BP sees market balance in the second half of the year, oil at $50-$60 in 2017

BP (ticker: BP) released its second quarter earnings today, reporting the third consecutive loss as the international oil major continues to struggle with low oil prices. The company reported a $2.3 billion loss this quarter, but BP Group Chief Bob Dudley was more bullish than in the past, with the company forecasting market balance in the second half of the year.

“We expect 2016 to remain challenging but we are starting to see a much stronger outlook for the Group,” said Dudley on the company’s conference call. “Near-term, our balance sheet remains robust to deal with uncertainties. Looking further out, as oil markets rebalance we expect to see more support for oil prices, but we are not relying on this. Our confidence comes from being firmly down the path of transforming our business to compete, whatever the future holds.”

BP’s Group Chief said oil prices had been supported during the quarter by supply disruptions, although this was partially offset by increased production from Iran. The company sees U.S. production continuing to fall off through the third quarter before stabilizing by year-end.

“While some of the factors that have recently supported oil prices may only be temporary, we see the overall fundamentals bringing the market into balance during the second half of this year,” said Dudley. “Over the last quarter we have seen oil prices strengthen in anticipation of this rebalancing – with some weakening primarily due to the strong dollar in the last week or so. The longer-term fundamentals for the industry also remain robust.

“However, for the time being oil inventories remain high – well above their five-year average, shown in the green band – and these inventories could still hold back further increases in oil prices for a while yet. So the forward curve has flattened although it still remains positive. Markets also remain cautious as they await more clarity around the impact of Brexit on oil demand.”

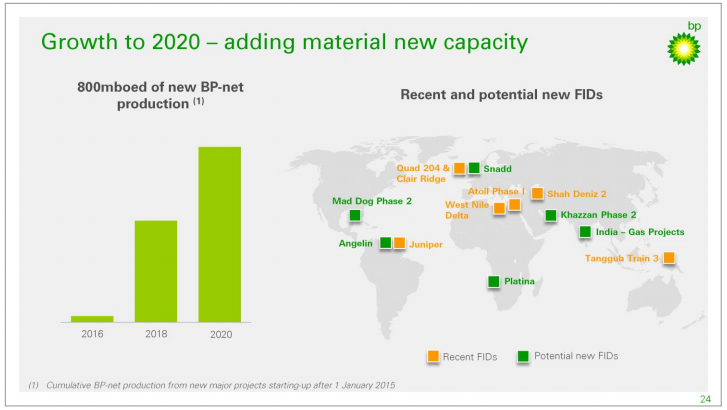

BP plans to add 800 MBOPD by 2020 without large acquisitions

Despite the continued weakness in oil prices, BP plans to add 800 MBOPD to production by the end of the decade without any large acquisitions. 500 MBOPD of that production is expected to come online by 2017 as the company starts up new projects. Including the company’s interest in Russian oil major Rosneft (ticker: RNFTF), BP reported total production of 3.3 MMBOPD for the second quarter.

“Along with continued strong management of our base production, we expect this to drive a growing contribution to Group free cash flow over the medium term, even in a $50 oil price world,” Dudley added.

Excluding Roseneft, BP reported 45 MMBO of resources, which the company said it could produce at today’s level for the next 50 years.

BP plans to reduce costs by $7 billion from 2014 levels

Even as the company continues to grow production through its current assets, it believes that it will be able to cut costs further. BP believes that capital expenditures for the year will reach $17 billion in 2016, and sit in the $15-17 billion range in 2017 depending on oil prices. That represents a 30-40% drop from 2013 levels.

“The Group’s controllable cash costs for the last four quarters are now some $5.6 billion below 2014 levels, putting us well on track to achieving our goal of a $7 billion reduction in 2017 cash costs compared to 2014,” said Dudley.

“Our ultimate aim over time is to sustain a position where operating cash flow from our business covers capital expenditure and the dividend,” added BP CFO Brian Gilvary. “Once rebalancing is achieved, and based on our current portfolio, free cash flow is expected to start to grow at prices similar to where we are today.

“This is supported by the stronger cash flows expected from the next tranche of Upstream project start-ups and resilient performance from the Downstream. If the price environment improves we will look to ensure the right balance between disciplined investment for even stronger growth and growing distributions to shareholders over the longer term,” he said.

Dudley said during the conference call that the company is projecting 2017 capital costs of $13 billion to $14 billion, 35% less than it forecasted for the year 2017 back in 2014. This is largely from cost reductions that have come amid the oil price downturn.

Cost reductions at whose expense?

Many of those cost reductions have come at the expense of oilfield service companies like Halliburton (ticker: HAL), which reported last week. During its conference call, HAL CEO David Lesar said he believed E&P companies knew that prices would have to come back up as oil prices improved.

Dudley said during BP’s conference call that BP believes 75% of the cost reductions it has realized will stick, no matter the oil price.

The conference call included a more bullish tone from Dudley and his team than last year. Dudley said he expects oil prices between $50 and $60 per barrel next year as the crude market starts to tighten and the gasoline glut shrinks.

“We’re not as pessimistic as some,” he said.