$800 to $900 million will be raised

BP Midstream Partners (ticker: BPMP) has launched its IPO today, marking another step in the process of spinning off the company’s pipeline assets.

BP will offer 42,500,000 common units at an anticipated price of between $19 and $21 per unit. This equates to a total of between $800 and $900 million, making it among the largest IPOs by the industry this year. The underwriters of the offering have a 30-day option to purchase up to 6,375,000 more units. BP Midstream Partners will trade on the NYSE under the ticker “BPMP”.

The units being offered represent an interest of 40.6%, or 46.7% if the upsizing option is executed. BP will own the remaining interest. According to the company’s S-1 Registration Statement, all proceeds from the process will be paid to BP in a special distribution.

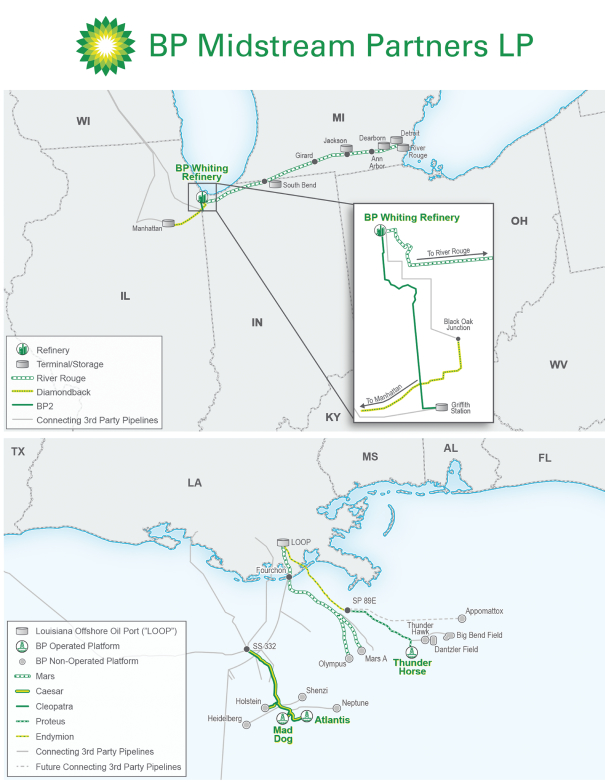

BPMP owns one onshore crude pipeline, one onshore refined products pipeline, one onshore diluent pipeline and interest in five offshore pipelines. In total, these represent over 850 miles of pipeline, with a capacity of roughly 2.9 MMBOPD.

According to Reuters, BP has been considering spinning off some of its midstream assets for the past five years. The oil price downturn shelved those plans, but the company has revived the opportunity as it seeks new funding.

Several major companies have spun off midstream assets in recent years. Shell (ticker: RDS), for example, received nearly $1 billion when it offered its midstream assets. The most recent of these was Oasis Petroleum’s (ticker: OAS) offering in September, which was relatively similar and may provide an outline for the timing of BP’s offering.

Oasis’s recent midstream offering provides clues to process

Oasis Midstream Partners was announced on September 11, when the company announced it would offer a 27.3% interest. The price target set was $19 to $21. On September 20, Oasis announced that it had priced the offering, at $17 per unit. The units began trading the day after, and the offering closed on September 25.

The stock first closed at $16.75, below the initial price, but has since improved. Oasis Midstream closed at a high of $17.98 on October 13, and is currently trading at $17.25.

Pricing expected ~October 24

While the timing of BP’s offering may differ, it seems likely that BP will announce the price of its offering in roughly one week, with trading beginning soon afterward.