You can’t underestimate the positive change in attitude that we are seeing in our North American customers, they’re getting back to business: Lesar

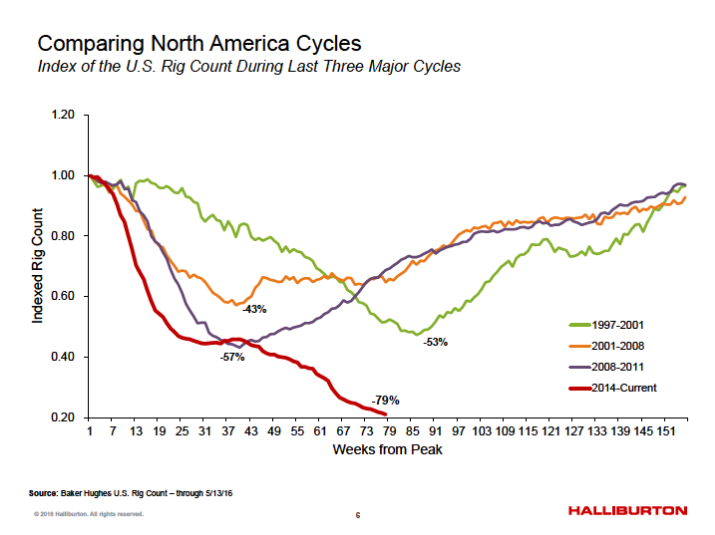

Oilfield service giant Halliburton (ticker: HAL) announced its second quarter results today, reporting a larger loss than in the first three months of the year, but the company’s management was clearly optimistic that this quarter represented what they believe is the bottom of the market.

“Our total company revenue declined only 9% sequentially, compared to the 19% decline in the global rig count. And our North America revenue was down 15% from the prior quarter, significantly outperforming a 23% decline in the average U.S. rig count,” said Halliburton CEO David Lesar during the company’s conference call. “However, despite these continuing headwinds, based on the recent improvements to North American activity, I believe that the second quarter will mark the trough for our earnings.”

“I can summarize this market in one sentence,” Lesar said. “Today our customers are thinking about growing their businesses again, rather than being focused on survival.

“You can’t underestimate the positive change in attitude that we are seeing in our North American customers,” he said. “In almost every case, they’re talking about adding rigs, buying assets, or doing something value accretive. In short, they are getting back to business.”

It is not all sunshine and good times ahead for the E&P sector, Lesar clarified.

“Hedges rolling off have created cash flow uncertainty. Balance sheet repair is still critical and many customers are looking at severe declines in production, as many of them have drilled few wells in the last 18 months. And while there are many customers that have adequate liquidity, there is also a large segment evaluating how to access capital… But the important point is they are back in business.”

When asked when the company expects it might get back to breakeven in North America, Halliburton’s management said it believes the first quarter of 2017 will mark the tipping point.

Three obstacles to the coming upcycle: equipment, sand, and people

Scrapping and cannibalization have taken their toll on the U.S. OFS fleet, with up to four million horsepower removed, representing about 20% of total U.S. horsepower capacity at the industry’s peak. The current downcycle forced E&P and OFS companies alike to squeeze out every efficiency, however, and Halliburton now believes that the market will start to see gains again with much lower total horsepower.

“Let me start today with a headline,” Halliburton President Jeff Miller began his portion of the company’s call. “900 is the new 2,000 for U.S. rig activity. I believe that it’ll only take 900 rigs to consume all the horsepower available in the market.”

“We preserved idle equipment outside of our field locations so it doesn’t get cannibalized. It’s clear to me that it will be cheaper to reactivate our cold stacked equipment than to put capital into cannibalized horsepower. This means we are best positioned to more quickly get back to work in the market recovery and are prepared to activate equipment when we see economic opportunities to do so,” Miller said.

Halliburton believes that while its competitors struggle to meet growing demand in the coming upcycle, its idled equipment will give it a significant advantage to corner more of the market. Two other bottlenecks will stand in the way of OFS companies during the recovery though, said Miller.

“The pinch points will be equipment, sand and people.

“From a sand standpoint, it’s not the sand as much as it is the logistics, and in our view, we are very well-positioned around that. Having built out our infrastructure over the last several years, we’ve got sand delivery in every basin, and we’ve got sufficient real infrastructure to address the logistics part of that.”

Miller added that Halliburton has done its best during the downcycle to retain experienced people in order to maximize its efforts when markets turned around, although the company did report cutting 5,000 jobs in its quarterly release. “And then don’t forget, it was just in 2014 we put 21,000 people onto the payroll, and so we know how to do that and we know how to make those people effective,” he added.

Service costs will be a give and take

Much of the cost savings reported on the E&P side of the industry have come from reductions in oilservice costs, some of which Halliburton said are sustainable through the upcycle, but some will have to change, according to management.

“Rig efficiencies are sustainable. The speed that we can drill out laterals is sustainable. The bigger jobs and higher production is sustainable. But that doesn’t come without a cost,” said Lesar. “[Our customers] know in their heart of hearts that service prices have to go up. They are going to fight that impact of prices coming up as fast and as long as they can, but the reality is – they know they need a viable service industry to be successful in the long run. So it will be a give and take.”

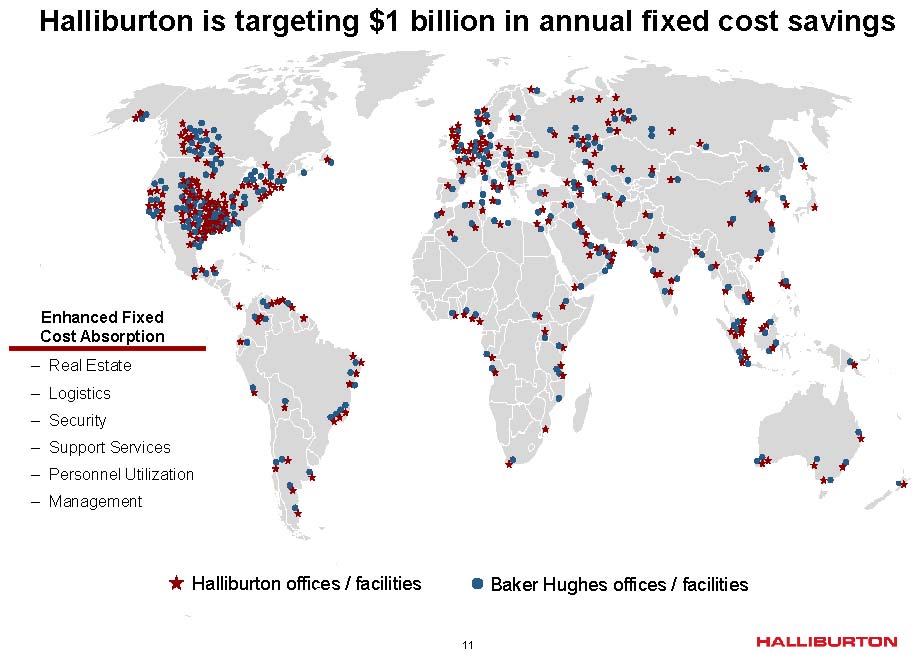

What about the failed merger?

While it was likely on the minds of many listening to the company’s conference call, no questions were asked about the failed merger between Halliburton and Baker Hughes (ticker: BHI). The only mention of BHI during the call was the financial impairment Halliburton took during the second quarter as part of the deal cancelation.

The termination fee associated with the deal was $3.5 billion. The company also recognized pre-tax restructuring and other charges of $423 million for the quarter, taking a serious hit over the failed deal.

“Speaking of cash flow, this quarter was particularly noisy because of the termination of the Baker Hughes deal and continued restructuring work we are doing,” said Halliburton CFO Mark McCollum. “When the smoke clears from the unusual items, however, cash flow from operations were slightly positive, and we closed the quarter with $3.1 billion in cash and equivalents.”

International markets expected to lag six to nine months behind the U.S.

Halliburton reported some market share gains in international markets as part of its conference call today, but still expects a recovery to lag six to nine months outside of the United States. The Eastern Hemisphere, in particular, is “an absolute brawl” according to the company’s management.

“Part of it’s just a natural budgeting cycle for many of our NOC clients,” said McCollum. “They’ll have to take their budgets and get it approved by legislative bodies. They’re not spending and they don’t have a lot of cash flow. And so that means that really until those budgets are approved, they’re not going to be spending.”

“In this environment, we are confident that North America will recover the fastest. The North America market has turne, and we expect to see a continuing modest up-tick in the U.S. rig count during the second half of the year and becoming more meaningful as we go into 2017,” said Lesar. “And now that we have seen the floor in activity levels, we expect revenue to increase based on higher utilization rates.”