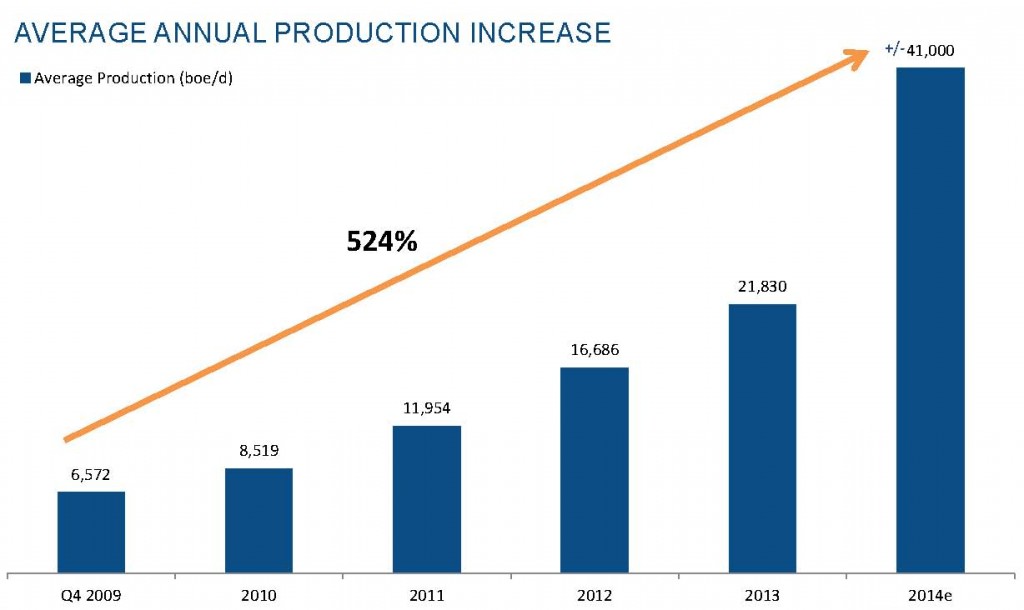

Bellatrix Exploration Ltd. (ticker: BXE) is a Calgary-based E&P operating in the Western Canada Sedimentary Basin. The majority of operations are focused on the Cardium tight oil play in Alberta – an area that has boosted production rates tenfold since 2008. Horizontal drilling and hydraulic fracturing has revitalized the region and current estimates place recoverable reserves of the Cardium at 3.0 billion to 4.5 billion barrels. Bellatrix forecasts production growth of nearly 100% in fiscal 2014, after more than doubling its reserve base in 2013.

A Record Quarter

Bellatrix is on track to reach its lofty expectations after achieving quarterly records for production sales (36.3 MBOEPD) and earnings ($38.3 million) in Q2’14. The totals represent increases of 64% and 147%, respectively, compared to Q2’13. Funds flow from operations for 1H’14 was $148.7 million and exceeds flow from its entire 2013 operations. Earnings ($63.4 million to date) are already more than triple 2013’s total of $20.0 million.

The company also added some liquidity to its balance sheet by increasing its senior credit facility to $625 million up from its previous total of $500 million. Currently $301.5 million is drawn, and the company reported $144 million in cash flow from 2014 operations to date. Additional capital was brought in through a Shelf Prospectus offering, which will allow the company up to $750 million. Roughly $172 was drawn at the time of the release.

On June 5, 2014, the Company closed a bought deal offering of 18,170,000 common shares at a price of $9.50 for aggregate gross proceeds of $172,615,000. Net proceeds went to temporarily reducing the outstanding indebtedness under the Company’s credit facilities, thereby freeing up borrowing capacity that may be redrawn, from time to time, to fund the Company’s ongoing capital expenditure program and acquire additional assets.

“Primarily our concern was to add some tuck-in assets that would give us a little lower decline because we’re basically a drilling company,” said Raymond Smith, President and Chief Executive Officer of Bellatrix, in a conference call following the release. “We’ve built our company with the drill bit and we felt it necessary for sustainability in the long-term that we acquire some additional assets that have a lower decline rate that we can add into our high quality drilling program.”

As of the earnings call, the Company is still evaluating a number of potential tuck-in assets that fit their selective investment criteria.

Improved Operations

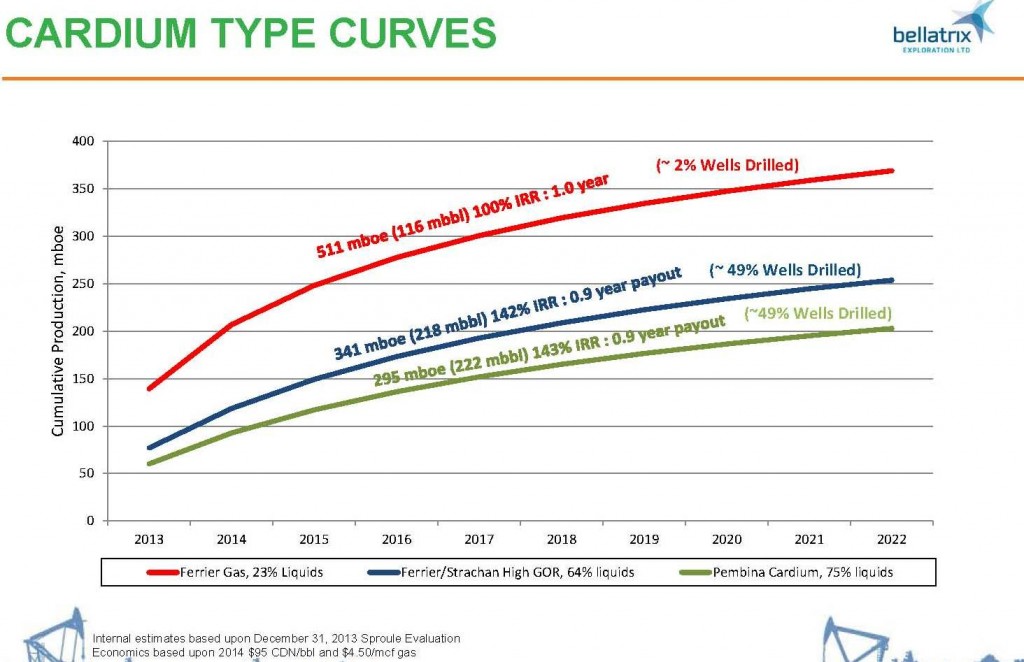

OAG360 covered the logistics of the Cardium play in a in June 2014. The play has traditionally been difficult due to its tight sands and wide ranging depth of 4,000 to 9,000 feet. However, technological advances and Bellatrix’s increasing knowledge continues to boost operations.

BXE successfully drilled all of its 63 gross wells (34.56 net) by the time of its Q2’14 release, including 47 gross (27.38 net) wells in the Cardium. The drilling program led to operating costs of $7.80/BOE in the quarter – a company record and 4% lower than Q1’14. As an added bonus, the Cardium’s hydrocarbons generally consist of light condensate, making its resources attractive to both refineries and the company balance sheet. Each region is believed to hold anywhere from 6 MMBOE to 16 MMBOE of potential resources, and BXE is currently spending about $3.75 million per well.

A winter 2013 report from the Alberta Oil & Gas Industry said more than 2,300 horizontal well licenses were distributed between 2010 and 2012, and 2014 production is expected to average 172 MBOPD – 13% higher than 2013 volumes.

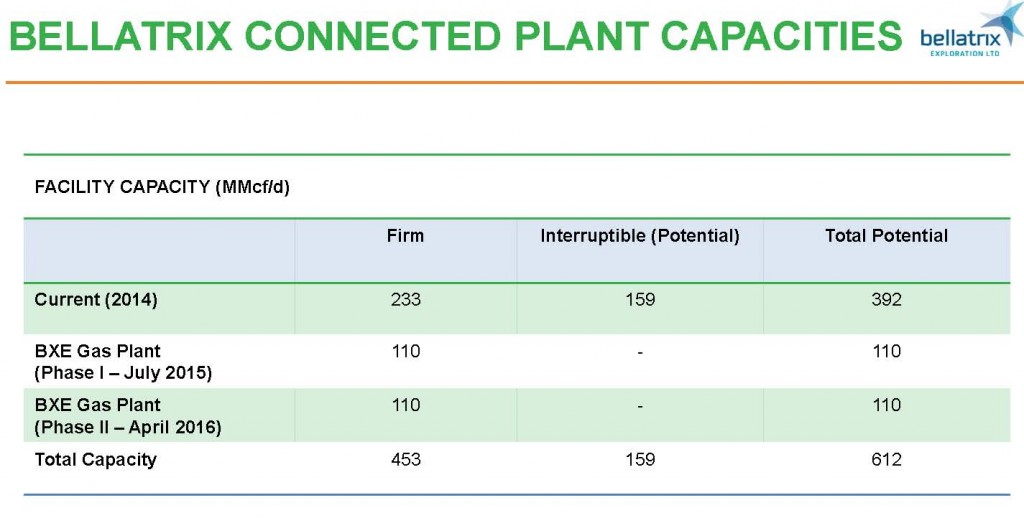

“There’s a lot of competition for room in the plants to get your gas in place,” said Smith. “Luckily our company got ahead of the curve two years ago.”

Infrastructure on the Way

The company says quarterly totals would be even higher if not for capacity constraints in the local infrastructure – a hurdle currently being addressed by BXE. The company has spent $290.2 million in 2014 capital projects in order to manage its climbing production. A 34-mile (55 kilometer) pipeline was completed and will handle 100 MMcf/d of plant processing capability. An oil battery with treating capacity of 2.8 MBOEPD was also completed, and 21 compressors were purchased to aid third party gas processing plants.

“The good news is that it’s neither a well problem nor a productivity problem, it’s a constraint that’s outside of our control,” said Smith. “We’re doing everything we can to bring it back into our control, which will happen by the time we get our plants on stream… Certainly, our wells can overrun the area very quickly.”

Plants scheduled for completion in July 2015 will add to BXE’s capacity and strengthen the balance sheet. “The plant alone gives us a 45% rate of return,” said Smith. “In an area where interest rates are close to zero, a 45% rate of return is an absolute gimmie as far as an investment opportunity.”

Top-Tier Metrics for Bellatrix

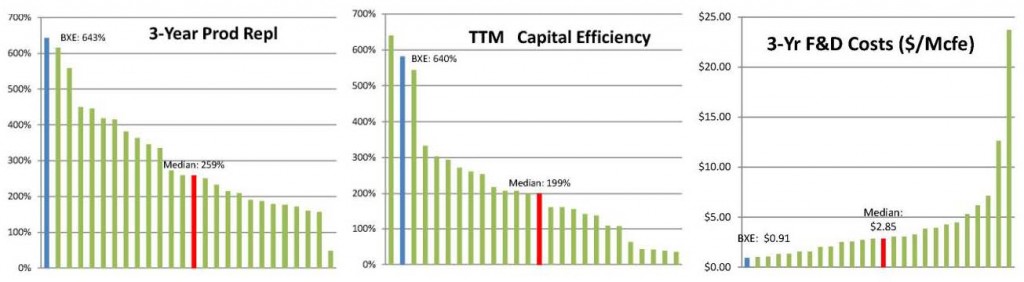

EnerCom’s E&P Weekly is designed to reveal value among industry E&Ps, and Bellatrix’s ability to ramp up its reserve base at a low is among the best of its 25 Canadian peers. EnerCom uses five particular categories, known as Value Drivers, to distinguish individual company development. Among the Drivers are production replacement and finding and development costs, which are measured in the latest three full fiscal years of 2011, 2012 and 2013. BXE’s three-year finding and development costs of $0.91/MMcfe are the lowest of the group and less than one-third the industry median of $2.85. Similarly, its three-year production replacement of 685% (also the best of the group) is 148% better than the industry median. Capital efficiency on a trailing twelve month basis, or the amount of cash a company generates for every invested $1, is the second-best of the group at 588%, a value nearly three times greater than the industry median.

Raymond Smith said BXE’s initial rate of return on its Falher/Notikewin properties is around 400%. “The liquid recovery alone recovers a net profit on those wells, so we could drill right down to a very low gas price,” he said. “We actually would prefer if gas prices stayed in the $4 window for a longer period of time. We don’t really want to see gas prices continue to accelerate, because it will ultimately drive up our operating cost base as there becomes more and more competition for services in the field.”

Groundwork in Place

If its history is any indication, BXE’s upward trend will continue as it’s primed for what is expected to be the best year in company history.

“We had 20 consecutive quarters of growth and cash flow increase. We had a speed bump when we ran into these constraints, which we knew were coming,” said Smith, referring to comments made in the company’s Q1’14 conference call. “We’ve done very well in the marketplace and our stock is still up 16 or 17 fold in the last four years. We need to keep adding value. And when the market comes back and the tide comes back in, we will flow it up as one of the better players.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.