Rhum, Bruce and Keith fields divested

BP (ticker: BP) announced the sale of several fields to Serica Energy (ticker: SQZ) today, in a deal worth around $400 million.

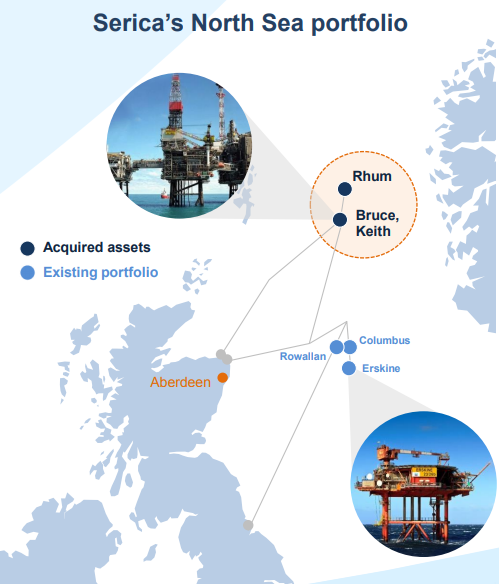

BP will sell its shares of the Bruce, Keith and Rhum fields in the North Sea. Serica will receive a 36% interest in Bruce, a 34.83% interest in Keith and a 50% interest in Rhum, will become operator of the assets and will acquire about 110 BP staff.

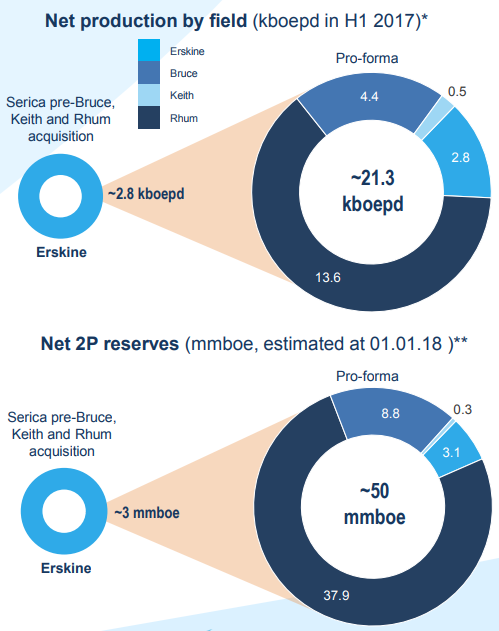

The acquired fields produced a net 18.5 MBOEPD in the first half of 2017, with about 50 MMBOE of net 2P reserves. The Bruce and Rhum fields are both gas fields, while Keith is a smaller oil field. All three plays are tied into the same facilities, located northeast of Great Britain.

The Bruce field was discovered in 1974 and came into production in 1993, with Keith tied back to Bruce in 2000. Rhum, a high-pressure, high-temperature satellite field located 40 kilometres to the north of Bruce, was brought into production in 2005. According to Serica, Bruce has upcoming potential despite its age, as a well stimulation program has recently begun, in an effort to extend the life of the filed. Rhum has currently produced just under half of its recoverable gas reserves. Keith, on the other hand, is a very late life field, and is expected to cease production in 2019.

This transaction is a major move for Serica Energy, significantly increasing the company’s size. Net production jumps seven-fold, while reserves grow sixteen-fold.

£300 million over time in complex transaction

The terms of this transaction are more complex than most U.S. onshore deals, which usually simply involve a lump sum which is then adjusted by certain considerations. In this transaction, Serica will pay BP £12.8 million up front, with additional contingent payments of up to £39.1 million payable dependent on certain production and gas price thresholds being achieved. BP will also receive a share of pre-tax net cash flow from the assets of 60% in 2018, 50% in 2019 and 40% in each of 2020 and 2021. BP will retain liability for decommissioning costs related to the properties including wells, but Serica will pay BP up to 30% of such costs.

BP expects to receive total payments of about £300 million, the majority of which will be received over the next four years.