Blackbird Energy (TSX-V: BBI) has announced the results of an independent resource evaluation of its Pipestone/Elmworth Montney lands by McDaniel & Associates Consultants Ltd.

McDaniel & Associates conducted the resource evaluation for this same area of lands for Blackbird Energy one year ago.

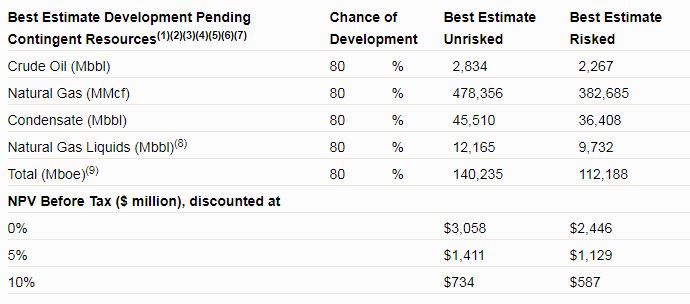

The 2018 reports show a 149% increase of Best Estimate Development Pending Contingent Resources to 112.2 MMBOE as of May 1, 2018.

In conjunction with these findings, the estimated risked before tax NPV of future net revenue, assuming a discount rate of 10% per year, was $CAD587.3 million. This is a 35% increase from last year’s evaluation.

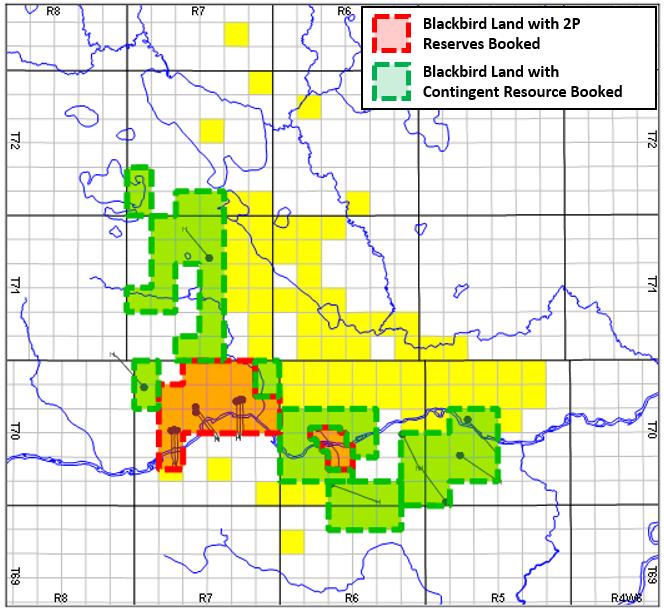

Blackbird has booked 29.4% of its Pipestone/Elmworth Montney acreage in addition to the booking of contingent resources in two of four prospective Montney intervals.

The estimated cost to bring on commercial production for all four product types is approximately $CAD1,833 million and $CAD668 million when discounted at 10%. The estimated timeline to reach production is between 2021 and 2042.

Blackbird would utilize the same techniques of horizontal drilling and multi-stage fracing currently being implemented in this region by the company.