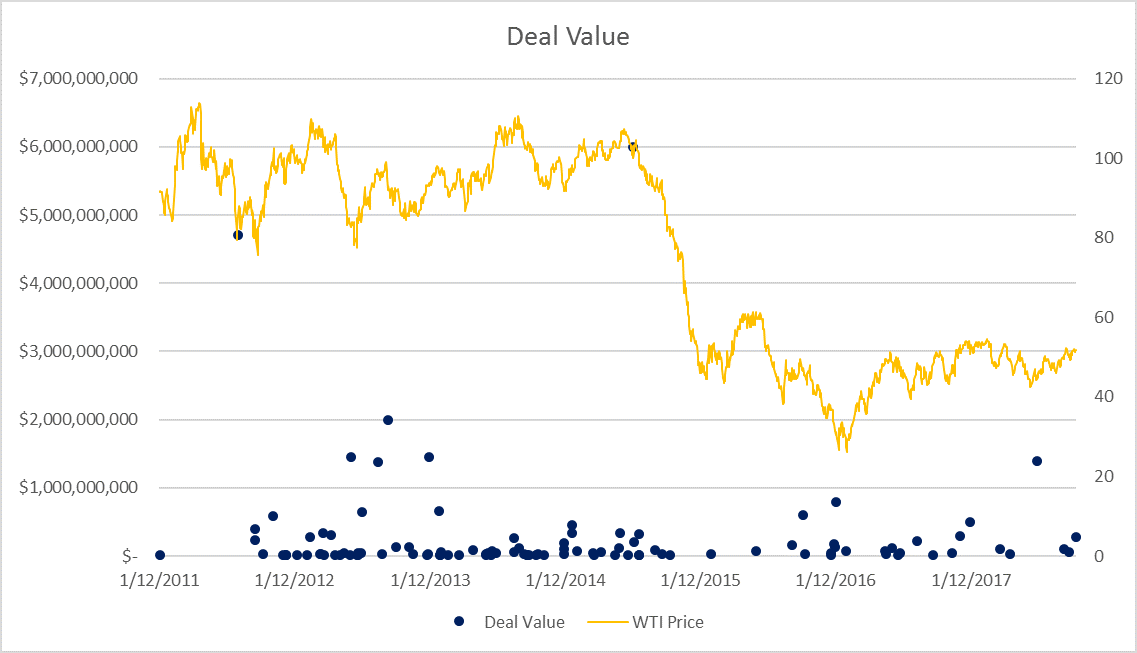

As far as companies buying and selling acreage and assets in the Williston basin, nearly $2.5 billion has changed hands in the Bakken this year. There are two more months of 2017, but already deal flow in the region is 25% higher than for all of 2016. While this does not come close to the values seen in 2011, 2012 and 2014, nonetheless it is the highest level of A&D the basin has seen since the downturn began.

LINN Energy’s (ticker: LNGG) sale of its Bakken properties this week marked the most recent in a series of Bakken transactions. For the E&Ps jockeying for position in the U.S. shale basins, A&D has steered north.

Bloomberg counts a total of seven different A&D transactions in the Bakken this year. And while this is fewer than the 13 that were announced in 2016, Bakken deal value in 2017 is up.

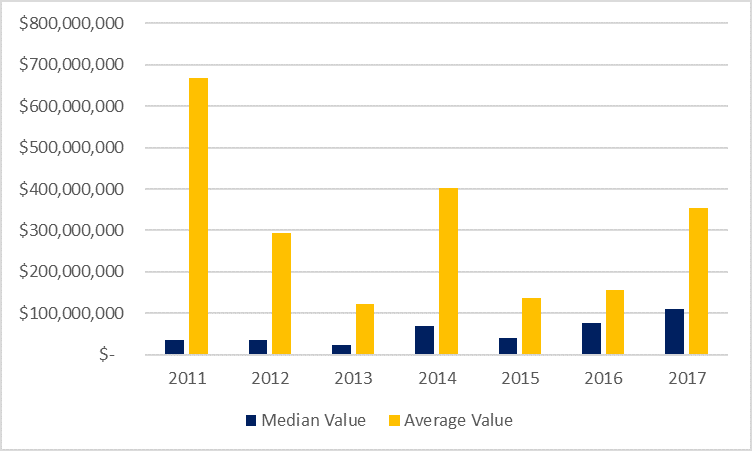

In addition, the median value of deals in 2017 is $110 million, higher than any previous year. The average deal value in 2017 is the third-highest since 2011, at just over $350 million.

LINN and Halcon: How do they stack up?

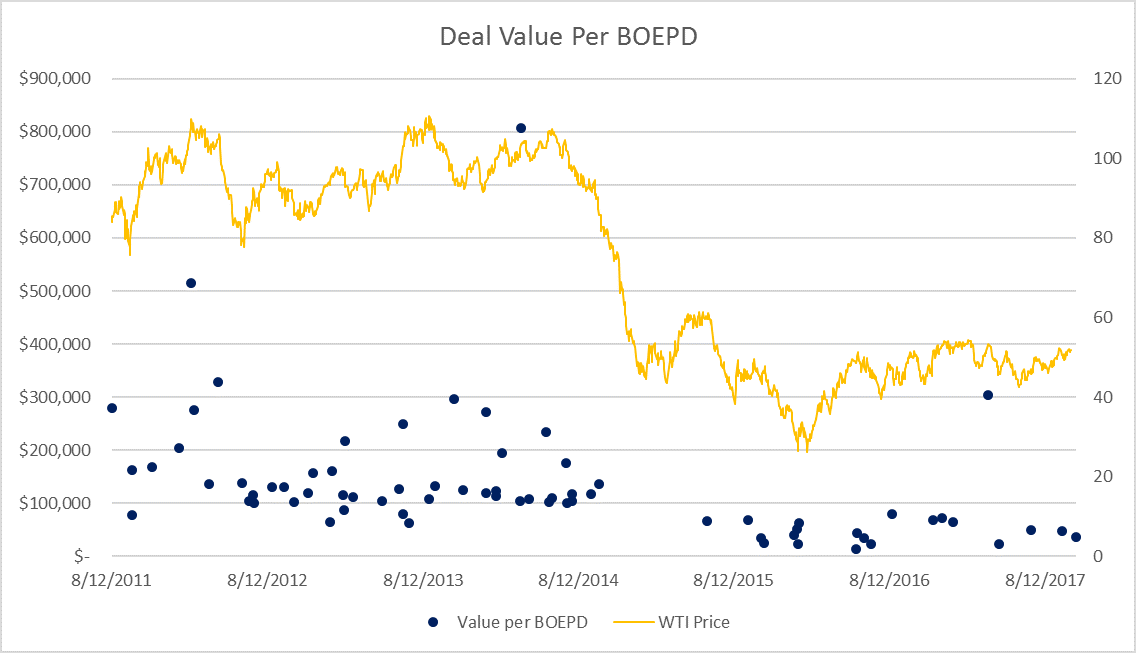

LINN’s sale is most comparable to Halcon Resources’ (ticker: HK) sale of its properties in late September. Both involved sales of non-operated interests in Bakken properties, and the transactions were of similar size. LINN sold 8 MBOEPD of net production for $285 million, while Halcon sold 2.3 MBOEPD for $110 million.

Halcon’s properties received a higher valuation in terms of deal value per flowing barrel of production. Halcon received just under $48,290 per BOEPD, while LINN was paid $35,625 per BOEPD. When the net undeveloped acreage in the transaction is considered, on the other hand, LINN received a higher valuation. Based on Bloomberg data, and without adjusting for production, LINN received $14,250 per undeveloped acre, while Halcon received $7,050.

| Announced Date | BUYERS | SELLERS | Deal Value (Million) | Production (MBOEPD) | Net Undeveloped Acres | Value per BOEPD | Unadjusted Value per Undeveloped Acre |

| 10/23/2017 | Valorem Energy | Linn Energy | 285 | 8 | 20,000 | $35,625.00 | $14,250.00 |

| 9/20/2017 | Riverbend Oil & Gas | Halcon Resources | 110 | 2.278 | 15,600 | $48,287.97 | $7,051.28 |

While far from the valuations received during the boom period before the downturn that began in late 2014, these prices are about what can be expected since 2014. Most deals in the past three years have valued production below $100,000 per BOEPD, and the Halcon non-operated deal actually represents the exact median of the past three years.

6th-largest Bakken deal ever happened in 2017

The Bakken also saw one of its largest-ever deals this year, when Halcon sold its operated properties to Bruin E&P Partners. This deal, valued at $1.4 billion, was the sixth-largest since 2011, and the largest since Whiting’s (ticker: WLL) massive acquisition of Kodiak Oil & Gas for $6 billion in 2014.

Private equity- backed companies are moving into the Bakken

A new trend that has become prevalent after the downturn is the rise of private operators making moves in the basins.

Public companies are moving out of the Bakken, selling to private equity-backed companies. Both LINN and Halcon, for example, sold their properties to private equity-backed firms. Out of the seven deals listed by Bloomberg in 2017, only one had a public buyer. Two of the thirteen 2016 deals had publicly traded buyers, and only one of the seven 2015 transactions had a public company buying properties. This is far less than in 2014, when about half of the sales had public buyers.

What does this mean for Bakken pure players?

While pure-play Bakken producers are becoming a rare bird, compared to before the downturn, they still exist. Oasis Petroleum (ticker: OAS) is the largest of these, with a market cap of about $2 billion. The most recent production information from the company reports more than 66 MBOEPD in July 2017. If the company were valued at the median value per BOEPD, $48,290, Oasis would be worth significantly more, just under $3.2 billion. This conclusion is backed by EnerCom Analytics’ Five Factor Model, which predicts that Oasis is undervalued relative to its small cap peers.