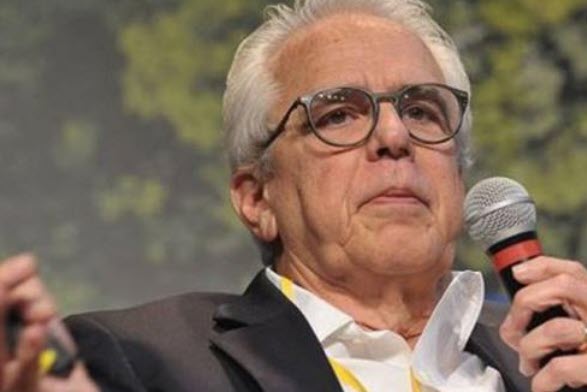

Rio de Janeiro — Brazilian state-led oil company Petrobras could turn to Guyana for access to acreage along South America’s equatorial margin if local environmental regulators do not grant permits to drill in Brazil’s Foz do Amazonas Basin, said Dec. 3.

According to Castello Branco, Petrobras has been invited by Guyana to participate in the neighboring country’s bid rounds and may do exactly that if Brazil’s regulators continue to drag their feet. That would mean creating jobs and oil supplies for Guyana rather than for one of Brazil’s poorest regions, Castello Branco said.

“This has to be resolved,” Castello Branco said of the environmental-licensing troubles during an interview at the Rio Oil & Gas 2020 digital conference. “We have big oil prospects there, and we’re prohibited while Guyana is enjoying a moment and opening up.”

“For now, we’re going to keep betting on Brazil,” Castello Branco said. “But it could be that we go there, too.”

The warning came amid Brazil’s desire to open additional oil frontiers and diversify the country’s resource base as development of the subsalt region off the country’s southeast Atlantic coast reaches critical mass. Brazil’s equatorial margin, which is covered in part by the Foz do Amazonas Basin, could hold similar potential to Guyana’s Stabroek block, where a group led by ExxonMobil made 18 separate discoveries holding more than 8 billion barrels of oil equivalent since 2015.

Oil companies operating in Brazil have long complained about delays getting drilling permits and environmental impact reports approved by environmental regulator IBAMA. The issue has been especially acute in the offshore Foz do Amazonas Basin, as well as at onshore blocks sold as potential prospects for hydraulic fracturing, which has largely been blocked by lawsuits.

Brazil’s National Petroleum Agency, or ANP, has attempted to alleviate the concerns by working more closely with IBAMA ahead of licensing rounds in an effort to eliminate future concerns about obtaining environmental permits. The blocks approved for the ANP’s Open Acreage program, for example, are required to have preliminary environmental reports approved before being included in the sale.

[contextly_sidebar id=”amJnydwgkTRM5msAxr3QTlkDIRdkvkhL”]

The troubles caused France’s Total to finally relinquish on Sept. 7 the five blocks that the company had operated in the Foz do Amazonas Basin, following the unsuccessful six-year battle to win approvals from IBAMA. Total then transferred its 40% operating stake in the FZA-M-57, FZA-M-86, FZA-M-88, FZA-M-125 and FZA-M-127 blocks to Petrobras for an undisclosed amount on Sept. 28. Petrobras now owns a 70% operating stake in the blocks, with BP Energy retaining the remaining 30%.

Total had planned to drill seven wells in the blocks, which the company acquired at Brazil’s 11th bid round, held in 2013.

BHP Billiton also abandoned plans to drill in two Foz do Amazonas blocks in 2019, while BP Energy has also faced permitting issues at the FZA-M-59 block in recent years. In October, BP transferred operatorship of the FZA-M-59 block to Petrobras. BP still retains 70% of the block, with Petrobras owning 30%.

Environmental groups had protested against drilling in the region after the discovery of a previously unknown coral reef in the turbid waters at the mouth of the Amazon River. The groups said the drilling could damage the reef and affect marine life in the area. The statements have gained even more weight during the coronavirus pandemic, which has made companies reevaluate environmental issues amid calls for greater reductions in greenhouse gas emissions to counter climate change.

In addition, IBAMA raised concerns about Total’s emergency plans in case of an accident, including coordination with neighboring countries during a potential oil spill.

Petrobras, however, has decades of experience dealing with Brazilian regulators and enormous influence at the government level, which has led many industry officials to expect a quick resolution to the dispute over drilling. Petrobras also included $1 billion in investments earmarked for the Foz do Amazonas Basin and Brazil’s equatorial margin in its recently released $55 billion spending plan for 2021-2025.