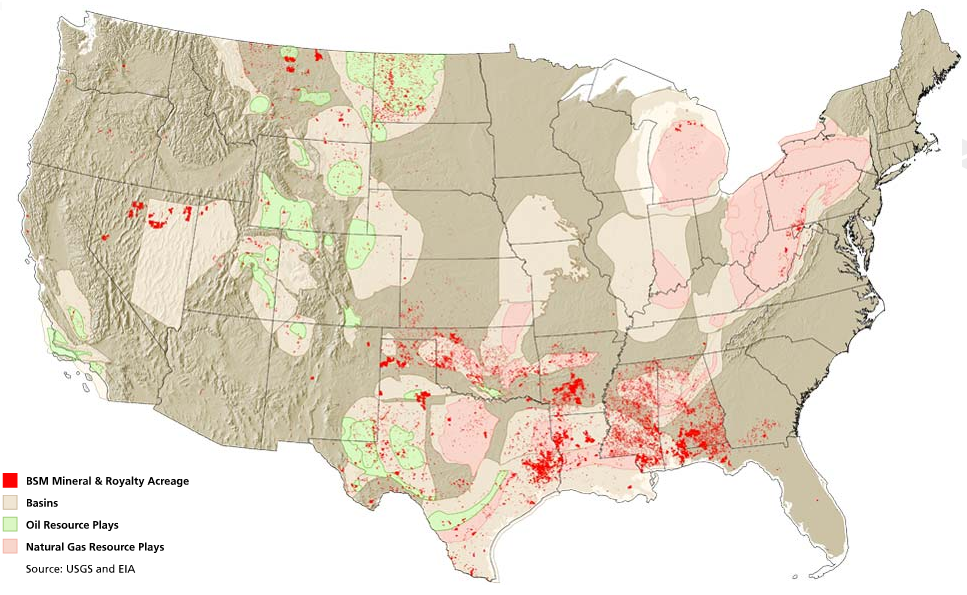

Black Stone Minerals (ticker: BSM) holds approximately 18 million mineral and royalty acres across 60 producing basins and 40 states, all for the purpose of leasing attractive acreage positions to E&P companies.

Black Stone Minerals maintains an attractive business model in that it lacks operating expenses and drilling capital costs. The company expects that its positions in the Haynesville/Bossier play and the Permian basin will fuel the majority of its short-term growth, and that its diversification will grant the company exposure to both established plays and those that are emerging.

Black Stone Minerals’ business model has not restricted it from taking the initiative to establish more acreage—this is visible in its 2017 acquisition of assets in the Delaware basin for approximately $31 million in in cash and $12 million in equity, or its acquisition of acreage in the Haynesville and Bossier shales for approximately $29 million in cash and $44 million in equity.

Beyond lease interest

Black Stone Minerals also holds non-operating working interest in several of its leases and, through these working interests, it produced 35.6 MBOEPD in Q1, 2017.

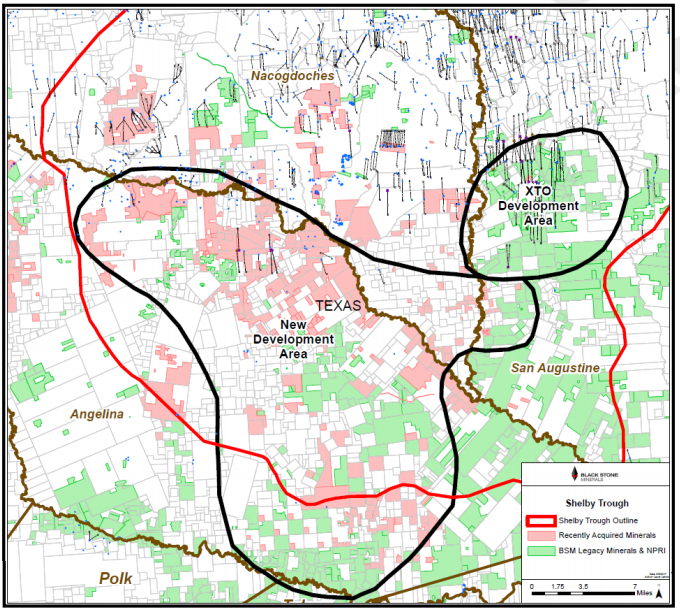

The company is particularly proud of its Shelby Trough acreage, wherein it holds approximately 100,000 net acres in the Haynesville/Bossier shale. Black Stone is leasing the majority of its Shelby Trough acreage to XTO Energy, which is focusing heavily upon approximately 17,000 net acres. In 2014, Black Stone Minerals organized development agreements with XTO to drill at least 10 wells per year—beginning in late 2015. As of June, 2017, XTO drilled 20 wells on the acreage.

Since Stone Minerals’ agreement with XTO, other unnamed oil companies have been attracted to the acreage, and acreage currently under development increased to approximately 89,000 net acres from the initial 17,000 net acres.

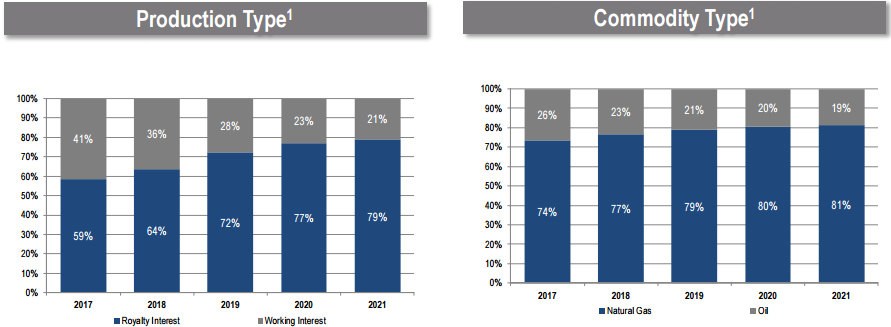

Black Stone Minerals expects that the amount of working interest it holds will gradually decline from 2017—where it is expected to total 41% of the company’s production—to 21% in 2021. This is coupled by a shift towards more natural gas production—from an estimated 74% in 2017 to 81% in 2021.

Black Stone Minerals L.P. is presenting at EnerCom’s The Oil & Gas Conference® 22

Black Stone Minerals will be a presenting company at the upcoming EnerCom conference in Denver, Colorado—The Oil & Gas Conference® 22.

The conference is EnerCom’s 22nd Denver-based oil and gas focused investor conference, bringing together publicly traded E&Ps and oilfield service and technology companies with institutional investors. The conference will be at the Denver Downtown Westin Hotel, August 13-17, 2017. To register for The Oil & Gas Conference® 22 please visit the conference website.